Investors around the world need to buckle up because the Federal Reserve is preparing to unleash QE to infinity.

November 20 (King World News) – Matthew Piepenburg, partner at Matterhorn Asset Management: It doesn’t require decades of financial expertise to balk at the notion of selling retail air conditioning units in Siberia or lemonade stands in the heart of the Arctic.

That is, even a high-school freshman would foresee the likely mis-match in supply and demand. After all, unwanted assets, including USTs, can often have more supply than demand.

In other words: Common sense matters.

But in the land of twin deficits, pathologically dishonest/lobbied politicians, negative net international investment positions, chronically obese Fed balance sheets, the Paul Krugman-like blue pill of solving every debt problem with more debt and a Noble prize granted to a central banker who pays that debt with money created out of thin air, common sense appears to be the latest concept to be cancelled in DC.

In fact, if DC’s open incompetence (or blatant corruption) wasn’t otherwise so tragic, it could almost make anyone burdened with self-awareness laugh out loud.

Almost…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

The Not-So Funny Facts

But there’s nothing funny about a nation living at historical levels above its means and drowning in an openly ignored 120% debt/GDP debt spiral.

Meanwhile, emotional-heavyweights (yet evidence-free-lightweights) openly signal their virtue – pandering to safe consensus (and voters) about everything from trans-gender bathrooms and the original sin of white privilege to an increasingly vocal chorus bent on slowly eradicating each of our ten Bill of Rights, from free-speech to due process.

In other words, the divided are squawking as Rome burns…

Nor is there anything funny about debating “hard vs. soft landings” with a middle-class suffering record-high credit card debt at 20% interest rates while repo men collect delinquent autos at a pace higher than the Great Financial Crisis of 2008.

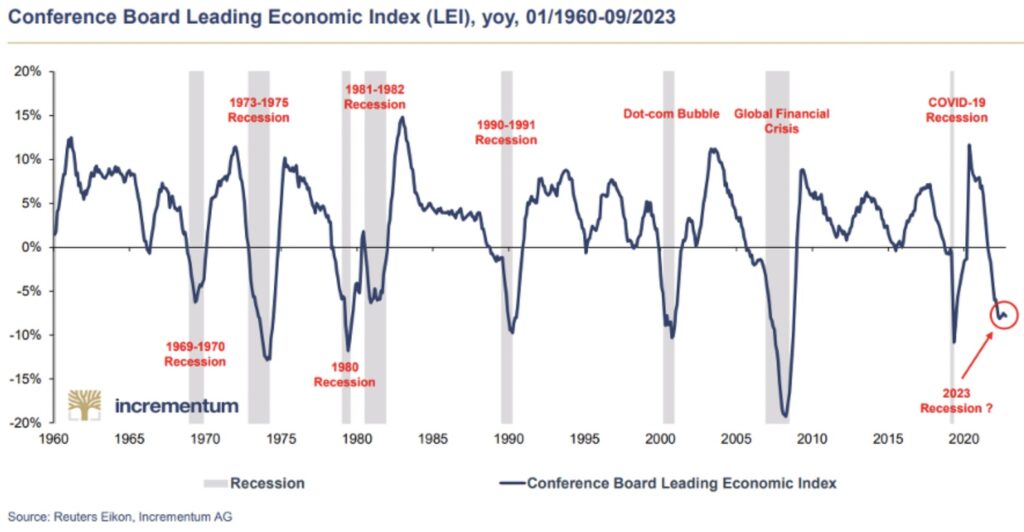

And let us not forget, of course, pundits debating about a recession or “looming” recession when the inverted yield curve, YoY M2 declines, the Conference Board of Leading Indicators and ignored illiquidity in the repo markets make it factually clear that America is already in a recession.

At the same time, the U.S. is approaching year-end with over 400 bankruptcies and rising lay-offs as its debt-driven S&P 7 pretends “resilience” while ignoring the over $750B in corporate bonds beneath those stocks about to roll-over at higher (Powell-made) debt costs in 2024, and another $1.2T more roll-overs coming in 2025.

Given that the now distorted American Dream lives off debt, when the cost of that debt rises, the “dream,” as well market, dies.

