With the price of gold breaking to a new record high above $2,600, look at this amazing commentary about today vs 1970s.

Gold

September 13 (King World News) – Graddhy out of Sweden: I said it was coming soon, and gold broke to new all-time high yesterday.

And has follow-through today, so far, which is very important to see.

Gold Continues Its Record Surge

One Of My Favorite Charts

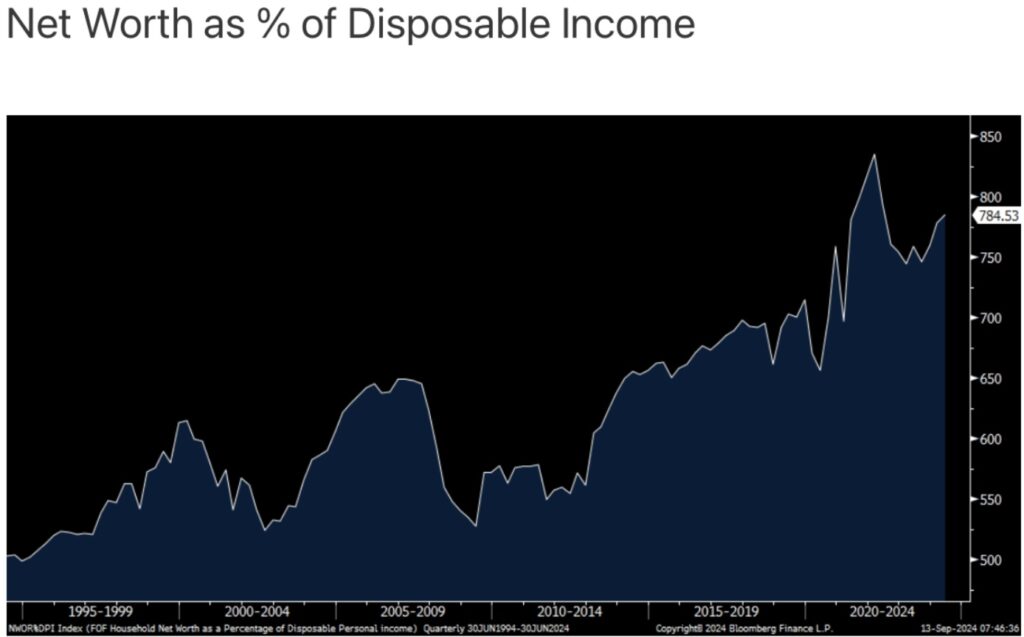

Peter Boockvar: The Fed issued its new Q2 flow of funds statement (h/t DDB for heads up) yesterday and my favorite chart has now been updated. It is of household net worth as a percent of disposable income. It’s basically measuring the level of asset prices relative to the broad economy and highlights again how inflated the former is relative to the latter and how dependent we are on that inflation as we are hugely dependent on high end consumer spending.

As seen, it got to 614% at the tech stock market peak in Q1 2000. That was exceeded in Q4 2006 when housing prices were raging higher at 649%. Q1 2022 was the all time high at 835% after the 2021 run in both stocks and home prices and right before the rate hikes came. It now stands at 785%.

