While the “invisible hand” temporarily keeps the Dow elevated, the price of gold has surged back above the $2,000 level ahead of the collapse of the Super Bubble.

This Collapse Will Be Brutal

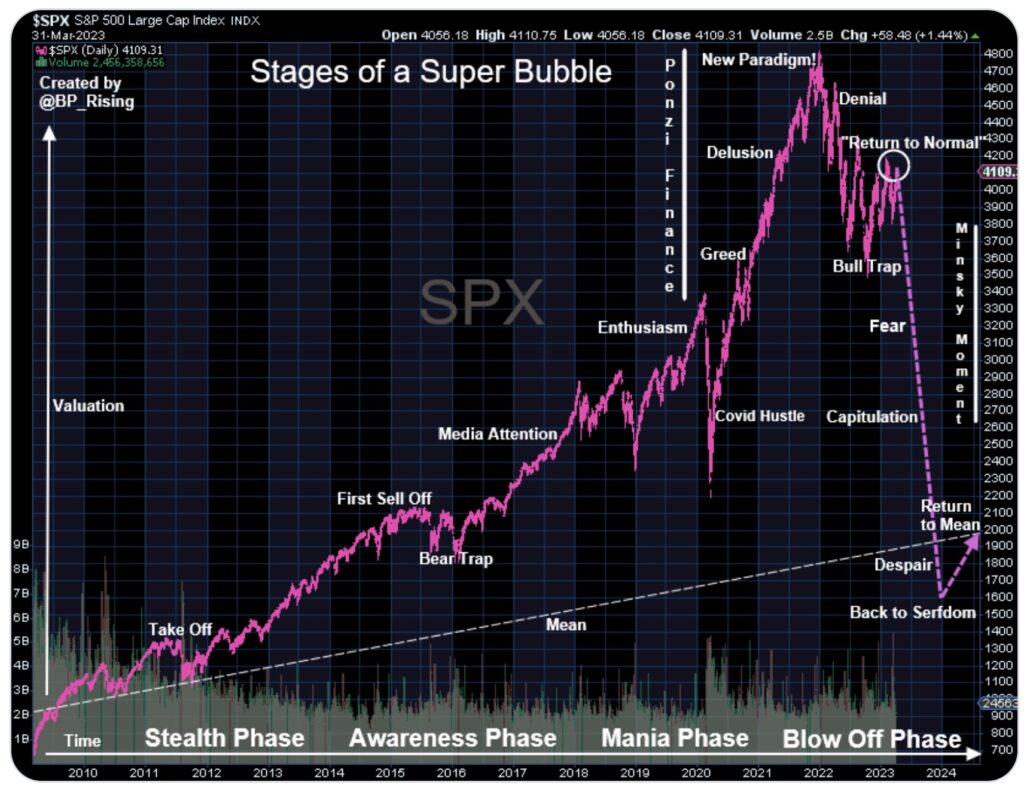

April 3 (King World News) – Ponzi Finance: Stages of a Super Bubble (using S&P 500 chart since 2009 bottom).

Stages Of A Super Bubble:

