With gold hitting $2,440 and silver approaching $30, within hours King World News will be releasing a powerful interview with legend Pierre Lassonde, and what he had to say about where the price of gold is headed as well as what to expect from the mining stocks will stun many people.

Legend Pierre Lassonde’s King World News interview has now been released! But first…

Gold & Silver Continue Spectacular Run

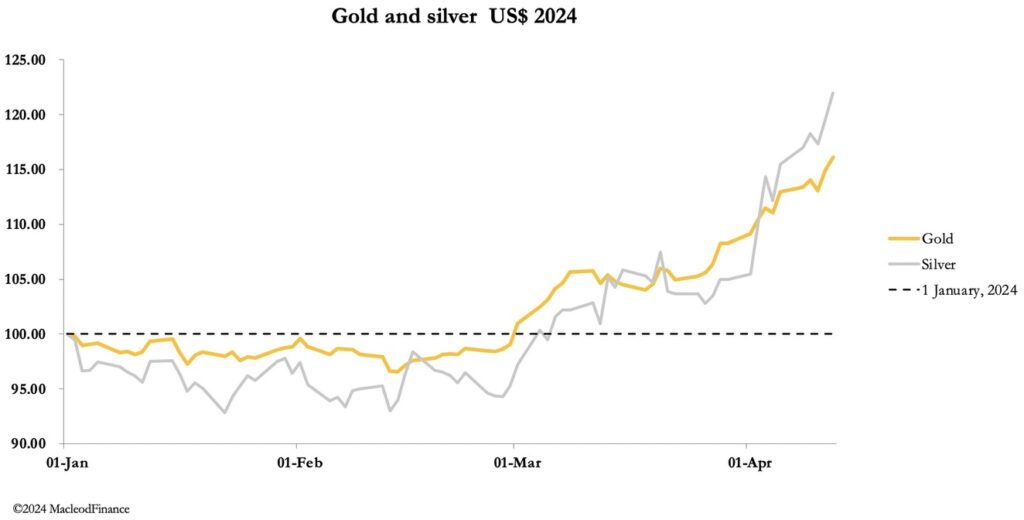

April 12 (King World News) – Alasdair Macleod: Gold and silver continued their spectacular run, with gold testing the $2400 level in European trade this morning, up $70 from last Friday’s close, and silver $29.15, up $1.70 on the week.

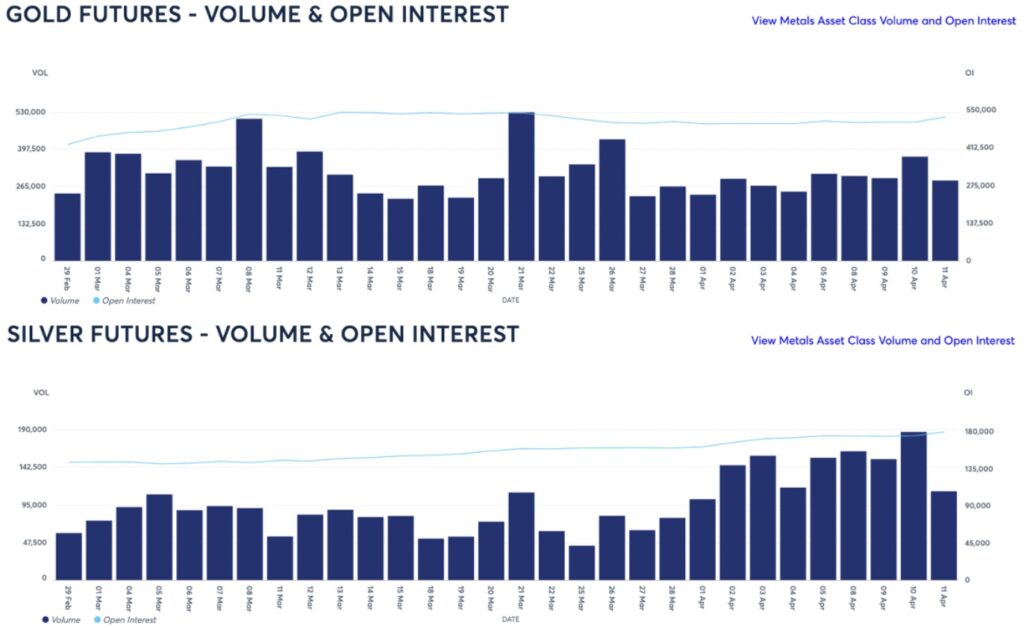

Trade volume in silver futures on Comex was high but declined materially yesterday on a sharply rising price. This tells us that selling on Comex is drying up, possibly indicating price strength will continue. In gold, volumes were remarkably subdued indicating that rising prices are not because of increased speculative activity. These are shown next.