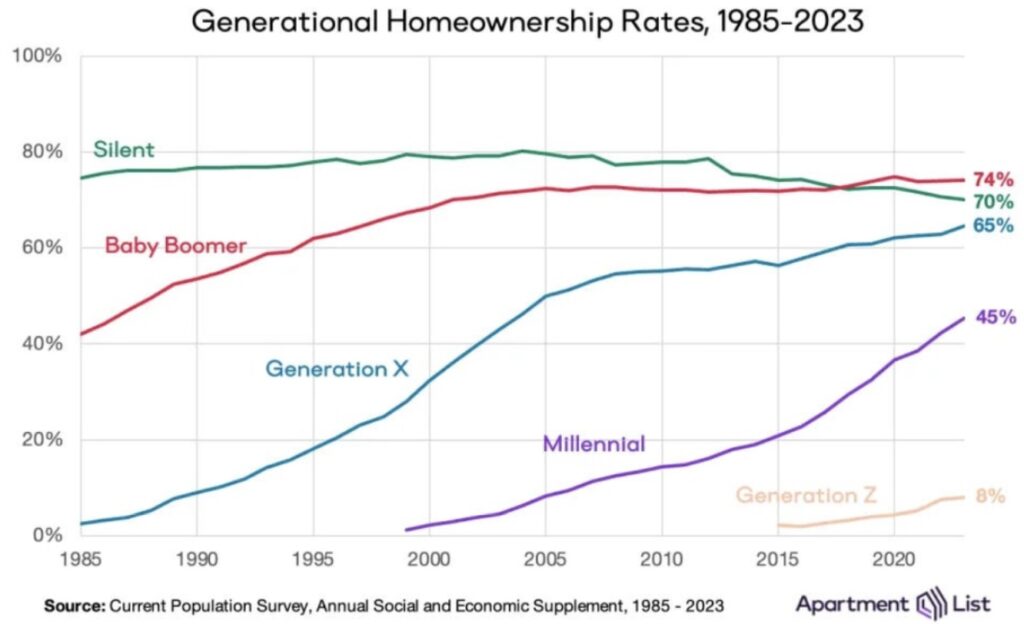

While this benefits those that own assets, it is a major financial hurdle for those that don’t. Apartment List yesterday released its 2024 edition of their Millennial Homeownership Report. It said “Today 45% of all Millennials are homeowners, a new high. But Millennials continue to buy homes at a slower pace than previous generations. By the time they reach age 30, just 33% of Millennials are homeowners, compared to 42% of Gen Xers, 48% of Boomers, and 55% of Silents, when they were the same age.”

And, “Data are also emerging for Gen Z, who face a severe shortage of affordable homes. Today just 8% of Gen Z adults are homeowners, and it’s still much more common for them to be living with parents than to be owning homes.”

This gets to my point that while there is a flood of new apartment supply this year, particularly in the sunbelt states, it will be well absorbed and set us up for a resumption higher in rents beginning in the latter part of 2025 and into 2026. https://www.apartmentlist.com/research/millennial-homeownership-2024

Another Record High For Gold

Gold by the way, at another fresh record high. Silver has a lot of catch up to do and I believe it will, talking my book…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

Amazing Commentary Here…

Peter Boockvar continues: From RH, and CEO Gary Friedman:

“demand was up 7% in the 2nd quarter and has continued to inflect positive, gaining momentum each month with July finishing up 10%. Demand accelerated into the 3rd quarter with August up 12% and product margins inflecting positive despite operating in the most challenging housing market in three decades.”

He highlighted that they are taking market share. “We believe our demand performance demonstrates we are the best positioned brand in our industry to benefit from the anticipated rebound of the housing market once interest rates decline and home prices reset lower, closing the affordability gap that has suppressed the market for the past several years.”

On the guidance, “Despite expectations for industry conditions to remain challenging until interest rates ease and the housing market begins to rebound, we expect our demand trends to accelerate throughout 2024 and into 2025.”

We know they have a higher end customer.

We Don’t Care About Social Media

Gary is always colorful. “By refusing to follow the herd into the anything-but-social world of social media, you won’t find us on Instagram, or paying a bunch of strangers, called influencers by some, to say they love our brand on TikTok, one thing you can be sure of is that place you will likely find us, is on the road less traveled, one guided by our vision and values that will continue to ignite our spirit and inspire our customers.”

And as we debate the extent of the rate cut next week, and what is to follow and so many are spiking the football on the inflation story without reflecting yet any sign of the sustainability of the inflation decline (as we need time for that), Gary reflected on the 1970’s.

The Terrible 1970s Inflation And Economy

“go to the 1970s and look at what happened like it’s inflation up, they took rates up, they thought they had it, they took them down, they thought they had it, then up and down, up and down, up and down, up and down, up and down, till the federal funds rate was like 21%…it’d probably be good to really zoom in and just have the patience to count it, and who says that can’t happen again? I hope not…I’d rather have them not cut the rates. It’s bad for our business. Do not cut the rates until you are absolutely have killed inflation. Leave no doubt. Because if it starts going up and down and so on and so forth, it hits anywhere like that period that, I mean, it’s like the worst 10 yr economic period in American history, except for the Great Depression. And you just don’t want that to happen. I’d rather hang on and we’re going to inflect no matter what.”

Stock Market Bubble To Pop!

***To listen to the man who helps oversee $150 billion discuss everything from inflation to global markets, a new launch and much more CLICK HERE OR ON THE IMAGE BELOW.

Prins Predicts $4,000 Gold Price & Much More

***To listen to Nomi Prins’s predictions for the price of gold, silver, uranium, interest rates and much more CLICK HERE OR ON THE IMAGE BELOW.

Just Released!

***To listen to Alasdair Macleod’s just released audio interview discussing the Russian gold buying along with other central banks and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.