Dying Beyond Our Means

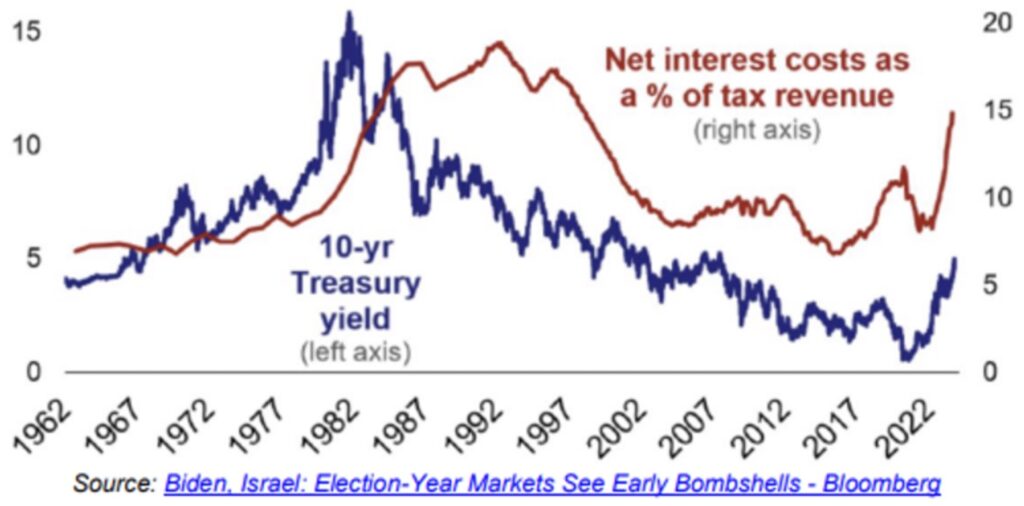

This hidden skunk in the debt roll-over woodpile of a nation in slow decline (as all debt-soaked nations do) is only made worse when we realize that the pattern of marching toward a rate-hike cliff is even worse for US government debt (racing toward $34T and counting).

Folks, unless the Fed pivots toward QE, rate cuts, and likely YCC, 30% of that already unpayable public debt is about to be re-priced at higher (Fed-made) rates in the next 36 months.

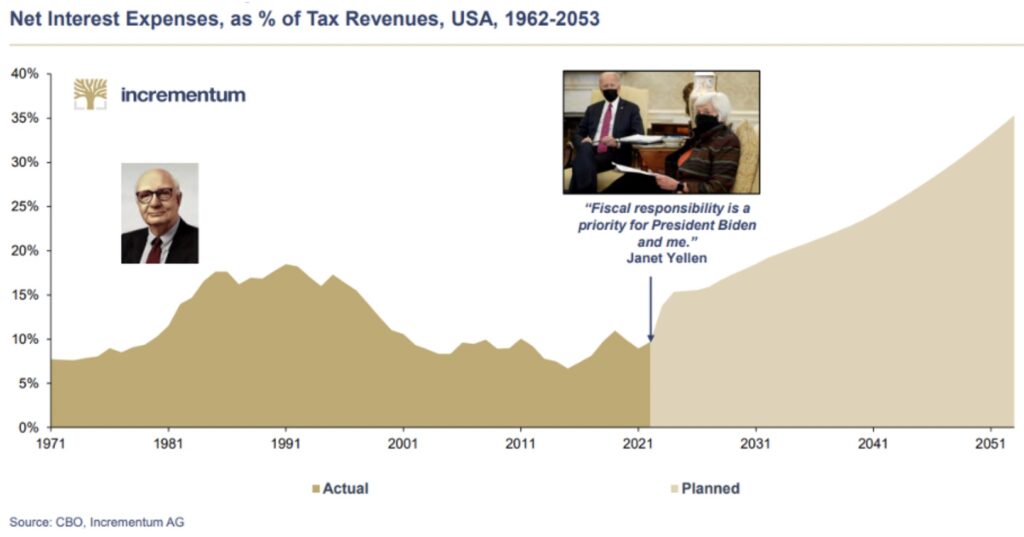

This means that more than 40% of US tax receipts (which will be even less if markets tank) will be allocated to just paying down the interest expense on Uncle Sam’s openly grotesque bar-tab.

Such debt, interest rate and credit market realities prove that America is not living beyond its means, but actually (as an impoverished Oscar Wilde moaned from his death bed in a Parisian hotel) “dying beyond its means.”

This slow death, of course, may sound sensational, but facts (and basic math) are stubborn things, no?

Our Own Opinions, Not Our Own Facts

Although we are all entitled to our own opinions, we are not entitled to our own facts, despite our “data dependent” Federal Reserve forever seeking to re-engineer the “data” of our so-called CPI/inflation scale, recession metrics and unemployment rates.

The ironies just abound as each of us struggle to thread the needle of information vs. misinformation on everything from vaccine efficiency to George Santos’ college volleyball stats… (assuming he went to college?)

