It appears the global elite orchestrated a shadow bailout to survive the $5,600 gold peak.

February 9 (King World News) – From retired pawnbroker Gurjit L: THE VORTEX PROTOCOL: How the Global Banking Elite Orchestrated a Shadow Bailout to Survive the $5,600 Gold Peak

A Note from the Team: After last Friday’s absolute chaos—a historic 47% plunge in silver—we decided to get our team together and do a deeper dive. We have worked to fit the pieces of the puzzle together to see how the “plumbing” of this entire system was orchestrated. This maneuver wiped out nearly $7 Trillion in global market value in a matter of hours. It wasn’t planned by one person or one bank; it was a complex, multi-institutional coordination in the shadows. We can now reveal how they save themselves while the system bleeds.

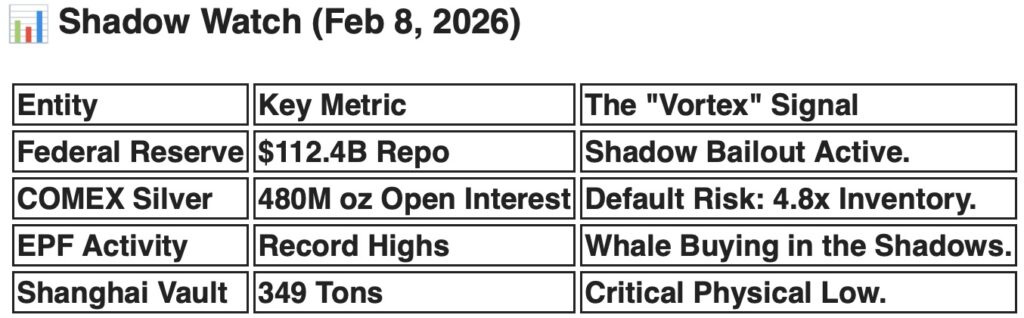

I. THE LIQUIDITY PUMP: The Fed’s $112 Billion Lifeline

The “Vortex” required massive pressurized cash to flush the market without bursting the pipes of the Bullion Banks.

- The Shadow Bailout: On Friday, February 6, the Fed’s Standing Repo Facility (SRF) spiked to $112.4 Billion. This provided the “Big Four” (JPM, HSBC, etc.) with the emergency cash needed to handle the 480-million-ounce claim sitting on the March contract.

- The “Warsh” Smokescreen: The nomination of Kevin Warsh (Jan 30) acted as a psychological “Flashbang,” spiking the Dollar (DXY) and giving the banks the “fundamental” cover to dump millions of ounces of paper metal.

II. THE EPF TRAP: The “Whale” Buying in the Shadows

Here is the secret: Every time the banks “Vortex” the price down, they are met with a Whale of buying that they themselves are often forced to facilitate.

- The EPF (Exchange for Physical) Surge: Throughout the week of Feb 2–6, we saw a massive spike in EPF trades. These are “off-exchange” deals where paper contracts are swapped for physical metal privately.

- The Friday “Whipsaw”: On Friday, Feb 6, silver crashed to near $64 and then snapped back violently. This was the “Whale” entering. The banks are forced to buy back their own shorts at the bottom to prevent a total physical “lock-out.”

- The Conclusion: They are washing their “dirty” paper shorts into “clean” physical metal through these private EPF channels, hiding the true demand from the public ticker.

III. THE EASTERN SEAL: UBS and the Shanghai “Account Heist”

- The UBS Valuation Trick: To stop a physical “Run on the Vault,” UBS SDIC in Shanghai overnight revalued its $2.2B Silver Fund using crashed Western paper prices. This -31.5% NAV drop on February 2nd essentially “stole” the equity from Chinese investors to protect the bank’s remaining physical bars.

IV. THE GLOBAL VACUUM: The RBI & the GIFT City “Smart Valve”

The banks are fighting a “Black Market” vacuum they cannot control, and the Indian Government just locked the front door.

- The India Trap: While the paper price says $78, the “Street Price” in Mumbai has seen premiums explode. The DGFT has restricted silver imports until March 31, 2026, to stop the drain.

- The “GIFT City” Pipe: The only way to move metal now is through GIFT City (IIBX) under the Tariff Rate Quota (TRQ). This allows the big banks to satisfy Indian “Whales” in private, without it hitting the open market and spiking the COMEX price.

V. THE DOOM LOOP: The Cycle of Violence

The banks are trapped. They will likely initiate “The Vortex” several more times before the February 27th COMEX Notice Day.

- The Goal: They must force the public to sell their physical metal back to the “House” at a discount.

- The Problem: Every time they slam the price, the “EPF Whales” and industrial users (Solar/AI) step in and vacuum up the physical metal even faster. This is a true Doom Loop—the lower they push the price, the faster the physical vault empties.

VI. FINAL WORD FROM THE LENS

I am just a retired pawnbroker, and I share what i find with logic, data, and deductions. This is not financial advice. Just remember to do your own research, and I hope some of this helps you on your wealth preservation strategy.

Remember, mainly, we do nothing with our stacks but research and watch this whole episode unfold in a spectacular show. The Fed provided the getaway car, the CME turned off the cameras, and UBS locked the customers in the basement. But here’s the catch: Every time they try to run, they realize the tires are flat. They’re buying back metal at $75 because they know if they don’t, there won’t be a market left to rob by March.

LISTEN: Gold, Silver, US Dollar, Oil, future inflation and more…

To continue listening to legend Rob Arnott discuss gold, silver, the US dollar, oil, future inflation and much more CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

To listen to Alasdair Macleod discuss the collapse in Open Interest in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

Investing Legend Rob Arnott Says Silver vs Oil Ratio Reached Insane Levels CLICK HERE.

Gold & Silver Open Interest Has Collapsed To Historic Low! CLICK HERE.

UPDATE: Here Is Where The Silver Market Stands After The Crash CLICK HERE.

SILVER: People Start Making Poor Decisions When Volatility Spikes CLICK HERE.

Central Banks Will Move Gold Price Much Higher CLICK HERE.

SILVER: Look At What Is At One Of The Most Undervalued Levels In History CLICK HERE.

Economic Collapse And The Implementation Of The Slave Monetary System CLICK HERE.

Friday’s Historic Takedown In Gold & Silver Caused Some Dealers To Close The Door On Precious Metals Buys CLICK HERE.

This Is The Biggest Breakout In History! CLICK HERE.

Major Gold & Silver Update After Friday’s Crash In The Silver Market CLICK HERE.

Making Sense Of Friday’s Utterly Rigged Nonsense In The Silver Market CLICK HERE.

What To Do After Friday’s Brutal $37 Plunge In Silver CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.