Asian buyers have returned to the physical gold market, pushing the price of gold price near the all-time high.

Asian Buyers Return

October 11 (King World News) – Alasdair Macleod: Gold and silver are now nicely set up for higher prices in the runup to the BRICS summit in eleven days’ time. But after that, will there be profit-taking and a pull-back consolidation?

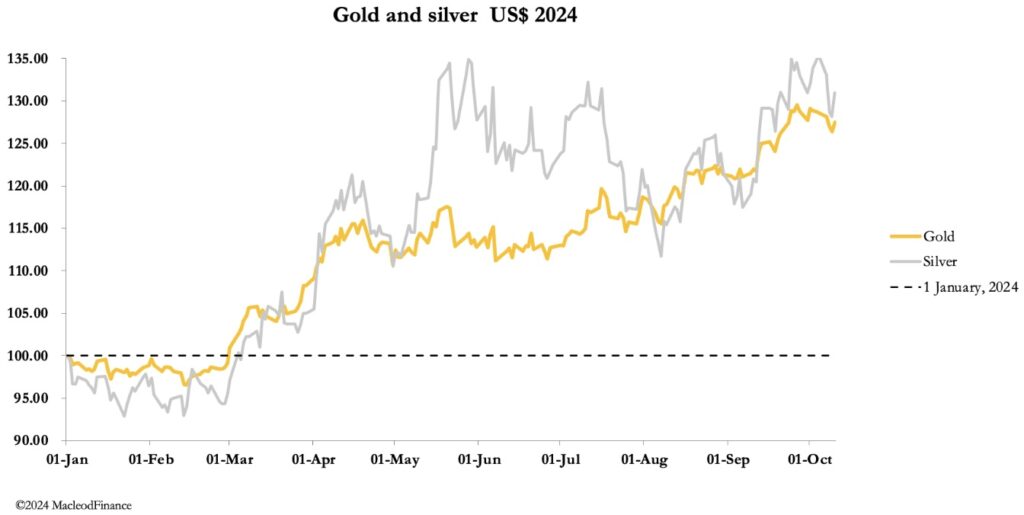

After a sell-off on Wednesday completing a 10-day consolidation, spot gold saw a resumption of overnight (Asian) demand last night, to trade at $2641 in early morning European trade, down only $11 on the week. After peaking at $32.96 intraday last Friday, spot silver sold off down to $30.14 before recovering to $31.15 this morning, for a net loss of $1.00 on the week.

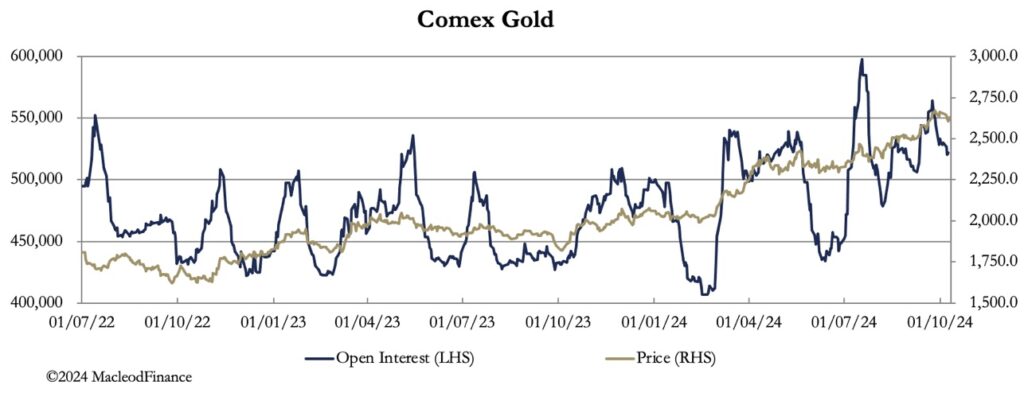

The temporary absence of Chinese demand coincided with the Golden Week holiday, with dealers returning on 8 October. It gave market-makers and bullion bank traders an opportunity to shake out speculative longs in western derivative markets. But Comex saw gold’s Open Interest decline by a paltry 11,000 contracts, before buyers stepped in buying all their positions back in only two sessions.

