Even with gold trading over $4,000, the gold price remains radically undervalued vs the 1980 high.

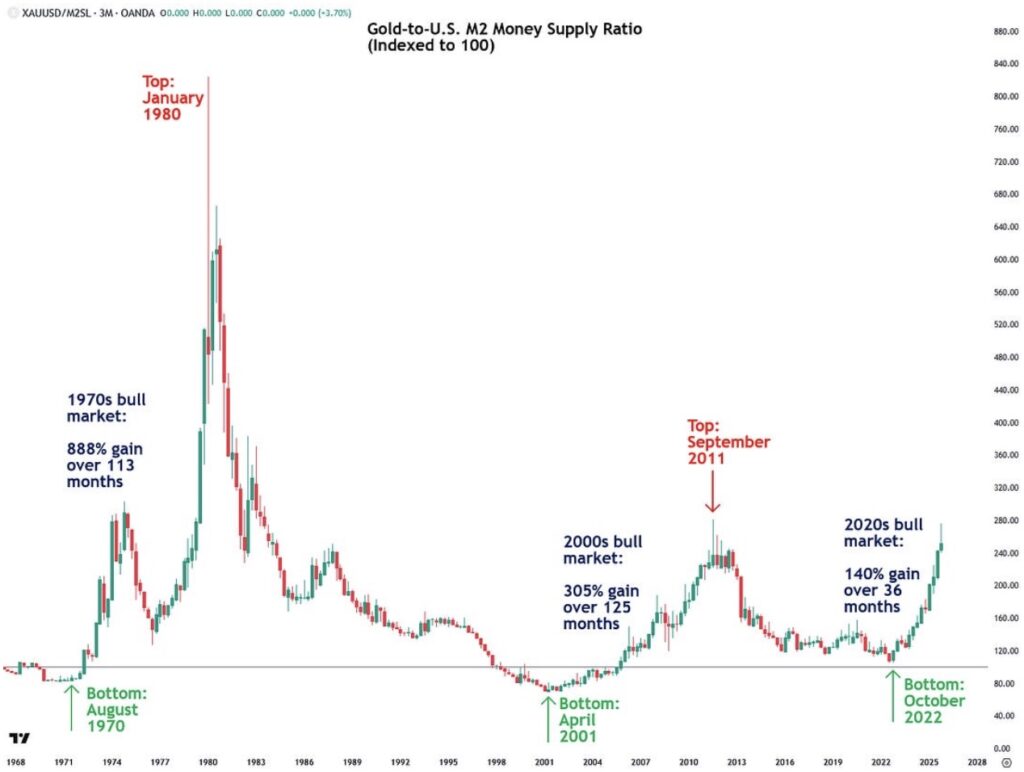

November 10 (King World News) – Jesse Colombo: … look at gold in relation to another measure of inflation: the U.S. M2 money supply. The money supply may be an even better indicator of inflation than the CPI, which is known to understate actual inflation (learn more). Moreover, growth in the money supply is the underlying cause of inflation itself. As Milton Friedman, the Nobel Prize–winning economist, famously said, “Inflation is always and everywhere a monetary phenomenon.”

During the secular bull market of the 1970s, gold measured against the M2 money supply rose by 888% over 113 months. In the 2000s secular bull market, it gained 305% over 125 months. In comparison, the current secular gold bull market is up only 140% over just 36 months. This is yet another indication that the current bull market is still quite young, and those claiming it is long in the tooth are clearly out of touch with the objective facts.

KING WORLD NEWS NOTE: Gold Radically Undervalued vs US M2 Money Supply Compared To 1980 High

Another novel yardstick I have been experimenting with lately for comparing precious metals and commodity prices is the U.S. national debt. After all, the more the national debt grows, the closer that brings us to the final ultimate fiscal crisis, which will then open the floodgates of digital money printing. That, in turn, will cause a currency crisis and hyperinflation, which will send precious metals to prices that our minds can barely comprehend…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

During the secular bull market of the 1970s, gold measured against the U.S. national debt increased by 978% over 113 months. In the 2000s secular bull market, it rose 195% over 125 months. In comparison, the current secular gold bull market is up only 115% over just 36 months—a sign of a young bull market that still has a lot more life left in it.

KING WORLD NEWS NOTE: Gold Radically Undervalued vs US National Debt Ratio Compared To 1980 High

