Here is a look at gold, silver and the bursting of a credit bubble.

The bursting of a credit bubble

November 18 (King World News) – Alasdair Macleod: There is little doubt that the credit bubble is at or close to its peak. There are signs in the Mag7 and cryptocurrencies that bullish momentum is fading in these leading indicators.

All the signs of a market top are showing in US equities today. Value is the least consideration: momentum and investment fashions are what matters overwhelmingly. Relative to bonds, equity valuations have become more stretched than ever. Bank credit has been expanding to finance demand for the easy money made in a bull market. But the psychology of easy money is fading in cryptocurrencies, which before bitcoin declined some 23% in recent weeks were seen as a surefire path to riches.

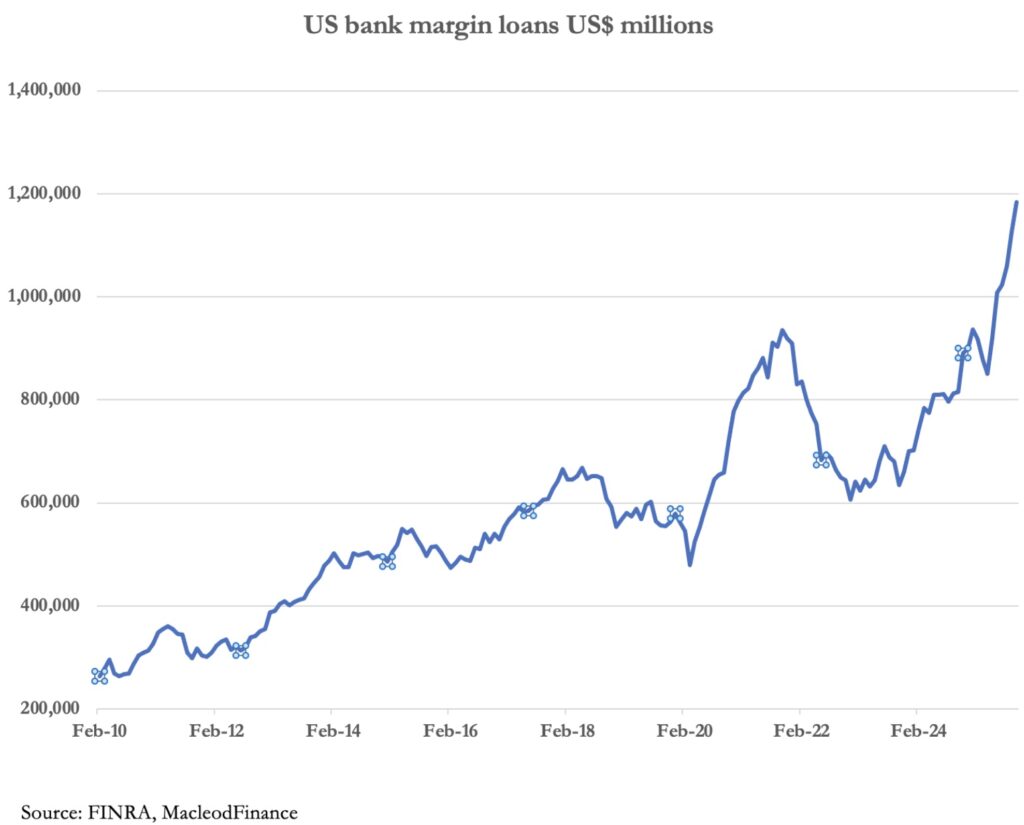

Ignored by the bulls, higher equity prices are dependent on the continual expansion of credit to inflate prices. FINRA’s estimate of US dollar margin finance has just been posted for October, and it’s a further rise to a record $1.184 trillion. In the context of trillion-dollar stocks, it might sound minor, but it probably finances over $3 trillion of leveraged positions.

Consequences for gold, silver, and the miners

If the slide in Bitcoin and the MAG7 stocks is the start of the bubble bursting, then we are in choppy waters for everything. The decline in equity values will be disorderly with periods of panic. When stocks in your portfolio decline, human nature is not to take losses on the chin, but to sell positions which are still in profit.

In 2008—2009, when the so-called great financial crisis hit, gold was sold down from over $1000 to $680, though the consequences of debt expansion coupled with crises in the Eurozone drove gold subsequently higher to $1920. At a guess, a sharp selloff in gold and silver this time is less likely, partly because it is barely owned in portfolios, partly because speculative interest in derivatives is subdued, and partly because of shortages of bullion relative to genuine demand from central banks and other monetary players. That is not to say that there could be some limited downside.

It is a guess but seems reasonable. However, mining stocks are more vulnerable to distressed sellers in tech and other stocks, even though they are under-owned by investors. Recently, they have outperformed nearly all but the highest of high-flyers, and they do not have the support of central bank buying.

The difficulty for investors in mining stocks is first to judge whether the current decline in the S&P, NASDAQ etc. is the start of a bubble collapsing. If not, then the danger to mining stocks is deferred rather than removed. For holders of physical gold and silver, the answer is to ignore the volatility and just keep stacking. And be thankful for opportunities presented!

Jaw-Dropping Price Predictions

To listen to Nomi Prins’s jaw-dropping predictions for gold, silver and mining stocks CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: Look At What Has Collapsed To Levels Last Seen During 2020 Panic CLICK HERE.

ALSO JUST RELEASED: Here Is The Big Picture As Gold Price Remains Above $4,000 CLICK HERE.

ALSO JUST RELEASED: Nomi Prins – China Is Buying A Lot More Gold Than They Are Reporting CLICK HERE.

ALSO JUST RELEASED: The Metals Shortage Is Real And This Time It’s Global CLICK HERE.

ALSO JUST RELEASED: Silver Price Remains Radically Undervalued vs 1980 High CLICK HERE.

ALSO JUST RELEASED: Another Day In Clown World: Look At What Just Collapsed CLICK HERE.

ALSO JUST RELEASED: Silver Bull Market Just Getting Started, Plus Gold & Silver Email CLICK HERE.

ALSO JUST RELEASED: END STAGE: We Are Witnessing The Liquidity Addiction That Will End Disastrously CLICK HERE.

ALSO JUST RELEASED: Remember 2008? Risk Has Never Been Higher CLICK HERE.

ALSO JUST RELEASED: 3 Fascinating Emails And Gold Will Soar Even Higher CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.