Beware The Looming (Pink Dotted) Collapse

$2,000+ Gold With The Situation Deteriorating

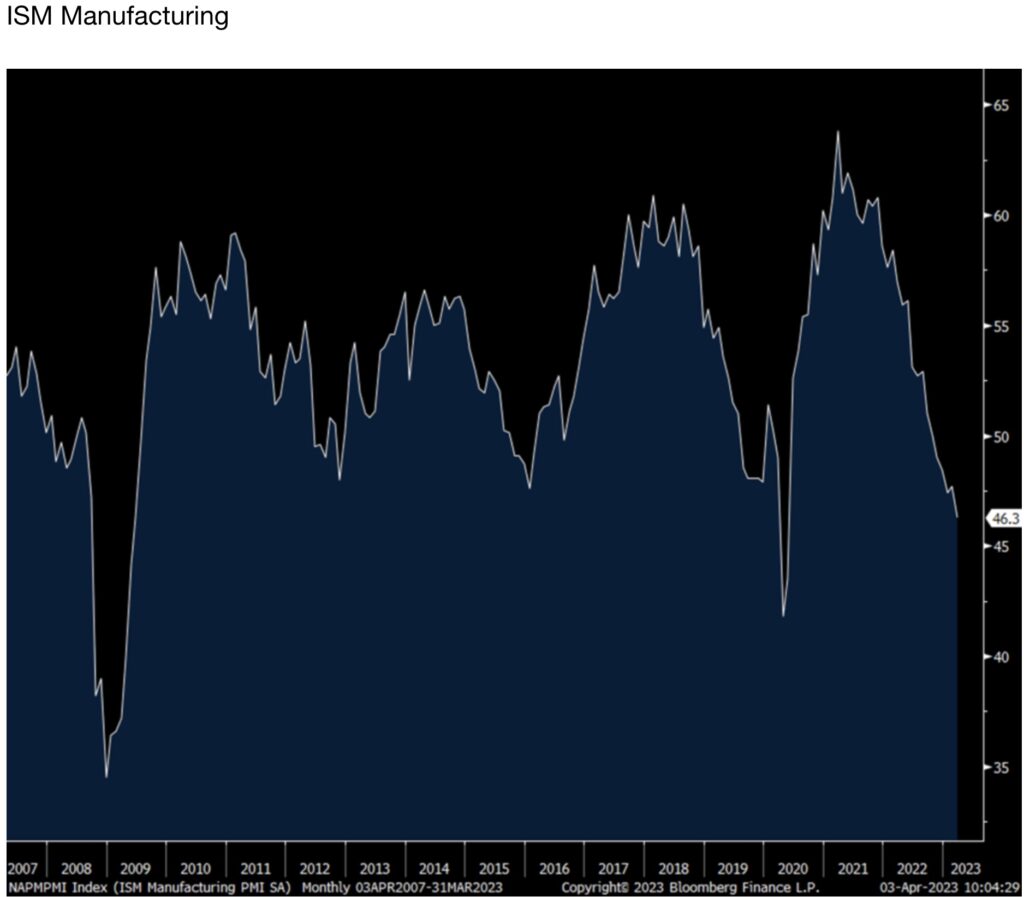

Peter Boockvar: US manufacturing as measured by the ISM remained very weak in March as its index fell to 46.3 from 47.7 and that was below the estimate of 47.5. Not including Covid you have to go back to 2009 to see a figure this soft and we’ve now seen 5 months in a row of below 50 prints.

Treasury yields fell immediately after the print followed by the Pavlov dog response higher in stocks that the end of Fed rate hikes soon is the savior. The dollar is weaker and gold is back above $2,000.

Expecting $100+ Crude Oil

Well at least for now, there goes our chance to start refilling the SPR at $70 to lift inventory levels off a 40 yr low. Yes, two of the 4 main facilities are closed for maintenance but that also means 2 are still open. I still believe, and am positioned for it, that oil prices will be well into the triple digits again in the coming year or two. Maybe we have an OPEC put here.

We’re About To Find Out

What’s more important for stocks, what the Fed will do or the direction of earnings growth? We’re about to find out as the equity rally is solely based on the change in rate expectations I believe and certainly not the further risks to the economy and earnings post SVB. On March 9th we know the bank and lending world changed as SVB spiraled. On March 8th the 2 yr yield was 5.08% vs 4.09% today. The December fed funds futures contract on March 8th was yielding 5.59% vs 4.49% today.

What Are CD’s Paying?

Seeing on Friday another decline in bank deposits by $126b with all coming from small and medium sized banks as large ones saw a modest increase of $15b, I went to a few bank websites to see if there were any increases in deposit rates and I was surprised to see many banks offering still just .01% savings rates. For sure, CD rates are much more competitive to money market rates and we’re seeing more ads for ‘money market savings accounts’ but I would have expected more banks to get off microscopic savings rates. Here’s a link to the interest rate sheet for Sandy Spring Bancorp, a $1.2b market cap bank reflecting that .01%, https://www.sandyspringbank.com/sites/default/files/PDFs/ssbdepositrates1.pdf. They don’t see to be trying hard to retain deposits other than the bare minimum.