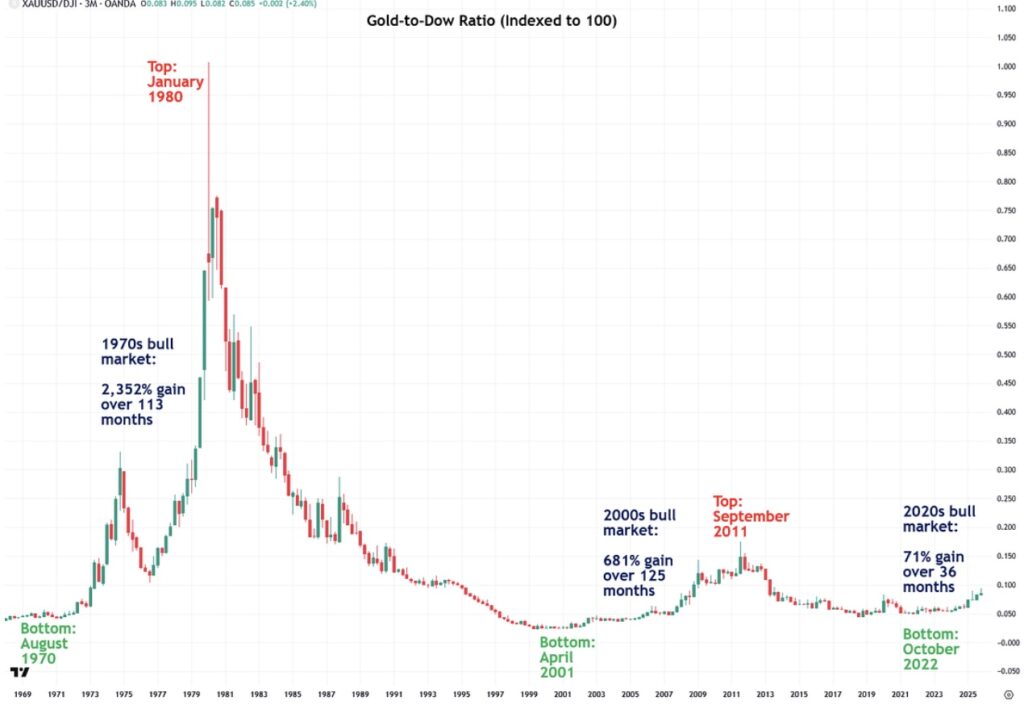

Finally, we measure gold against the Dow Jones Industrial Average, which I find to be a particularly useful yardstick. There is a well-established principle that equities and gold move in opposing long-term cycles, where one outperforms the other as large amounts of capital rotate between them. When major secular bull markets in stocks come to an end, such as in the early 1970s or early 2000s, a significant amount of capital typically flows out of equities and into gold, and I believe we are about to see that dynamic play out again, which will send gold’s current bull market into overdrive.

During the secular bull market of the 1970s, gold measured against the Dow rose by 2,352% over 113 months. In the 2000s secular bull market, it increased by 681% over 125 months. In comparison, the current secular gold bull market is up only 71% over just 36 months, which indicates that, by historical standards, it has barely even begun.

KING WORLD NEWS NOTE: Gold Radically Undervalued vs Dow Compared To 1980 High

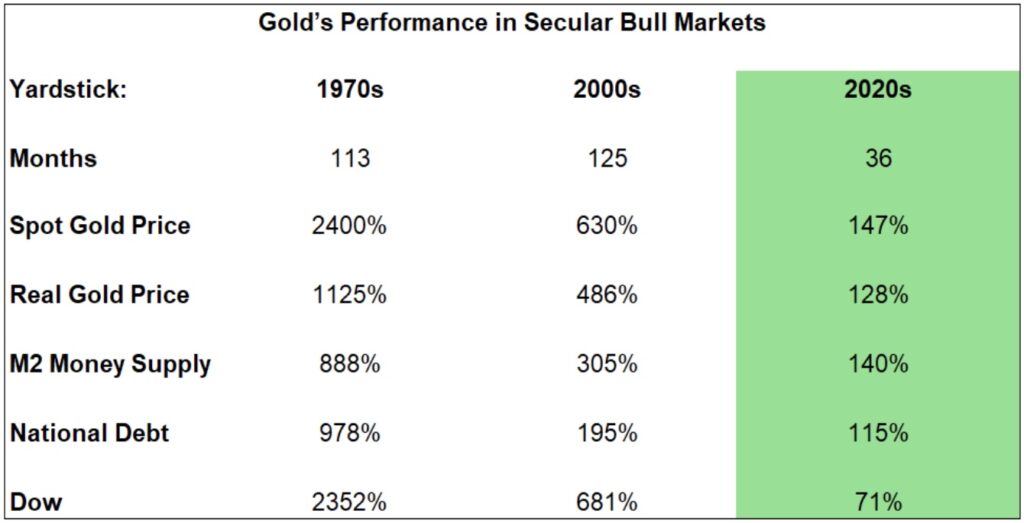

Now that we’ve looked at the various yardsticks in chart form, I’ve compiled all the data on gold’s performance in past and current secular bull markets into this helpful table to show how the current one compares. As you can see, by every metric, the secular bull market that began in October 2022 still pales in comparison to the previous two. This is a clear indication that it has many more years and gains ahead.

For example, if gold were to match the performance of its 1970s bull market, it would reach a peak of $40,486 per ounce. If it were to replicate the performance of the 2000s bull market instead, it would peak at $11,819 per ounce. In both cases, these targets are significantly higher than the current price of $4,001 per ounce.

KING WORLD NEWS NOTE: Gold Price Will Reach $40,486 If It Repeats 1970s Bull Market

King World News note: This was just a small portion of the latest piece from Jesse Colombo’s fantastic work featured on his substack illustrating how radically undervalued the price of gold is vs the high set in 1980.

Boockvar On $200 Silver And More

To listen to Peter Boockvar discuss $200 silver as well as the upside for gold and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

Just Released!

To listen to Alasdair Macleod discusses some big surprises in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: Boockvar – Silver’s Inflation-Adjusted Price Is A Jaw Dropping $200 CLICK HERE.

ALSO JUST RELEASED: Colombo – This Is Where Things Stand In The Gold & Silver Markets CLICK HERE.

ALSO JUST RELEASED: Volatility: Riding The Gold & Silver Markets CLICK HERE.

ALSO JUST RELEASED: DC’s “Financial Apocalypse” Playbook REVEALED CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.