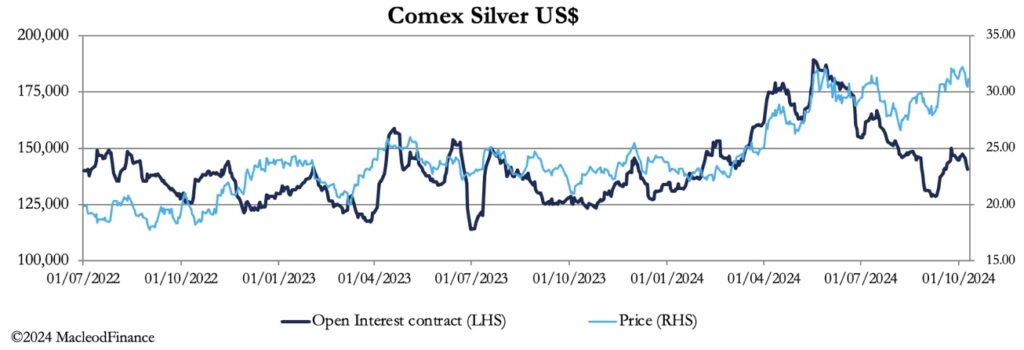

In silver, Open Interest fell by 4,200 contracts before recovering only 422 of them on preliminary figures yesterday. Despite all the volatility from the start of Golden Week, the price is unchanged, a remarkable demonstration of the failure of the bullion establishment to reduce their short positions. The charts below, of Open Interest and price for gold and silver are worth more than a cursory glance.

Silver is particularly interesting, showing how despite a downtrend in Open Interest, the price has been in an uptrend since mid-August. This is a clear demonstration of a systemic bear squeeze on the Swaps.

Returning to gold, this market has a strong underlying feel to it, demonstrated by the technical chart below, which suggests that the price has sufficient underlying momentum to run away to the upside, now that this brief consolidation appears to be over:

While technical analysis is far from infallible, reading this chart suggests that $2750 is a minimum target for traders, before a longer consolidation allows the moving averages to catch up. Meanwhile, silver is also looking bullish:

It looks like the consolidation level (the pecked line) has now succumbed with a break-out on the upside, and the 55-day moving average is turning up sharply. A runup to roughly $37, maybe more, seems likely in the short-term.

We can see that technical considerations for both gold and silver are likely to drive both markets into overbought conditions. The timing coincides with the runup to the BRICS summit at Kazan on 22—24 October, only 11 days away. The reason this is important is because of speculation that a new trade settlement currency based on gold will be on the agenda. In other words, this is a potential development which is to some extent discounted already…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

Experienced traders know to buy the rumour and sell the fact. Even if a new gold-backed currency project is announced, after initial excitement profit taking will probably set in. Even worse, if there is no announcement the setback could be significant. Therefore, the patterns revealed in the technical charts of a further run into higher prices before a broader consolidation is confirming a likely trading outcome.

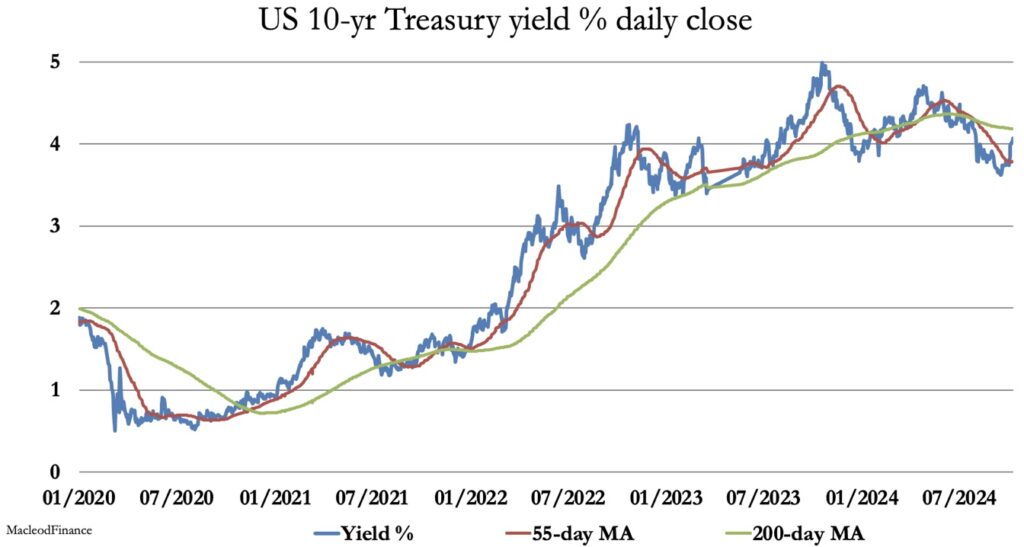

However, in the knowledge that the underlying fundamentals for fiat currencies are deteriorating badly stackers are unlikely to be perturbed by these short-term trading factors. Furthermore, bond yields are rising again, despite hopes for lower interest rates as the chart for the 10-year US Treasury note demonstrates:

The 55-day MA is now turning up, indicating that the 10-month decline in yields may be over. A little further to the region of the 200-day MA and then some consolidation before 5% is challenged, following a progression higher towards 8%+ is in prospect. Is this a headwind for gold? It is bound to be spun as such, but more correctly it indicates the debt trap is being sprung shut on the US Treasury, a condition leading ultimately to loss of credibility and therefore a collapse in value for the Fed’s fiat dollar.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.