In sum, it’s getting increasingly hard to perceive the lighthouse of truth or the little voices of our own common sense among an ever-thickening fog of top-down distortion and bottom-up resignation.

Which brings me back to my opening thoughts of lemonade stands in the Arctic and the need for resurrecting our common sense.

A Foreseeably Bad Treasury Auction

Toward this end, let’s consider the otherwise “boring” but oh-so seminal importance of the sovereign bond markets in general and the UST market in particular, for as I’ll say nearly every chance I get: The bond market is everything.

It’s very likely, given the Sturm und Drang of current headlines, that some of you may have missed Uncle Sam’s recent attempt to sell 30-Year Treasuries at auction in November.

Like that lemonade stand in the Arctic, there were very few buyers at Uncle Sam’s garage sale…

This, of course, is no shocker to those (both within and outside America’s borders) who already know that Uncle Sam is little more than a bad credit issuing a declining and increasingly unloved asset (UST).

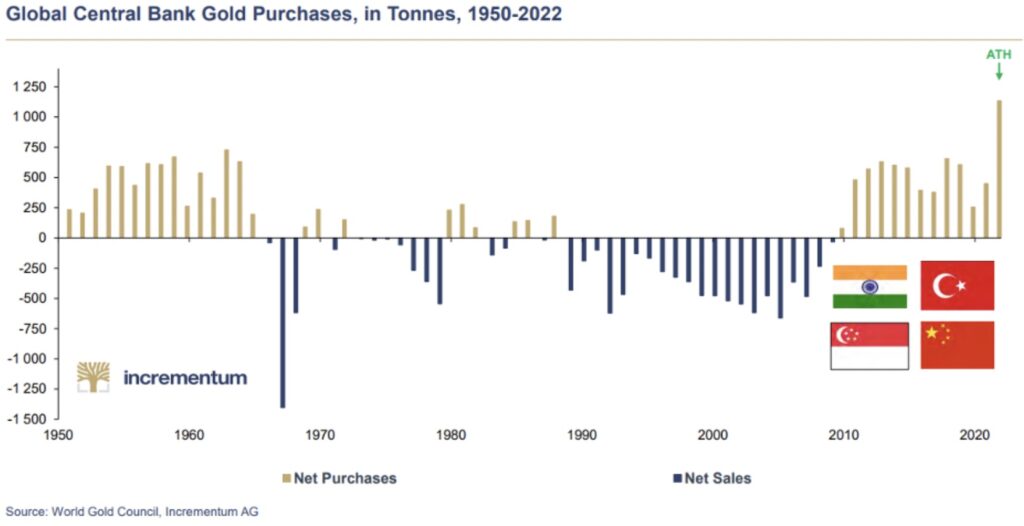

The evidence of this tanking demand is most evident among global central banks, who ever since 2014, have been net sellers of USTs, and in recent years, record-breaking buyers of physical gold.

Of course, as demand for Uncle Sam’s IOUs falls, so too does their pricing, which explains why their yields (which move inversely to price) have been rising like nasty little shark fins among a credit sea of frothy chum.

Earlier this month, yields on the 30Y UST climbed from 4.65% to 4.8% after $24B in US bonds saw less love/demand from investors than Uncle Sam had otherwise hoped.

(Apparently, the policy makers in DC were still hoping that lemonade in the Arctic was a great deal…)

Who Wants a Declining Asset from a Bad Credit?

But when fewer and fewer buyers show up at those Treasury auctions, the primary dealers (i.e., big banks) are forced to finance the leftovers (i.e., fill in the demand gap).

In fact, these “branch office banks of the Fed” had to buy nearly 25% of those unloved bonds themselves.

This level of “gap purchasing” by the primary dealers is now more than double the average rate, which means interest in Uncle Sam’s 30Y UST is openly tanking at a similar rate.

When Billions Are No Longer Enough

What is far scarier, however, is the fact that the US Treasury Department’s recent sale of $24B in bonds bought Uncle Sam only 5 days (as opposed to months) of liquidity and US deficit “coverage” otherwise essential to keep the government on its respirator of seemingly endless deficit spending.

By the way, once DC finally confesses the US is officially in a recession (always months after the fact), such US deficit spending, already beyond the pale of common sense, will only increase, which will mathematically push the US fiscal deficit (now at 8% of GDP) to well over 10-15% of GDP.

Such simple math places unbearable pressure on the traditional/forced buyers (suckers?) of Uncle Sam’s debt (banks, pension funds, and foreigners), who will become increasingly thirsty for USD liquidity (nod to Brent Johnson) and hence be forced to sell more of those very same USTs to obtain that “sucking straw” of Dollar liquidity.

