The price of gold closed at another record high, but look at this…

Gold Price Closes At Record High

March 5 (King World News) – Peter Boockvar: With the obsession over bitcoin over the past few weeks with non stop coverage that is right now only benefiting from new ETF flows rather than some sort of fundamental reason (are there ever any?), there was not a peep at the closing record high in gold on Friday. NOT A PEEP…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

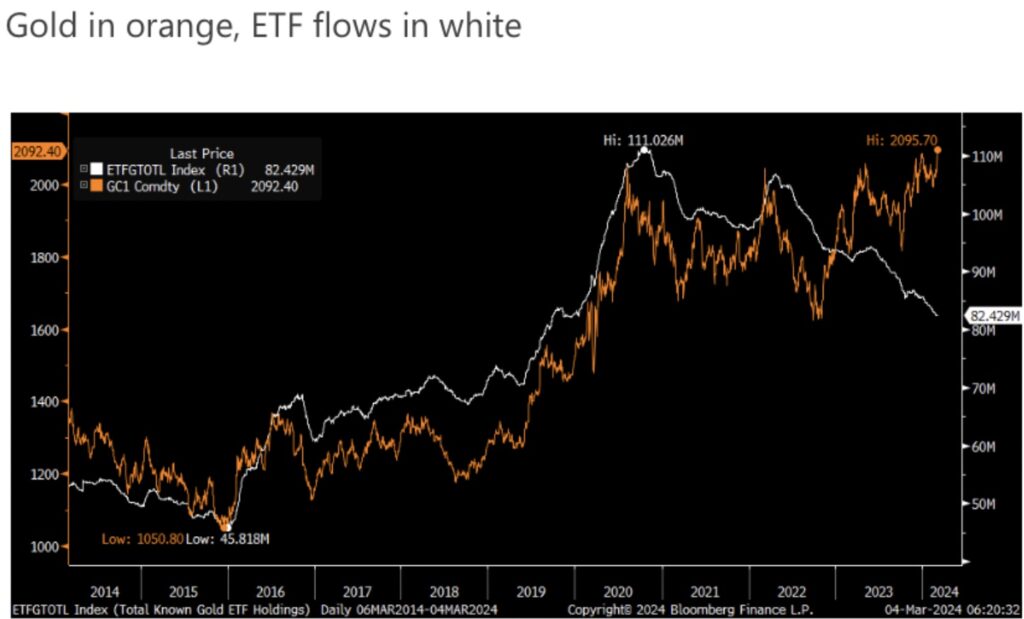

Back in early December it did see an intraday move higher on that strange Sunday night but on a closing basis, Friday saw it and I did not see one bit of coverage, anywhere. For us bulls, that is a good thing because no one here seems to care as it’s also happening as western investors continue to flee as seen with the ETF flows that continue to shrink. At some point that will reverse and that’s when gold really takes off.

See the disconnect beginning last year between ETF flows and the gold price and its because of the voracious buying from central banks and the complete apathy in the US.

West Continues To Hemorrhage ETF Gold (WHITE LINE) While The East Vacuums Up Every Available Ounce

Ahead Of Powell’s Fed

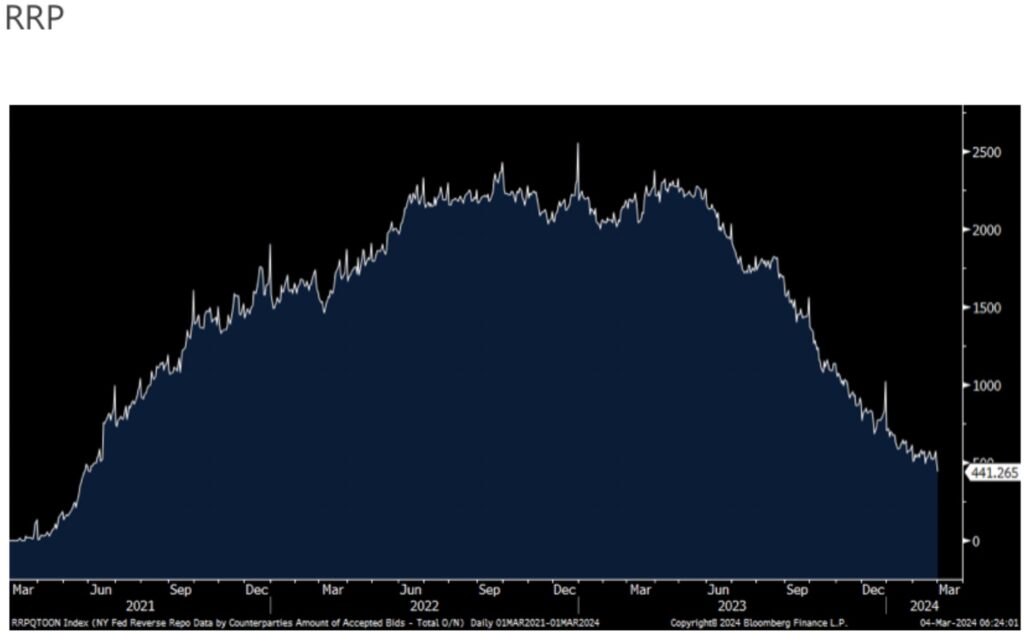

Ahead of Powell this week, it’s a good thing the Fed is ready to start talking about the balance sheet because the liquidity wave from the reverse repo facility is nearing its end and that is when QT really kicks in and the liquidity drain that will take place. Up until now, the RRP shrinkage has completely offset and then some QT as its fallen in size by more than $2 Trillion, which has flowed into the Treasury market, while the Fed’s balance sheet is only smaller by about $1.2 Trillion.

