Consumers are struggling, plus a look at real estate as Art Cashin says keep your seatbelt fastened.

Keep Your Seatbelt Fastened

July 7 (King World News) – Art Cashin, Head of Floor Operations at UBS: They [the bulls] attempted to get the act together and really basically counter attacked the Bears, but it was not terribly successful [yesterday]. The S&P seemed to struggle to try to get above the 4411 level, which ironically is where it ultimately closed. And the Dow Jones had great difficulty as it approached the 34000 level. So a good deal will depend on today’s data, particularly the non-farm payrolls, which will come out an hour before the opening.

While traders obviously look at the headline number which is estimated at perhaps 240,000 jobs. They will also look at a variety of other items. There are rumours of an unusually large adjustment on the Birth/Death estimate (not birth/death of people, but the estimated birth/death of companies hiring or firing people). That can often distort the number, as can the seasonal adjustment, which is also rumoured to be somewhat outsized. Away from that traders will be looking to the wage component because it is wages which can have a particular inflationary effect. And al so hours worked which as oddly been easing back even as the hiring apparently goes up, which is contrary to ordinary logic.

But, in the meantime we should take a look and see what our cousins offshore are doing…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Unfortunately our communication with our normal offshore sources is a bit sticky this morning, so take these estimates with a very large grain of salt. But it looks like Tokyo was down about 400 points in the Dow and Hong Kong was off about 250 points in the Dow and Mainland China was off about 150 points in the Dow.

The European markets appear to be also apprehensive in front of today’s US data.

Today’s economic calendar is a rather light, obviously we get the payrolls data at 8:30am as we said and then at 10:30am we’ll get the natural gas inventories which was delayed by the July 4th holiday and then it being Friday we’ll get the Rig count at 1pm and I don’t see any Fed speakers listed on my docket.

So you know the current drill. Stay close to the newsticker, keep your seatbelt fastened. Stay nimble and alert. Have a wonderful Friday and also try to have a wonderful weekend. But in all cases try to stay safe.

Arthur

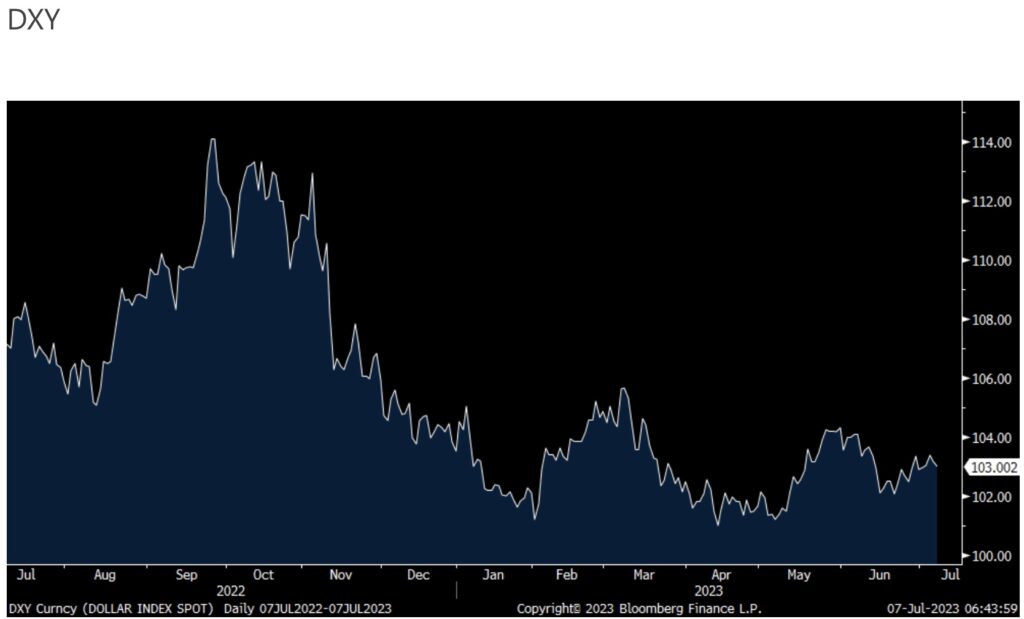

US Yields Rising But Not Helping US Dollar

Peter Boockvar: While US yields have jumped back to 4 month highs, the US dollar can’t get out of its own way and something to watch from here as maybe its other flaws now get exposed. Flaws such as the US being the largest debtor nation and with a budget deficit as a % of GDP at 7% even before a recession has begun.

