Investors looking to accumulate physical gold and silver should use pullbacks to add to their positions as historic breakouts have already taken place. Take a look for yourself…

James Turk is pinch hitting for Alasdair Macleod this week, and Turk’s audio interview has just been released! (link below). In the meantime…

All That Glitters Is Not Gold

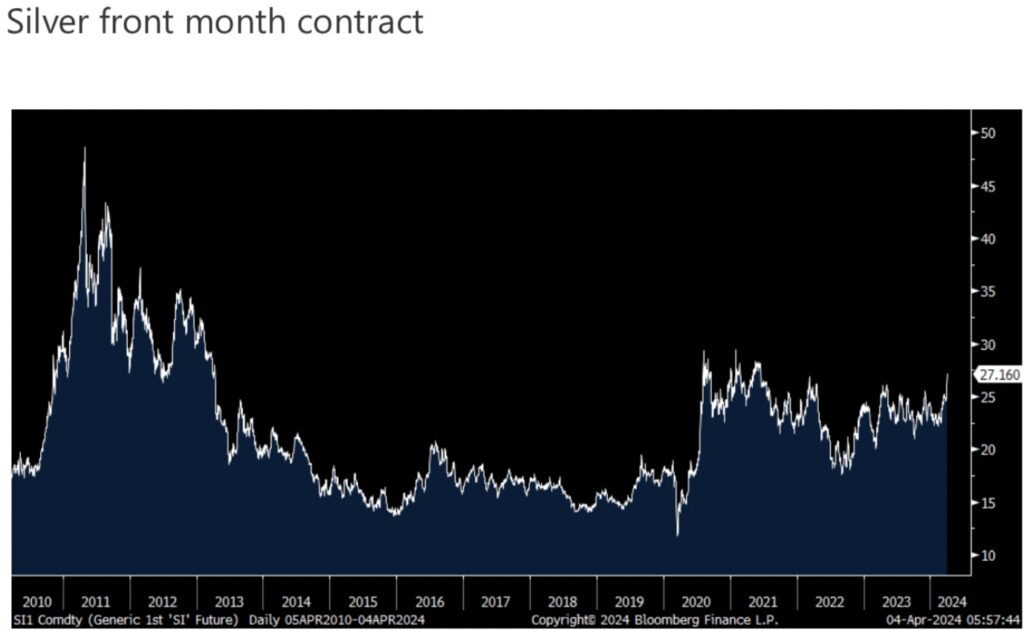

April 5 (King World News) – Peter Boockvar: All that glitters is not always gold (which people are FINALLY talking about but has outperformed the S&P 500 from the year 2000 if you didn’t know after 20 years of underperformance), it can be silver too. The small sibling of gold, with about half the demand coming from industrial uses, is finally playing some catch up and I believe has a lot more room to run…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Silver still remains nearly 50% from its record highs. Not the best way to value silver but to provide some perspective, going back to 1971 when Nixon officially took us off what was left of the gold standard, the gold to silver ratio averaged about 60x. Today it stands at 84. Getting back to that long term average would currently put silver at $38. We remain very bullish and long of silver.

Silver

Graddhy out of Sweden: SILVER already has a breakout on quarterly time frame.

Now, it is breaking out on monthly, regardless of trend line used.

Silver Has Already Broken Out On A Monthly Basis

Silver’s Historic Breakout

Graddhy out of Sweden: Been saying for 13 weeks that gold has a quarterly breakout.

Now silver has a quarterly breakout.

Silver’s Historic Upside Quarterly Breakout!

And the combined gold and silver vehicle CEF is also breaking out.

More Breakouts In The Precious Metals Space

This means the secular bull market is resuming. A proper lifetime opportunity, and threat. Get ready.

Silver & Mining Stocks

King World News note: For those of you accumulating physical silver, use any weakness to add to your holdings because the time to buy cheap silver may be coming to an end fairly quickly. For those of you in the high-quality mining and exploration stocks, they continue to climb not a “Wall of worry,” but a “Wall of Terror.” Virtually nobody in the investing world is interested in this sector, but that interest will come when the price of gold approaches or clears $3,000. By then the HUI will much, much higher than what is being quoted today.

JUST RELEASED: To listen to James Turk discuss gold closing the week at an all-time high as well as silver hitting new recent highs along with the HUI Gold Mining Index CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.