The price of gold has surged $44 on the heels of the US & UK strikes in Yemen. Silver is also moving higher once again above $23.50, up nearly $1. Here is what to watch.

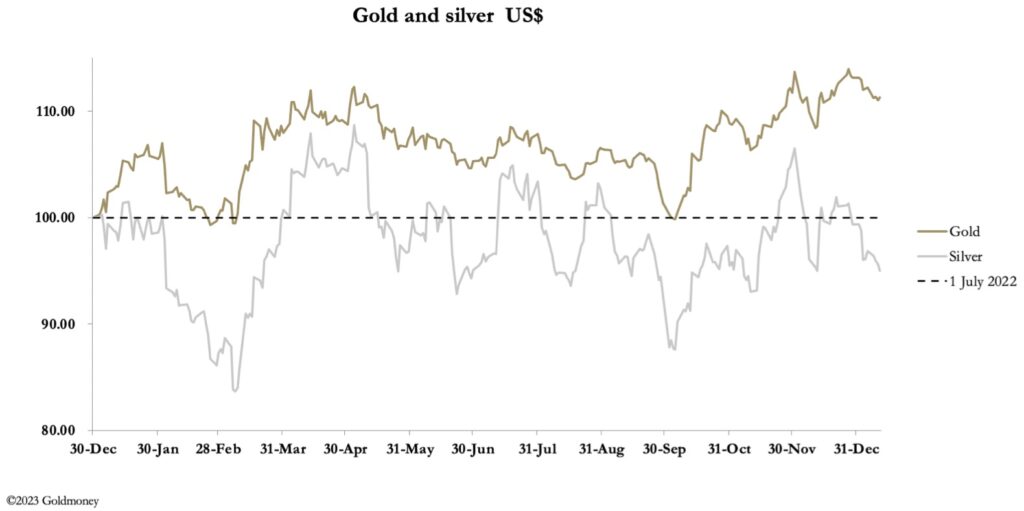

January 12 (King World News) – Alasdair Macleod: Gold and silver continued their recent consolidation, as US Treasury yields firmed, and the dollar’s trade-weighted index recovered slightly. In European trade this morning gold was $2046, up $3 from last Friday’s close, and silver $23.00, down 15 cents on the same time scale.

King World News update: Gold has now surged $44 higher to $2,063 and silver 84 cents higher now above $23.50.

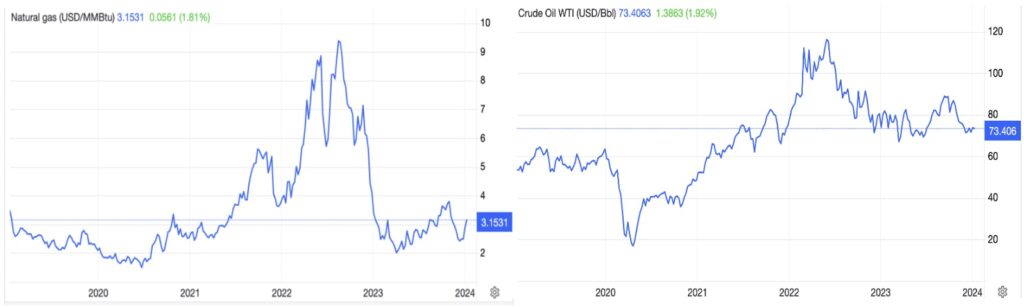

Overnight, the US and UK mounted an attack on the Houthis in Yemen, which so far has triggered only a small rally in gold and silver. WTI oil has firmed this morning to $75. Natural gas prices have already been rising strongly, up 8.4% on the week and 42% over the last month.

The outlook for energy prices will be determined by how the Middle East’s crisis plays out at a time of heightened demand in the northern hemisphere’s winter. The next two charts show the current position for natural gas and WTI oil.

The first point to note is that the extreme volatility of natural gas prices sees them back at 2020 levels, and on a cold snap or supply disruption they could easily triple. And secondly, oil looks like it has merely consolidated the 2020—2022 bull phase. In both cases, an escalation of the Middle Eastern crisis, made increasingly likely with US and UK attacks on Houthi positions, could see oil prices move substantially higher.

However, it is difficult to see how the ac.on against the Houthis will improve the situation. It will merely confirm that the Red Sea and Suez are out of bounds to shipping for the foreseeable future rather than facilitate it.

There is now a grave risk that Iran will respond to the attack on the Houthis by encouraging Hezbollah to escalate its already increasing attacks on Israel’s northern border. And if the US and her allies respond with yet more aggression, there is the backstop threat that the Hormuz Straits will be closed.

Increasing Geopolitical Instability Bound To Impact Gold

The reason for mentioning this is that increasing geopolitical instability is bound to affect gold, which we can very loosely to correlate with higher oil prices. There are the consequences for the inflation outlook. There is some evidence that the immediate threat to global supply chains leading to higher consumer prices was an important factor behind the decision to attack.

But if the situation deteriorates from here, then markets can kiss goodbye to lower interest rates, which the uptick in Treasury yields suggests is a possibility. This is our next chart.

The chart is at an interesting technical juncture. It tells us that acer falling from 5% to 3.75%, a recovery to test the 4% yield level was likely. On the chart alone, it is now 50-50 whether yields will fall further or rise strongly from what looks to be good underlying support.

The dilemma for gold traders will be to then decide whether higher yields are bad for gold, or increasing uncertainty in the Middle East creates additional bullion demand. Gold’s technical chart suggests that along with energy prices gold will continue to rise after its current technical pause is over.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.