It has been a wild 2025 for trading in the global gold market, but as we near the end of the year it appears China’s gold market is in turmoil with West vs East seated at a poker table vying for control ahead of the reset.

CHINA GOLD MARKET IN TURMOIL: The Gold Game of Sovereignty—West vs. East at the Poker Table

November 10 (King World News) – From the lens of King World News reader and retired pawnbroker, Gurjit L.: “The West is not the only game in town.”

China’s gold market is facing a severe downturn, marked by mass store closures, plunging stock values, and a surge in retail prices, following a surprise tax policy change by Beijing. For a veteran like myself, the chaos in Shenzhen’s gold hubs isn’t just news; it’s a critical lesson in high-stakes strategy. The phrase, “The West is not the only game in town,” perfectly frames the new geopolitical reality: China is playing a deep, complex game of poker, with its financial decisions driven by internal stability and global sovereignty.

“In my time, running a pawnshop wasn’t just about ethics and hitting our targets,” I reflect. “It was about knowing what the other players in town were doing, and why—what affected them might affect us, and vice versa. This China story is the same, but on a massive scale. It’s the government making a huge move, and it’s crushing the small businesses.”

The Tariffs’ Stress Test: The Stakes Are Raised

As a pawnbroker, I always had to gauge how big global storms would hit my small shop. The US tariffs on Chinese goods act like a massive stress test on the Chinese economy (ref 2), intensifying the fear and uncertainty that drive Beijing’s domestic gold policies. The tariffs are a massive geopolitical raise in the pot…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

The Catalyst: The ‘Freeze Card’ and the Crisis Unfolds

On November 1st, Chinese authorities abruptly ended a tax break for non-investment gold (jewelry and industrial use), reducing the input tax deduction for VAT from the full 13% offset down to just 6% (ref 1, ref 2). This move effectively raises the raw material cost of gold by about 7% for the retail sector (ref 4).

The market instability was immediate. Major hubs like the once-bustling Shui Bei gold market in Shenzhen reported deserted aisles. Large chains scaled back dramatically:

For context: Leading retailer Chow Tai Fook closed 905 stores in its 2025 fiscal year (ref 3), showing the immense scale of market contraction. When the largest players are shedding outlets at that pace, you know the independent merchants—the small family shops—are getting wiped out entirely.

“A 7% increase isn’t a tweak; it’s a brick wall for a small gold business,” I note. “Gold is a low-margin business that relies on volume. When the government effectively raises your cost of goods, you have to pass it to the customer. Then you lose sales, your margins disappear, and you have to close up shop. The government moved, and the small-time retailer is the one taking the loss.”

The ‘Small Blind’ Pays the Price: Pawnbrokers and Recyclers

In this high-stakes game, the small pawnshops and recyclers are paying the “small blind”—the mandatory cost of sitting at the table. The new tax rules, by widening the price gap and imposing crushing regulatory costs, are hitting the gold buy-back business hardest.

- The Widening Price Gap Kills Recycling: The gap between what a customer pays (high, tax-included) and what they get back when they sell (low, raw-metal value) has widened dramatically, surging to over 100 Yuan per gram in markets like Shenzhen. “That huge gap kills the incentive to sell old gold. They’ll keep the gold under the mattress.”

- Regulatory Costs Squeeze Small Merchants: Citi analysts estimate the tax policy could slash major jewelry retailers’ net profits by 15% to 26% if they don’t pass the cost to consumers (ref 3).

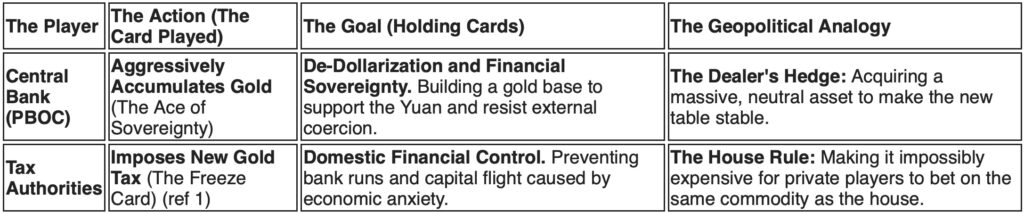

The Strategic Hands: China’s Dual Gold Game

The game is not played with one hand, but two: the strategic, geopolitical hand (PBOC) and the tactical, domestic control hand (Tax Authorities).

The Geopolitical Goal: Winning Monetary Sovereignty

The PBOC’s gold buying is driven by the fact that US tariffs and sanctions are the “weaponization” of the US dollar. Gold is the ultimate sanctions-resistant asset.

The Accumulation: The PBOC is the world’s most aggressive central bank buyer (ref 4). By late 2025, the PBOC had increased its gold reserves for twelve consecutive months (ref 5), reaching over 2,300 tonnes (ref 6). The central bank is deliberately shifting its vast reserves away from U.S. Treasury bonds.

- Tariffs Fuel Panic: Tariffs cause global gold prices to surge. The government’s tax hike is a frantic domestic counter-measure to stop this flow and stabilize its banking system while it plays the long game against the West.

- Controlling Autonomy: The tax increase discourages private gold hoarding, ensuring capital flows back into the state-controlled financial system.

Wisdom from the Bench: The Investor’s Strategy

“After all this talk of high finance and geopolitical poker, what does it mean for the average person with a little gold saved up?” I reflect. The truth is, when the major powers are betting the house, the small player’s best move is often to sit tight.

My advice from the pawnbroker’s bench is simple: Watch. Wait. Stack on the dips. Be patient. Do nothing.

The Poker Analogy: You don’t challenge a dealer who is stacking chips on the table and changing the house rules mid-game. You sit back, hold your gold, and let the big dogs fight it out. When the inevitable volatility—the ‘bad beats’—shakes the market, that is your opportunity to buy a little more on the cheap. You are investing in value, not gambling on policy shifts.

The gold you hold remains a true hedge against the instability caused by tariffs, property collapse, and central bank maneuvers. Keep your cards close to your chest, and let the geopolitical storm pass.

References

- (ref 1) China Ends Gold Tax Incentive in Setback for Key Bullion Market. MINING.COM (Nov 1, 2025).

- (ref 2) Gold and Silver Rebound from China’s Sudden Tax and Export Rule Changes. BullionVault (Nov 3, 2025).

- (ref 3) Chow Tai Fook (01929)’s big gamble: the gross margin of a thousand stores jumped… Webull (Jun 18, 2025).

- (ref 4) China’s Gold Purchases A Strategic Reserve Build-Up. Tekedia (Oct 16, 2025).

- (ref 5) China’s central bank buys gold for 12th straight month. The Economic Times (Nov 7, 2025).

- (ref 6) China Gold Reserves. Trading Economics (Q3 2025 data).

Boockvar On $200 Silver And More

To listen to Peter Boockvar discuss $200 silver as well as the upside for gold and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

Just Released!

To listen to Alasdair Macleod discusses some big surprises in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: Gold Price Remains Radically Undervalued vs 1980 High CLICK HERE.

ALSO JUST RELEASED: Boockvar – Silver’s Inflation-Adjusted Price Is A Jaw Dropping $200 CLICK HERE.

ALSO JUST RELEASED: Colombo – This Is Where Things Stand In The Gold & Silver Markets CLICK HERE.

ALSO JUST RELEASED: Volatility: Riding The Gold & Silver Markets CLICK HERE.

ALSO JUST RELEASED: DC’s “Financial Apocalypse” Playbook REVEALED CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.