Here is a surprising look at the war in the gold and silver markets.

August 9 (King World News) – Alasdair Macleod: Equity markets recovered some poise this week, allowing gold to stabilise. But how will they behave next week, and how will gold and silver be affected?

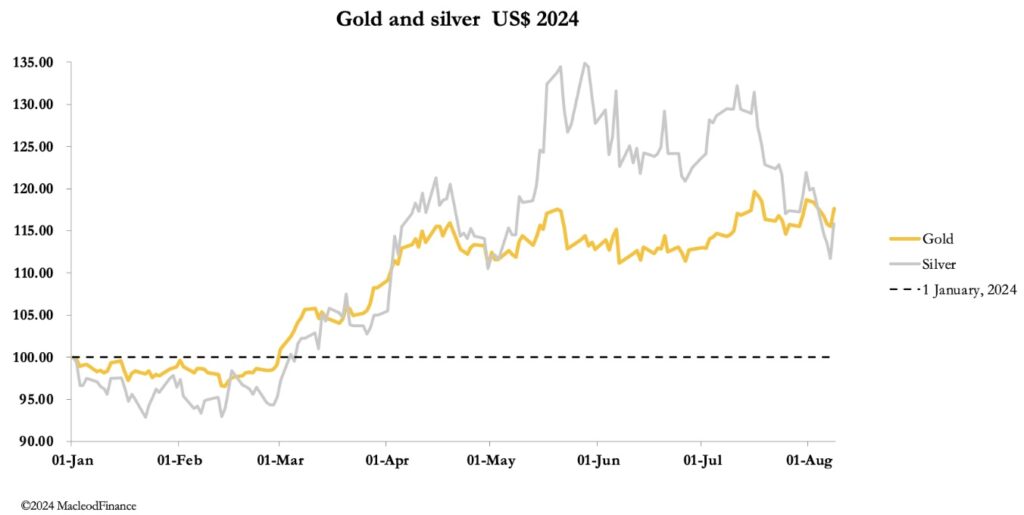

This week, gold consolidated, showing remarkable price resilience, while silver less so. In early European trading this morning, spot gold was $2425, down $17 from last Friday’s close, while silver was $27.52, down a dollar on the same time scale. Aside from Thursday morning, there was little evidence of overnight gold demand from Asia ahead of London’s morning fix, suggesting that market turmoil in equities is having a deterrent effect on Chinese speculators…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

That gold is more resilient than silver in these conditions confirms that solid eastern demand for bullion continues, with Chinese banks quietly taking any that’s offered. This is limiting attempts by bullion bank traders on Comex and in London to reduce their positions. Instead, they have been focusing on silver, undoubtedly trading silver’s wild swings very profitably.

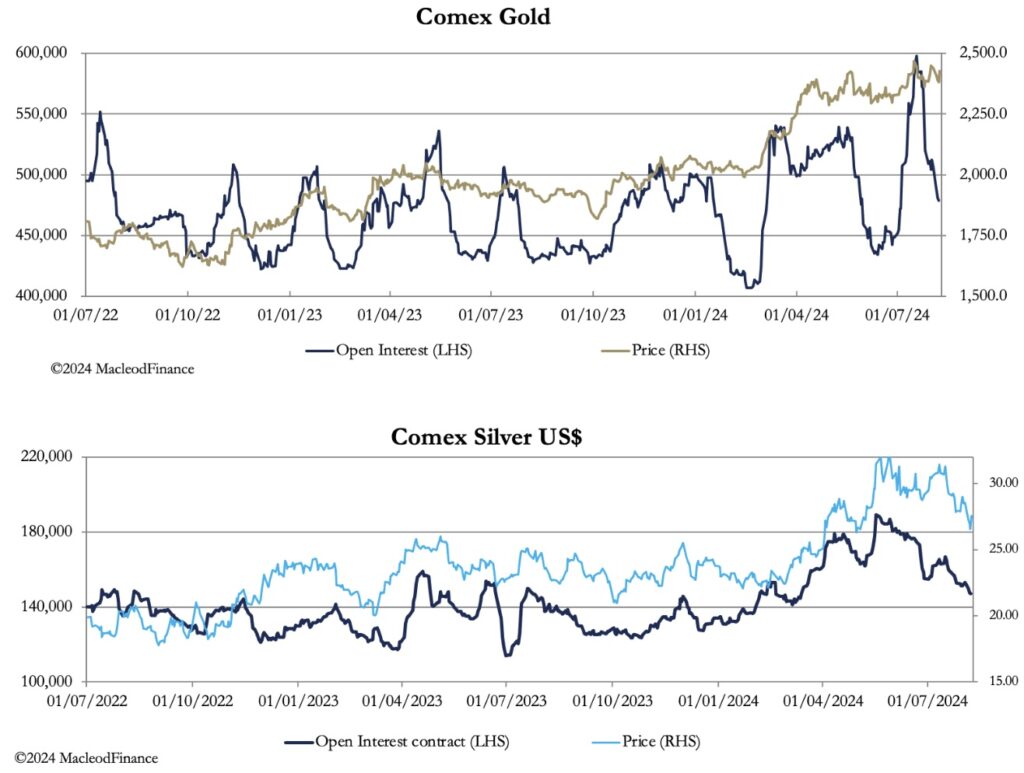

The next two charts show how different the technical position in silver is compared with that of gold on Comex.