Washington Federal is a bit more generous with a .10% savings rate yield but with a 1.24% interest rate in a ‘high yield money market’ account, https://www.wafdbank.com/personal-banking/interest-rates#savings. There you can get a 7 month CD yielding about 4.40% if you currently have a checking account there.

PacWest Bank is now offering a 5.5% 5 month CD as they at least are desperately trying to retain deposits. I couldn’t though find on their website what savings rates are paying. https://www.pacwest.com/banking/accounts-liquidity/elevate-your-rate…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

US Treasuries Continue Vacuuming Money Out Of Banks

I reflected last week the math behind the profit hit if rates paid on savings and checking accounts rise notably and that is clear to bank executives it seems as they are trying to mix paying almost nothing on savings accounts, nothing on checking but offering these money market savings accounts at about 100 bps higher (still not much) and CD’s.

What this all means is that the federal government is crowding out the private sector. For every Treasury bill/note/bond bought, for every Treasury money market money is moved to, that is money coming out of the private sector and going to finance the US government.

What I believe it is getting somewhat easier for those employers who need employees on premise and physically on site, it still is not easy filling certain spots. I read in the weekend WSJ this quote from the CEO of Waste Management Jim Fish, “We can’t hire a truck driver to drive a trash truck for $90,000 in Houston, Texas, but I can hire an MBA from a small school for $60,000, and I can get them all day long.”

McDonald’s Layoffs

As or those white collar workers, it seems that it might not now be just tech workers losing jobs as the WSJ reports today that “McDonald’s is temporarily closing its US offices this week as it prepares to inform corporate employees about layoffs undertaken by the burger giant as part of a broader restructuring.” They want to “deliver staffing decisions virtually. The company, in the message, asked employees to cancel all in-person meetings with vendors and other outside parties at its headquarters.”…

This Is Now The Premier Gold Exploration Company In Quebec With Massive Upside Potential For Shareholders click here or on the image below.

Meanwhile Across The Globe

March manufacturing PMI’s out of Asia and the manufacturing softness is not just a US thing but reflected globally: South Korea 47.6 vs 48.5, Thailand 53.1 vs 54.8, Vietnam 47.7 vs 51.2 and while Japan’s and Australia were revised slightly up, they remained below 50. India’s was exactly at 50 from 51.6 in February. Malaysia printed 48.8 vs 48.4, Indonesia 51.9 vs 51.2 and the Philippines at 52.5 vs 52.7.

Specifically for South Korea, S&P Global said “Output and new orders both registered steeper declines. A number of firms suggested that weak domestic and global economic conditions had weighed on the sector. At the same time, cost pressures remained widespread as the rate of input price inflation accelerated for the first time in 5 months and came in well above the historical series average.” The positive though was further easing of supply chains and business expectations lifted to an 8 month high.

China’s private sector Caixin manufacturing PMI fell to 50 from 51.6. Caixin said “Although market conditions continued to improve after a Covid policy shift, the marginal slowdown in recovery was evident. The subindexes for output and total new orders remained in expansionary territory, but both readings dipped by more than 2 pts from February. External demand weakened amid a global economic downturn, with the gauge for new export orders falling back into contraction, the 7th time it was below 50 in the past 8 months.” China’s reopening benefits has mostly helped the service side, in particular travel, leisure and hospitality and we remain bullish on Macau and Chinese tourists who spent $250b in 2019 traveling the world.

Japan’s manufacturing Q1 Tankan index also reflected weakness for both large and small companies. Also there was a notable drop in cap ex plans. Strength though was seen in the services sector. Along with yields in Europe and the US, JGB yields are higher too.

ALSO JUST RELEASED: Greyerz Just Warned The Everything Collapse Is Going To Devastate The World CLICK HERE.

***To listen to Gerald Celente discuss the death of the dollar and gold skyrocketing CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss the silver squeeze and the lack of available physical silver supplies CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.