Until yesterday when preliminary Open Interest in the gold contract jumped 18,000 contracts, it has been remarkably subdued. From 540,654 contracts on 13 March when the price was $2174, by Thursday Open Interest had declined to 505,601 contracts when the price was $2333 confirming current bear squeeze conditions. Open Interest’s 18,000 contract jump yesterday indicates that some speculative buying has returned, presumably driven by some hedge funds’ fear of missing out…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

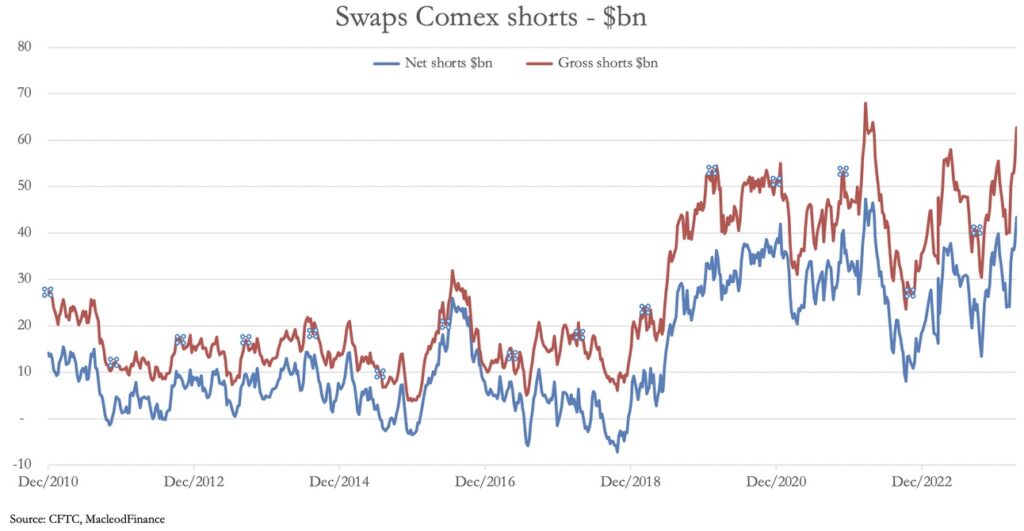

It couldn’t come at a worse time for bullion banks in the Swaps category. The next chart shows how their positional losses have accelerated. It takes the last COT figures (2 April, due to be updated tonight) adjusted for this morning’s price:

Gross and net shorts are approaching the levels last seen in March 2022 when speculation drove gold to test the previous record $2070 when Open Interest was 638,502 contracts. The heightened level of speculation enabled the bullion banks to take the price down subsequently to $1615 and their net liabilities to less than $10bn.

Can they do it again?

It seems unlikely in the absence of heightened speculative positions, and the credit background has deteriorated significantly. It is becoming clear that with inflation returning cuts in the Fed’s interest rates are on hold, and might even have to rise. Furthermore, auctions of 10-year and 30-year Treasuries were bad and lacklustre respectively, confirming fears of a possible debt crisis for the US Government. But perhaps the most worrying development is emerging from Japan, which might explain why Asian markets appear to be driving the price.

The next two charts show the yen/dollar rate and the yield in the 10-year JGB.

The yen has broken support at JPY151, where the Bank of Japan had drawn a line in the sand, and JGB yields are rising again. These factors could crash the entire Japanese banking system.

The Bank of Japan owns fully 60% of JGBs in issue having been buying them for the last 24 years. It has reduced the impact on its own balance sheet by suppressing interest rates below zero, only recently returning them to the zero bound. Markets are now signalling that unless the BOJ raises rates significantly, the yen will collapse. The reason this is becoming an issue is that hopes the Fed will reduce its funds rate are evaporating. The carry trade, as banks create yen to sell to buy dollars and T-bills for an increasing rate differential, is bound to increase.

On top of that, Japan’s commercial banks are among the most highly leveraged and will almost certainly face a crisis as the outlook for the yen and yen interest rates deteriorates. It is mostly visible to traders in the Far East, which appears to be driving gold higher while those of us in the West are wondering what on earth is going on. To listen to Alasdair Macleod’s timely audio interview discussing the wild trading in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

Legend Pierre Lassonde’s King World News interview with billionaire Pierre Lassonde has been released where he discusses his stunning prediction for where the price of gold is headed and so much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.