I bring this up because the RRP shrunk notably on Thursday and Friday and stands at just $441b. The past two day decline was $127b.

Crude Oil Near $80 Fuels Inflation Concerns

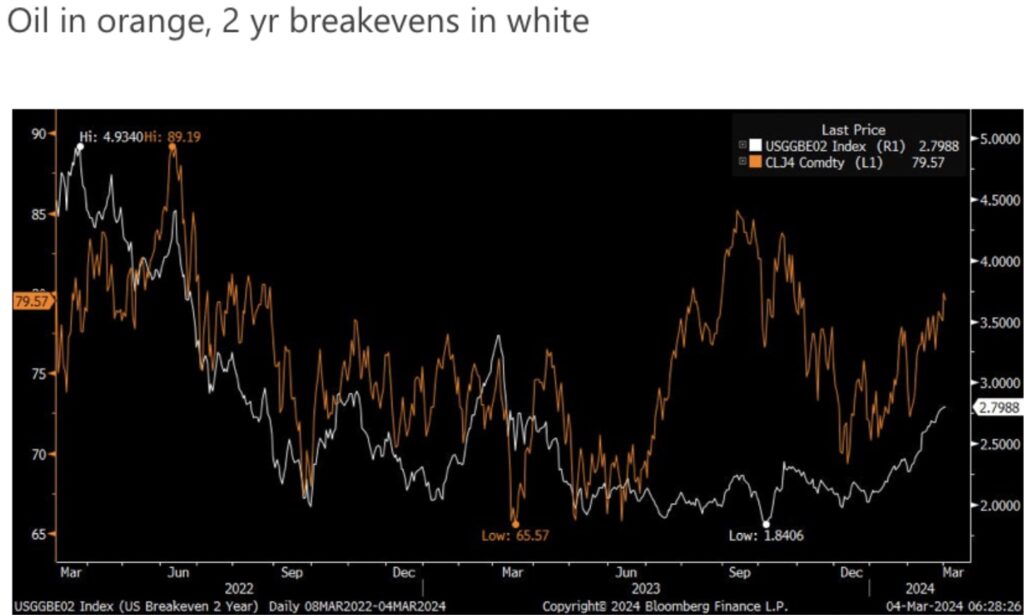

With WTI now trading around $80, it has helped raise again inflation expectations and you can see the chart below its relationship over the past few years, outside of the disconnect last September. The rise in crude has also helped to lift gasoline prices which were higher yesterday for an 8th straight day to the highest level since mid November, though it still is down 5 cents y/o/y. Natural gas is lifting today by 6% after EQT, the largest US independent producer, said its cutting production in response to very low prices.

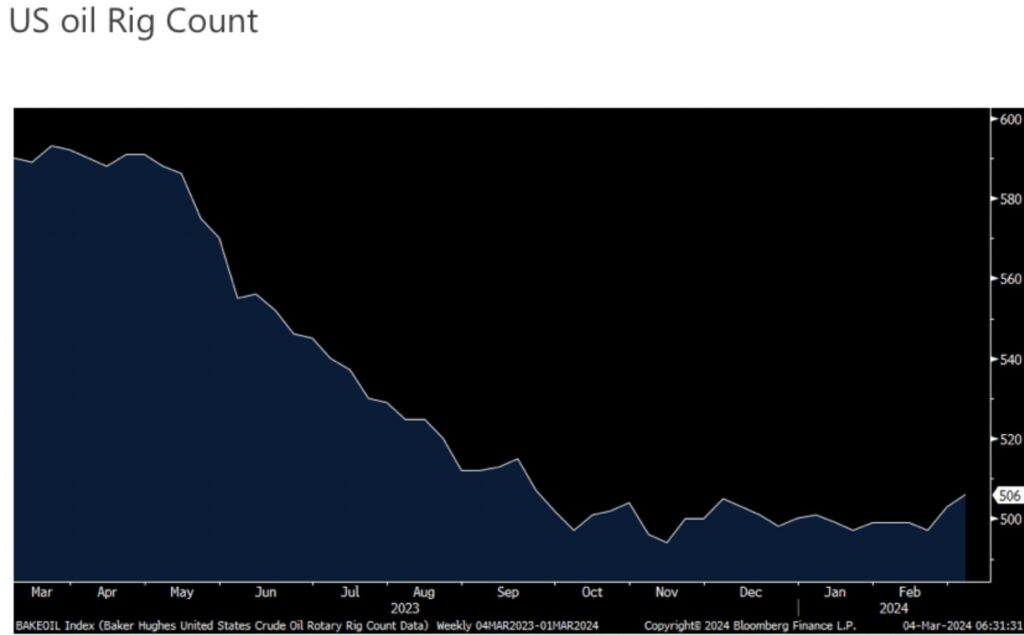

In response to this recent run higher in crude, we did see finally a lift in the US rig count which is now up 9 rigs over the past two weeks to 506. That’s the most since last September but it was at 590 one year ago.

King World News note: Rising oil prices are yet another bullish catalyst for gold as it approaches a new all-time high. This is also causing silver and the mining share markets to catch a bid. In fact, silver is very close to a major upside breakout that should propel it back to the $38 level and then back to its all-time high of $50. All of this is taking place with sentiment at one of the lowest levels ever for the metals and mining stocks. And interestingly gold has been surging while the dollar remains near the 104 level. So gold is rising vs all fiat currencies.

To listen to Alasdair Macleod discuss the huge trading on Friday that lifted the gold price close to the $2,100 level CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.