Consumer debt problems are skyrocketing. Plus a look at travel and luxury spending.

What’s Wrong With Deflation?

October 17 (King World News) – Peter Boockvar: We know for many years that the Bank of Japan has been wanting higher inflation, something sustainable around 2%. They’ve actually now gotten it in every month since March 2022 with inflation above 2% but they still only have their overnight rate at just .25%. What they and other central bankers still don’t realize, even after the last few years, is that while the average person of course does not like high inflation, they don’t even want a 2% rise in their cost of living.

If you didn’t see in the Financial Times this week, there is an article titled “Tokyo Bans Harassment of Staff by Customers.” It says, “Tokyo will become the first part of Japan to ban customer harassment of service workers amid a perceived worsening of consumer behavior that some analysts say is linked to the return of inflation.”

This is meant to “tackle customer nastiness known by the abbreviation ‘kasu-hara’…Now that sustained inflation has returned, senior executives in the restaurant, hospitality and retail sectors say customers are unhappy.”

This was a quote in the article from Jesper Koll who is a Japanese based economist:

“During the decades of deflation, customer satisfaction and happiness was built in. Now that prices are going up – and going up not just once but more or less consistently – Japanese feel cheated. Under deflation, the customer was always king. Under inflation, they are taken for a fool.” https://www.ft.com/content/f48b9af5-d48c-45c3-a9cd-6d34b3759202

My point here is too many think about inflation simplistically. High inflation bad, 2% good. All deflation bad. It’s not that simple. Lower prices are why the technology in your hand is so cheap. Lower prices are why Walmart and Amazon are the two biggest employers in the country. Deflation is really only bad for those that have too much debt to service and for those companies that don’t have productivity and volume levers to pull. The consumer loves deflation.

Meanwhile In The US

Speaking of inflation and how the US consumer feels about, in the NY Fed’s Consumer Expectations survey out yesterday, the one year expectation for it remained at 3%. It rose to 2.7% from 2.5% for the 3 yr view and up by one tenth to 2.9% for the 5 yr guess. The 2 tenths rise for the 3 yr view was “most pronounced for respondents with at most a high school degree” and likely a cohort that is feeling the inflation pain the most.

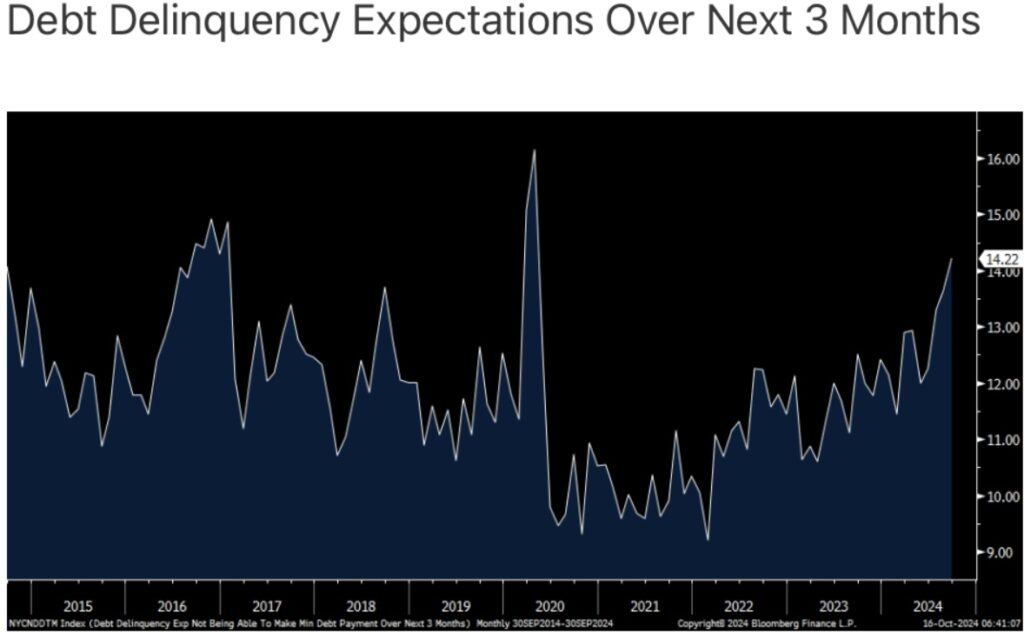

The answers to the labor market questions rose a touch but were little changed for income. Most noteworthy within in the data was on the credit quality side. “The average perceived probability of missing a minimum debt payment over the next three months increased for the 4th consecutive month to 14.2% from 13.6% in August. This is the highest reading of the series since April 2020. The increase was most pronounced for respondents between ages 40 and 60 and those with annual household incomes above $100k.” Interesting and that percentage is the highest since 2017 not including Covid.

Debt Delinquency Expectations Skyrocketing

Luxury Sales Struggling

…this is what LVMH said in their quarterly sales call:

“Overall, demand has been characterized by two opposing trends. On the one hand, demand from China clientele remained fairly dynamic in the first half of the year. However, Chinese consumers are facing growing macroeconomic headwinds, which obviously impacts their confidence and weighs on their discretionary spend. And on the other hand, demand from Western clienteles shows a sequential improvement, this being very gradual, given that inflation and interest rates remained high. So in a nutshell, the net effect of these two trends was slightly positive in the first half of the year and became slightly negative in the third quarter.”

Travel Remains Strong

Travel remains strong though as seen with United and pricing should also firm up:

“revenue trends improved as the industry reached an inflection point in the quarter with unprofitable capacity exiting the market. Domestic unit revenue was positive y/o/y in August and September. Demand continues to be strong for the United product: Corporate revenues were up 13% y/o/y in September and in the quarter premium revenues continued to remain resilient and were up 5% y/o/y and revenue from Basic Economy was up 20% y/o/y.”

Listen To Egon von Greyerz’s Stunning Gold Price Prediction

***To listen to one of Egon von Greyerz’s most powerful audio interviews ever where he makes a stunning prediction for the price of gold, and discusses what every investor must know heading into 2025 CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.