Gold’s Open Interest has fallen rapidly while the price remained with 3% of all-time highs, reflecting the lack of physical bullion liquidity. In silver, the decline in price accompanies the decline in Open Interest. This is normal, reflecting speculators being hammered by the establishment. And the subtext here is that with the US going into recession demand for industrial commodities will decline. Copper also conforms with this pattern.

If anything, markets being US-centric are myopic, thinking that Asia doesn’t exist. China must be delighted that copper prices and other commodities are declining due to the unwinding of western speculation, because they are the feedstock for her production-based economy. But this is not the urgent issue for western capital markets, the decline in stocks triggered by yen-based selling being the immediate concern. This week has seen global markets stabilise after an initial shock. But to put it into context, the next chart is of the S&P 500 Index:

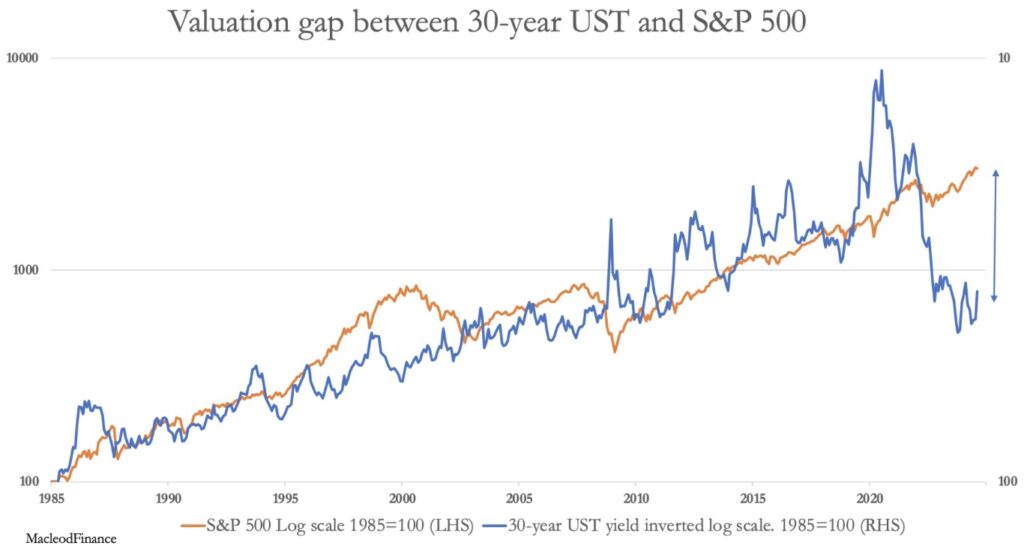

The change in sentiment is less than one month old, and the talk is now increasingly of recession. This is bad news for equities and on its own explains the change in sentiment. But the Fed is stuck with its inflation mandate and cannot yet abandon it. Therefore, this week’s rally looks like being no more than that, and that the coming weeks will see further declines in equity markets that are very expensive relative to bonds on a valuation basis. The next chart shows that this valuation gap still signals that equities are record expensive.

For this reason and the recession talk, equities are more likely to continue to fall, perhaps even dramatically. If so, then we can expect further attempts to shake out the long speculators in precious metals on Comex and even the Shanghai Futures Exchange. This should have less of an effect on gold than silver. But this is all very short-term stuff. And at some point, the realisation that falling equities requires the Fed to lower interest rates and reintroduce QE is highly inflationary, and that gold is far too cheap.

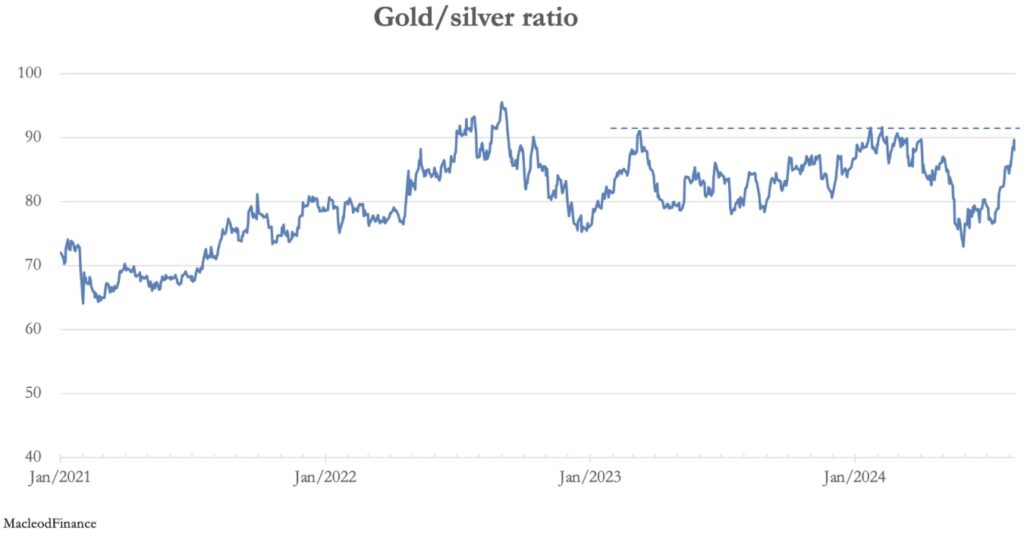

Until then, gold appears likely to hold its value through equity market troubles while silver is perhaps more vulnerable to a short-term selloff. But once gold turns higher, silver should soar, with the gold silver ratio already at 88 times. This is out last chart.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.