Gold is back above $2,350 and silver is surging $1.63 near recent highs, but here is the big surprise.

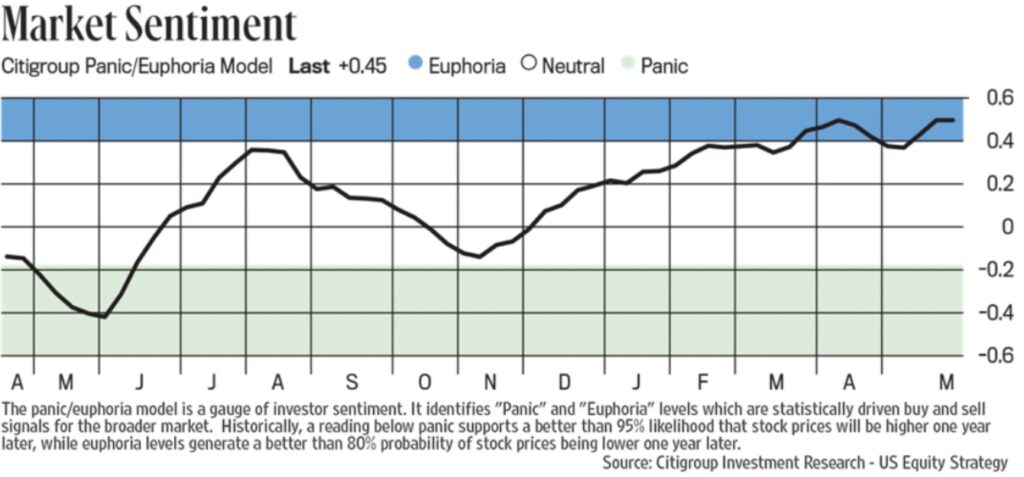

Euphoria

May 28 (King World News) – Peter Boockvar: As measured by Citi, euphoria is back to matching the mid April highs at .45 in its index and follows the extreme read in last weeks Investors Intelligence survey with the Bull/Bear spread above 40 points.

This index is particularly relevant in terms of its statistical significance according to Citi. As we know markets go up about 70% of the time, when someone argues that the odds of going down are at least 80% a year from now, it’s worth taking note. Obviously anything can happen but just be aware. Citi says:

“Historically, a reading below panic supports a better than 95% likelihood that stock prices will be higher one year later, while euphoria levels generate a better than 80% probability of stock prices being lower one year later.”

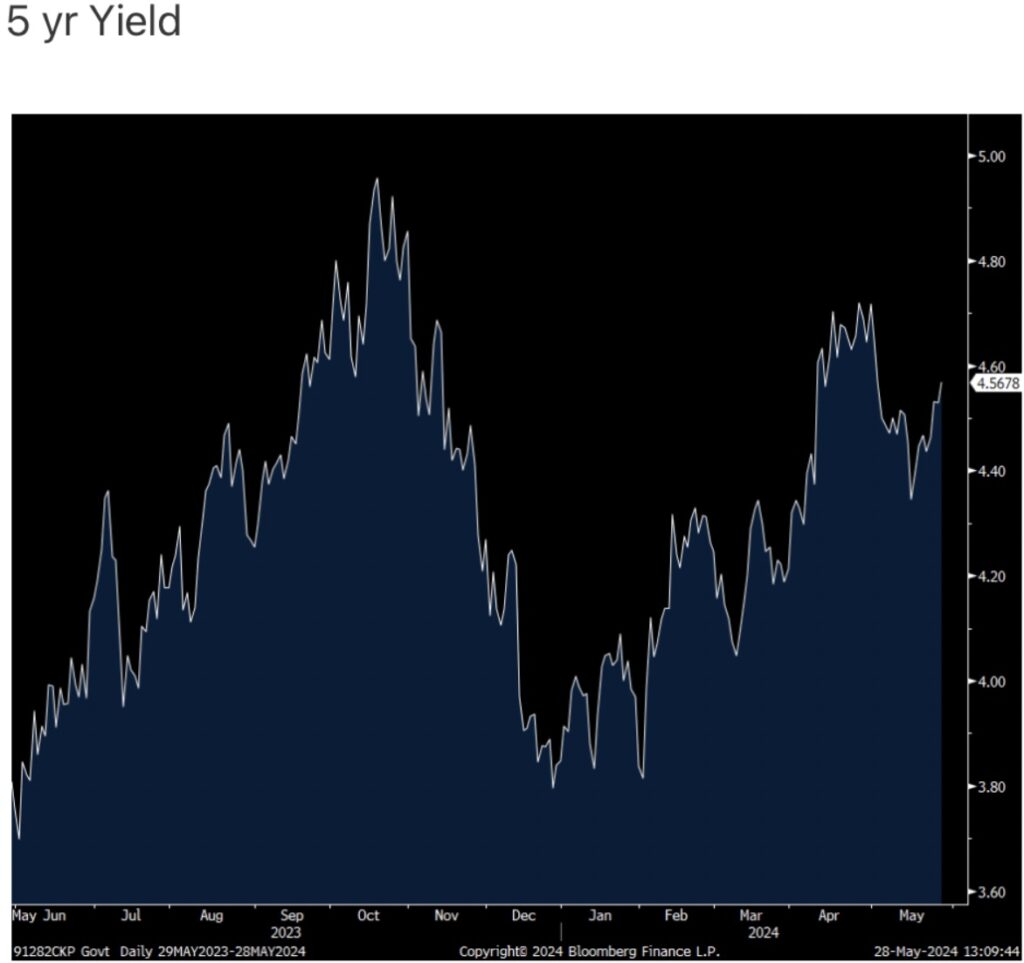

Treasury yields are rising to the high of the day after the 5 yr auction was poor. The yield of 4.553% was above the when issued pricing of 4.54%, thus tailing. The bid to cover of 2.30 was well below the one year average of 2.47 and the weakest since September 2022. And, dealers were stuck with the 2nd highest percentage of a 5 yr auction also since September 2022 at 19.5%. This follows the 2 yr auction earlier today that was mediocre and will be followed by a 7 yr tomorrow.

The 5 yr yield is quietly at a 4 week high in response.

Copper, Silver And Gold On A Roll

Separately but maybe an influence, it’s hard too not seeing what’s going on in some commodities today. After last week’s pullback, copper is up 2.3%, silver is up 5.3%, gold is up 1%, and WTI up by almost 3%. Ag prices are more mixed as wheat is at the highest since last July but corn and soybeans are lower. We remain long and bullish a variety of commodity stocks.

Gold, Silver, Commodities And Mining Stocks

King World News note: The continued debasement of global fiat currencies is showing no signs of slowing down, and that means the wind will be at the back of gold, silver and commodity investors for many years to come. Also of note, the high-quality mining shares continue to trade near the recent highs. That should be a theme that continues for some time to come.

Ultra-Wealthy Moving Into Physical Gold

To listen to Egon von Greyerz discuss the ultra-wealthy moving into gold and how that will impact the gold market CLICK HERE OR ON THE IMAGE BELOW.

Silver Shorts Are Desperate And Trapped

To listen to Alasdair Macleod discuss the silver shorts being trapped and what to expect from gold and silver in the coming weeks CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.