Gold futures have surged to an all-time high $2,730, but take a look at this…

Gold Breaks Above $2,700

October 18 (King World News) – Alasdair Macleod: Ahead of the BRICS meeting at Kazan, gold soared to $2700+ this morning. Is a new gold backed trading currency discounted? Do you buy the rumour and sell the fact?

Gold and silver continued to rise this week, driven by strong demand during Chinese trading hours, backed up by growing speculative demand on Comex. In European trade this morning, spot gold was trading at $2712, up $56 from last Friday’s close. Silver has been firm, less spectacularly so, nevertheless rising 58 cents to $32.10 on the same timescale…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

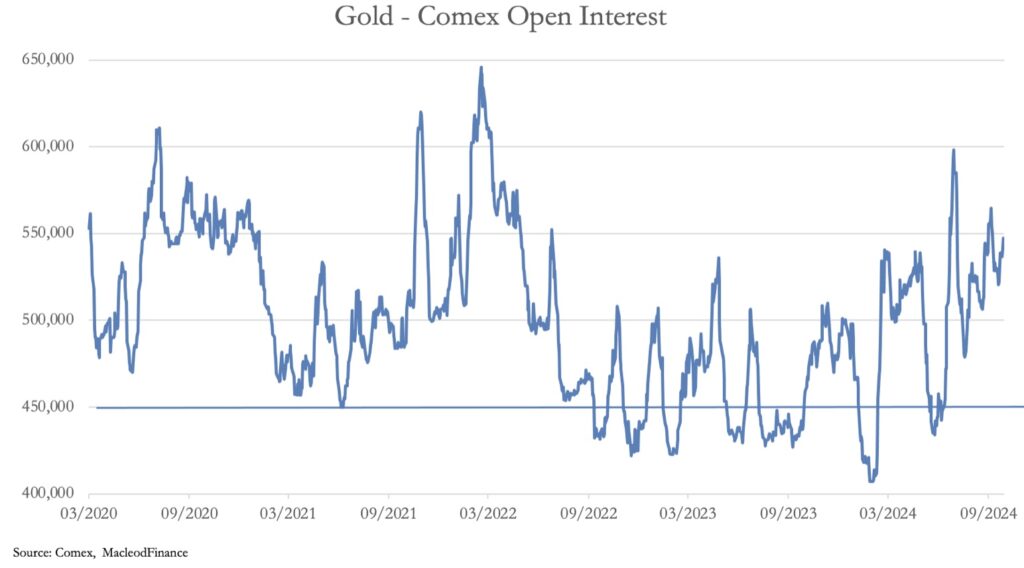

There are enough solid reasons behind this positive performance, and for those of us who understand the difference between legal money in the form of precious metals and credit with counterparty risk and backed by no more than faith, the phenomenon is one of declining credit values rather than gold rising. It’s just that in the short run there has been a buildup of speculative long positions on Comex, and presumably in other paper markets as well. The next chart is of Open Interest in gold futures:

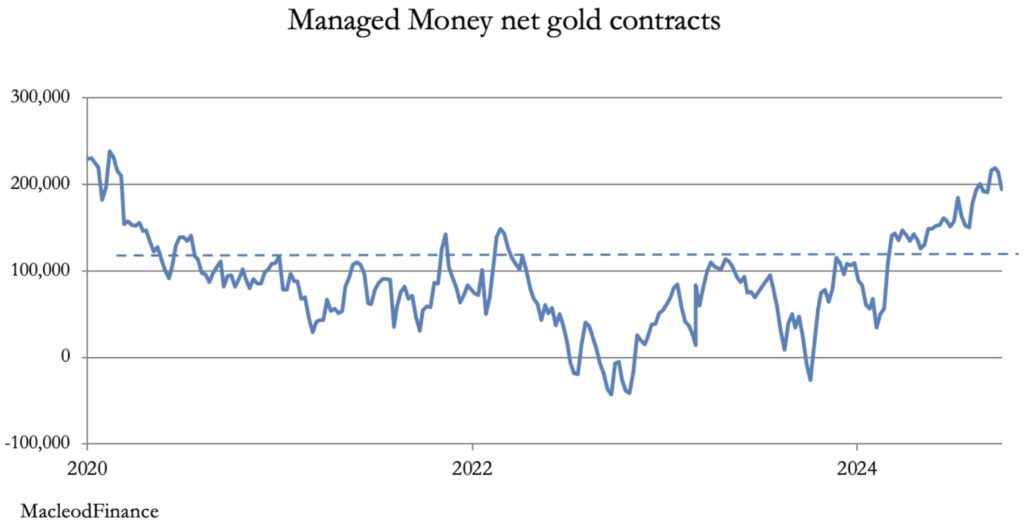

While on this measure there is some headroom before gold futures become seriously overbought, equally there is a heightened risk of a short-term pullback before gold values go much higher. While the hedge funds’ position for last Tuesday will only be available later today, the position on 8 October is our next chart:

Since then, Open Interest has increased by 27,000 contracts, likely pushing net longs to well over 200,000 contracts. Essentially, these positions are momentum trades. This is important because it takes no more than a pause in the bullish story for the Swaps to mark prices lower, triggering stops for a potential decline in the gold price. Whether this happens and the extent if it does will probably depend on events at Kazan next week.

This is the long-awaited BRICS summit, ahead of which there has been mounting speculation that led by China and Russia a new gold-backed trade settlement medium will be on the agenda. The issue is probably becoming more urgent, given a combination of heightened risks for the dollar which is noticeably sliding into a debt trap, an official policy of marginalising the dollar in both BRICS and Shanghai Cooperation Organisation trade, and now a need to protect roubles and yuan from a dollar fallout.

The difficulties in this decision are further compounded by an extremely delicate geopolitical background with a growing risk of military escalation, particularly in the Middle East and the South China Sea. Essentially, the decision over introducing a sounder medium of exchange than the dollar is more political than it has ever been. And that’s before we consider the consequences for China’s exports.

However, the downside in gold appears strictly limited because of continuing physical demand by central banks and similar institutions meeting insufficient supply. Then there’s the political uncertainty of the presidential election. Trump appears to be edging ahead of Harris. And Trump is committed to raising tariffs to protect American business.

We should remember the consequences of the Smoot-Hawley Tariff Act which in 1930 crashed world trade and the US economy, events which led to a 40% devaluation for the dollar in January 1934. At that time, Federal debt to GDP was only 16.5%. Now it is 135%, which suggests that tariff protectionism today will have far more negative consequences for the US and global economies, upon which the dollar’s credibility depends, than did Smoot-Hawley.

Just Released!

To listen to Alasdair Macleod discuss gold hitting a new all-time high, silver on the cusp of a truly historic upside breakout as well as what to expect from the high-quality mining and exploration stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.