Of course, more UST selling only puts more downward pressure on UST pricing, and hence more upward pressure on UST yields and interest rates.

And that, dear readers, is how a debt spiral looks, functions and corrupts economies. As yields rise, more and more of US tax revenues will be wasted on just paying interest expenses on DC’s IOUs…

That is, the more the US goes into debt, the more it costs and the more it breaks things, from banks and middle-class car owners to an ever-dwindling small business sector and a rightfully angry guitar player in Farmville, Va.

The Open Need for More Inflationary Liquidity

As importantly, given the now empirical fact that billions of IOUs per auction only buys Uncle Sam days rather than months of deficit coverage, it seems fairly clear to me, at least, that Uncle Sam is going to need more than just primary dealers to keep his bond market alive (and debt-based “growth” model in motion).

As I’ve consistently argued, the only place/buyer where Uncle Sam can eventually turn to support his unloved bond markets is a money printer (digital currency mouse-clicker) at the Fed.

This means at some point, the only option left (short of a Plaza Accord/Bretton Woods 2.0) for America is QE to the moon, which will send the USD’s purchasing power to the ocean’s floor.

In the interim, as Powell’s higher-for-longer (or even “pause”-for-longer) policies collide with rising deficits and declining UST demand, the only charts about to go up in the near-term are yields, the USD, gold and BTC, each of which has been doing precisely that.

Gold & the USD

Many will say, of course, that gold does best only when the USD is weak and rates and yields are low.

Yet gold is nearing record USD-priced highs despite rising rates and hence a rising USD.

Why?

It’s simple: Faith in a broke(n) USA is falling.

Trapped within a debt bubble, currency crisis and global policy corner as thoroughly distorted and beyond the pale of natural supply and demand as the current DC now finds itself, the world’s central banks are positioning themselves for an eventual and inevitable pivot toward trillions in more fake liquidity from an equally discredited Fed.

This means the USD’s relative strength and days of current (yet artificial) glory are indeed numbered.

This positioning is easy to see.

Just as armies preparing for an invasion bring their horses, troops, canons and men nearer to their borders for protection, central banks and BRICS+ nations are stacking physical gold day by day, month by month and year by year in anticipation for the kind of emergency (and bogus) liquidity that drowns all fiat currencies—including a world reserve currency.

Differing Opinions, Shared Facts

This liquidity end-game, which involves an inevitable debasement of the USD, is, in MY opinion, how the foregoing debt facts play out.

That is, the USD will be sacrificed to save the UST—and all that flows therefrom, i.e., equity markets, pension funds, tax receipts etc. In short: The “system” can only be “saved” by trillions of fake, new Dollars.

This is nothing new.

Throughout history, and without exception, all debt-soaked nations sacrifice their currencies to temporarily save their broken “systems.”

As mentioned above, we are all entitled to our own opinions, just not our own facts.

Toward this end, it is equally important to consider contrary opinions on the same facts, and I have enjoyed, as well as respected, other informed opinions on these same facts, including my recent discussions/debates with Brent Johnson.

Like myself, Brent Johnson is a powerful supporter of physical gold as a patient yet ultimate victor (and asset) as the foregoing debt endgame approaches its final hour.

But we don’t agree on everything.

He argues that entrenched global demand for the USD (via trade agreements, Euro Dollar and derivative markets, global USD-denominated debt contracts etc.) will continue to offer tailwind support to America’s otherwise distorted currency (DXY at 140+?) as per the admirable logic of his famous “milkshake theory,” which is not only rich with data, but common sense as well.

The Same Common Sense

But whether my opinion or Brent Johnson’s opinion as to the near-term direction of the USD prevails (I don’t see a 140 DXY), the stubborn reality of a paper and now weaponized currency losing its trust, respect and legs longer-term is as easy to see as the growing shine (and open demand) of physical gold as a far superior preserver of generational wealth than a corrupted Greenback.

For both Brent Johnson and myself, this end-game is not just evidence-backed, but simple common sense—a quality DC may have cancelled but which most of us still proudly possess.

Regardless then, of the USD’s relative strength (or weakness) in the months ahead, its inherent purchasing power is dying by the day.

Gold is one historically-confirmed way of addressing this reality with common sense. To read more fantastic articles from Egon von Greyerz and Matthew Piepenburg CLICK HERE.

To listen to Alasdair Macleod discuss available physical gold disappearing off the market, and the coming storm that is already beginning to ignite the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.