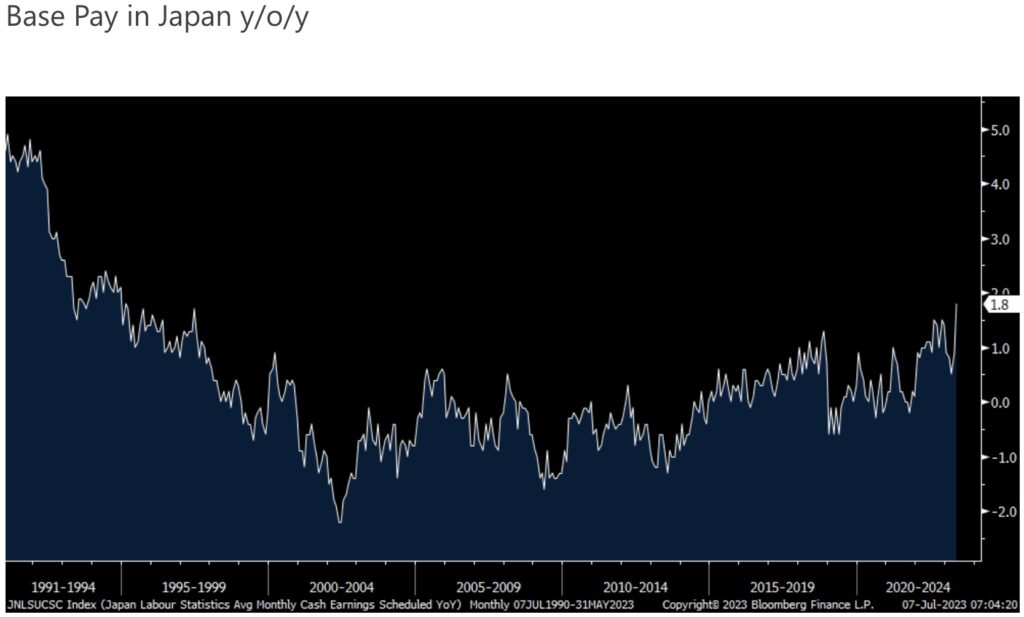

Yen Strengthens On Japanese Inflation

Also, the growing diversification away from its usage. In particular today, the major currency that has seen the most weakness against the dollar, that being the yen, is jumping after wage date came in stronger than expected. Regular base pay in May jumped 1.8% y/o/y, double the pace seen in April. While that doesn’t sound like a lot and is still trending below inflation, it is the fastest pace of gain since 1994, almost 30 years ago.

We just might be seeing the set up for another widening of YCC at a coming BoJ meeting.

The 10 yr JGB yield was higher by 1.4 bps to .43%, a 3 week high. The 9 yr yield was up by 3.4 bps to .37%, matching the highest since late April. The 40 yr yield was up by 3.2 bps to 1.43%. On a percentage basis, the yen is having its best day against the dollar in a month. Something to watch for global bonds.

Levis Says US Consumers Being Squeezed

These were some of the important comments from the Levi Strauss earnings call where they saw strength in DTC and international markets but softness in US wholesale. “There are two main drivers to the slowdown of our US wholesale business. First, the macro effects of higher inflation in a slowing US economy has put increased pressure on the price-sensitive consumer. Second, as we have mentioned for several quarters, our inventory backlog created supply chain challenges in our US distribution centers, resulting in our inability to fulfill all demand. The lower fill rate resulted in higher customer out-of-stocks and less newness on the floor the last few quarters.”

Demographically, “In the US, we’re seeing strong demand with the $100,000-plus income consumer, particularly in our mainline stores, helping drive share gains in the premium end of the jeans category in the US. We’ve also maintained our share of leadership with the key 18 to 30 yr old demographic.” On the other hand, “clearly the lower or moderate income consumer is being squeezed. And that is driving some of the big category dynamics, much more price sensitivity. When we look at our business, our value brands are down double digits, US wholesale down double digits, and softness in that channel.”

Also, “The peak of inventory is behind us.”…

This Company Has A Massive High-Grade Gold Project In Canada And Billionaire Eric Sprott Has A Huge Position! To Learn Which Company Click Here Or On The Image Below.

Commercial Real Estate Defaults Surging

Stating the now obvious reality, something that I expect to be a continuing story in many areas of commercial real estate as the year progresses was this story from Bloomberg News yesterday, “Hotel Owner Misses Debt Deadline on $982 Million in Mortgages.” The article said “Ashford Hospitality Trust failed to repay or refinance $982 million of mortgages on a hotel portfolio before the debt’s maturity in June. A special servicer who is managing the debt has hired counsel and is in talks for a workout agreement to extend the loan and delay a so-called ‘balloon payment’ that is owed, according to a June filing of date compiled by Computershare. The properties are valued at $1.3 billion.” Higher rates for longer and death by a thousand cuts economic reaction.

Homes Selling For More Than Asking?

Pointing again to the upside down housing market where a more than doubling in mortgage rates is not leading to lower home prices because of the tight inventory situation, Redfin yesterday said “The average sale-to-list price ratio hit 100.1% during the four weeks ending July 2, marking the first time in nearly a year the average US home is selling for more than its asking price.” Their median home price index was basically flat y/o/y, down .3%.

ALSO JUST RELEASED: Art Cashin Just Warned We Could See Another Wave Of Selling Today CLICK HERE.

ALSO JUST RELEASED: ALERT: Europe Now Taking Steps To Move To A Cashless Society CLICK HERE.

ALSO JUST RELEASED: Big Problems Around The Globe As Stocks Struggle But Look At This CLICK HERE.

ALSO JUST RELEASED: Stoeferle – Gold, Silver, The Mining Stocks And Where To Invest In A Recession CLICK HERE.

ALSO JUST RELEASED: Greyerz Just Warned A Major Revaluation Of Gold Is Imminent CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.