Today the price of gold futures surged to another all-time high above $2,620 as the Fed cut 50 basis points.

September 18 (King World News) – Peter Boockvar: For the bold step of a 50 bps rate cut, the wording of the statement was almost identical to that which they gave in July. They said again that “economic activity has continued to expand at a solid pace” but still decided to cut 50 bps. “Job gains have slowed” vs “job gains have moderated” in July but that’s a wash in terms of similarities and “the unemployment rate has moved up but remains low.” But they still cut 50 bps.

The greater confidence “that inflation is moving sustainably toward 2%” obviously triggered the cut along with what Powell said in Jackson Hole that they won’t tolerate further weakening of the labor market. As part of this, they raised (the median dot did) their year end unemployment rate to 4.4% from 4% and held it there for yr end 2025. Core inflation was trimmed to 2.6% this year from 2.8% and to 2.2% next year from 2.3%.

The hawk Michelle Bowman only wanted a 25 bps rate cut. Agree with her or not, kudos to her for standing out from the typical consensus crowd…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

What was notable was the dot plot, which again only matters as to what Powell wants, which did reflect a median fed funds rate by yr end 2024 of 4.4% which implies a total of 50 bps more by year end at the two remaining meetings. And, a 3.4% end of 2025 fed funds rate. That however is above the around 2.90% that the market was ALREADY pricing in.

Bottom line, Powell decided to take door #2 but I do think at his presser that he will coach markets that going 50 bps was a ‘get ahead of the curve’ move and not a cadence that markets should get used to.

While the 2 yr yield has fallen 6 bps post statement, the 10 yr yield is only down 1 bp as if the long end thinks that the Fed is getting soft on keeping inflation low, aka on a SUSTAINABLE basis, the long end doesn’t look so attractive.

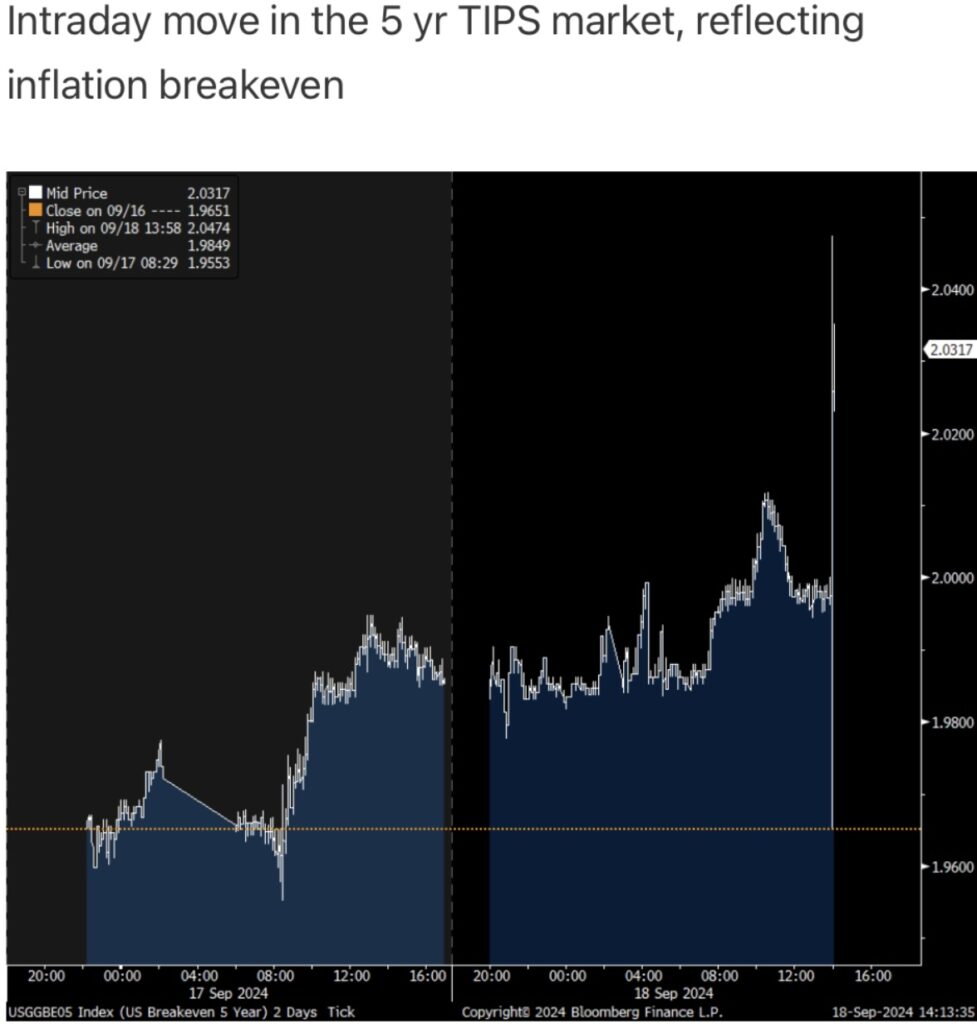

To this point, inflation breakevens are RISING in response with the 5 yr up 4 bps to back above 2%.

The 10 yr is up by a like amount to 2.15%.

Gold And The Death Of The Dollar!

***To listen to the top trends forecaster in the world discuss gold and the death of the dollar CLICK HERE OR ON THE IMAGE BELOW.

Gold Shorts Squeezed As Gold Hits Record High $2,600+!

***To listen to Alasdair Macleod discuss the short squeeze in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

Stock Market Bubble To Pop!

***To listen to the man who helps oversee $150 billion discuss everything from inflation to global markets, a new launch and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.