We could finally be seeing the end of derivatives in the gold market.

February 17 (King World News) – Alasdair Macleod: For years, bulls of gold and silver have complained about how derivatives have been used to suppress their prices. Their dreams of the practice ending could be coming true.

If you think about it, there is a simple reason that derivatives for speculating or hedging gold is fatally flawed. It is because in nearly every nation’s common law, gold is money, and currencies are inferior credit, which is where payment risk actually lies. That the Western financial establishment is ignorant of this fact does not change the facts.

There is a good reason why this matters. Gold has lasted as legal money, and credit has been separately acknowledged to be deferred payment in money since Roman law. Since then, there have been many instances of governments denying these facts and promoting their currencies in the place of gold, which have always ended in their collapse.

In any price relationship involving a medium of exchange, there is an objective value and a subjective one. The objective value is always in the medium of exchange, and the subjective value is in the goods or services being exchanged. Put another way, the buyer and seller will both value money or its substitute the same, but the buyer values the goods or services more highly than the seller: otherwise, the exchange won’t take place. But if gold is the money, where does that leave a fiat currency?…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Clearly, if the currency is not a credible gold substitute, then it should bear the subjective value relative to gold. That it is not regarded this way is partly due to government anti-gold propaganda, but mainly due to accounting in the government’s currency for tax purposes. Furthermore, while a gold standard is always defined as a currency being exchangeable for a given weight of gold, for convenience it is referred to as so many currency units per gramme or ounce. This gives the erroneous impression that gold is being priced in the subordinate currency.

This is as may be, but in the knowledge that a fiat currency always fails while gold as money never does, the recognition of this reality will eventually kill off any derivatives when fiat currencies collapse. And if some derivatives survive, it should then refer to fiat currencies in terms of gold-grammes, or better still, in a credible gold substitute instead if one exists.

Gold derivatives should not exist in the first place, except perhaps for seasonal agricultural produce — the original function. It should be borne in mind in the context of this article.

The plan was to kill off gold as money

Following the inflationary seventies, which almost destroyed the post-1971 dollar-based fiat currency system, there can be little doubt that the deep thinkers in the US Treasury thought long and hard as to how to drive inflation out of the economy while promoting the dollar to kill off gold as money. The solution chosen came in three distinct policies.

The first and most obvious was to reform the financial system so that the banks would wrest control of financial securities from the brokerage industry: this resulted in London’s big-bang, implemented by the Thatcher government in the mid-eighties at the US Treasury’s behest. A capital-starved securities industry would become turbocharged by bank finance, ensuring a perpetual bull market in financial asset values, including government debt, and ensuring everlasting demand for dollars.

The second was to reform statistical calculation for key economic indicators, such as consumer price inflation and jobless figures, giving a measure of government control over them to create the illusion of currency stability. Not only was the indexation cost of pensions and welfare thereby contained, but interest rates were permitted to be lower than they would otherwise be. All economic statistics are produced by government agencies who control this information.

The third was to sanction and encourage derivative markets to expand, and by doing so divert speculative demand from physical markets for gold. This was to prevent gold prices from being driven higher, threatening the status of the dollar as a medium of exchange. It was the basis of the massive expansion of gold trading on the LBMA, and of gold futures under the control of the large US banks, which would occasionally act as agents for the Exchange Stabilisation Fund.

In London, 44 million ounces were cleared daily in 1998 on the London Bullion Market, valued at approximately $13 billion at that time. Last December, 17 million ounces were cleared, but at higher prices, they were valued at $71 billion. It should be noted that outstanding forward commitments measured by their average duration in days are unrecorded multiples of daily settlement.

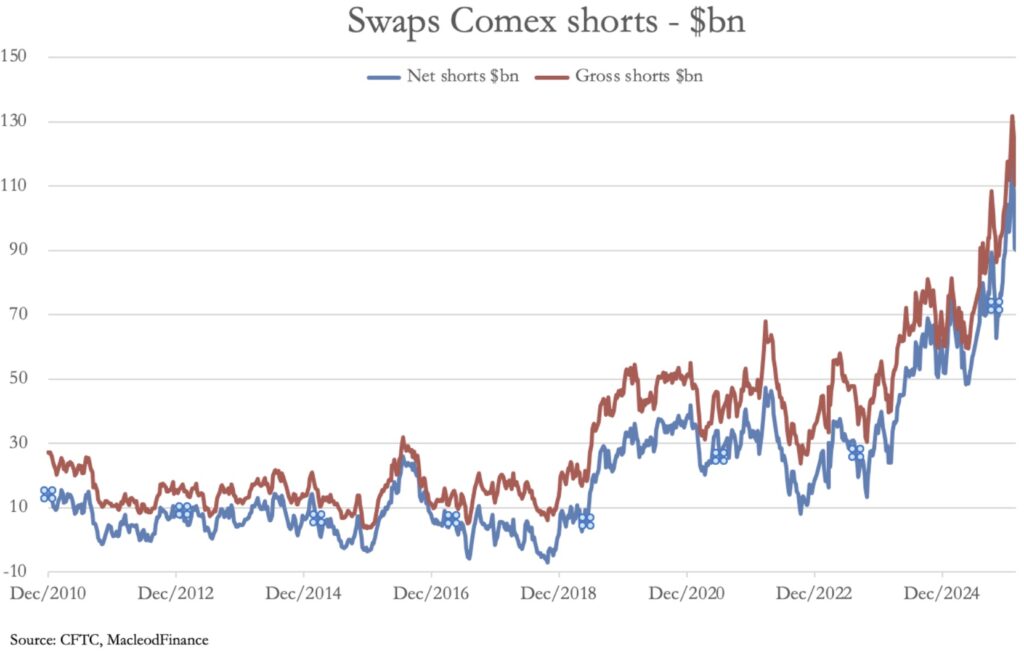

The falling settlement numbers in London from 44 million to 17 million, while the value of the settlement rose 4.5 times, illustrates the problem paper markets now face. On Comex, which has the same problem, this is demonstrated by the gross and net short position of the Swaps category, which is comprised mainly of bullion bank traders:

Between 2010 and 2018, the average gross short position was $15bn, compared with $112bn today. And the net position averaged $7bn, compared with $90bn currently.

This particularly matters because physical gold is now being drained out of London and New York directly or indirectly by a combination of central bank and wider Asian demand. While London faces a developing liquidity crisis of available gold bullion, Comex has a position which is proving impossible to contain, let alone from drifting into ever higher liabilities for bullion bank traders.

In both markets, higher prices require increasing fiat capital to sustain positions. This fact alone is bound to restrict these markets’ ability to trade in the numbers demanded of them.

Hope that demand for physical gold will diminish, allowing the bullion establishment to initiate a raid on bullish speculators, is proving to be whistling into the wind, a wind blowing with increasing strength driven by a mixture of geopolitics and increasing credit risk facing the fiat dollar. In short, gold derivative markets are drifting towards the rocks of a crisis.

This matters because gold is central to everything, more so than the illusory dollar. Gold as money in possession has no counterparty risk, while the fiat dollar with increasing counterparty risk is of uncertain future value. The central banks accumulating bullion, as well as other Asian entities and individuals, are being motivated to rid themselves of this dollar uncertainty, choosing not to encash them for other currencies which are ultimately tied to the dollar’s credibility but for gold.

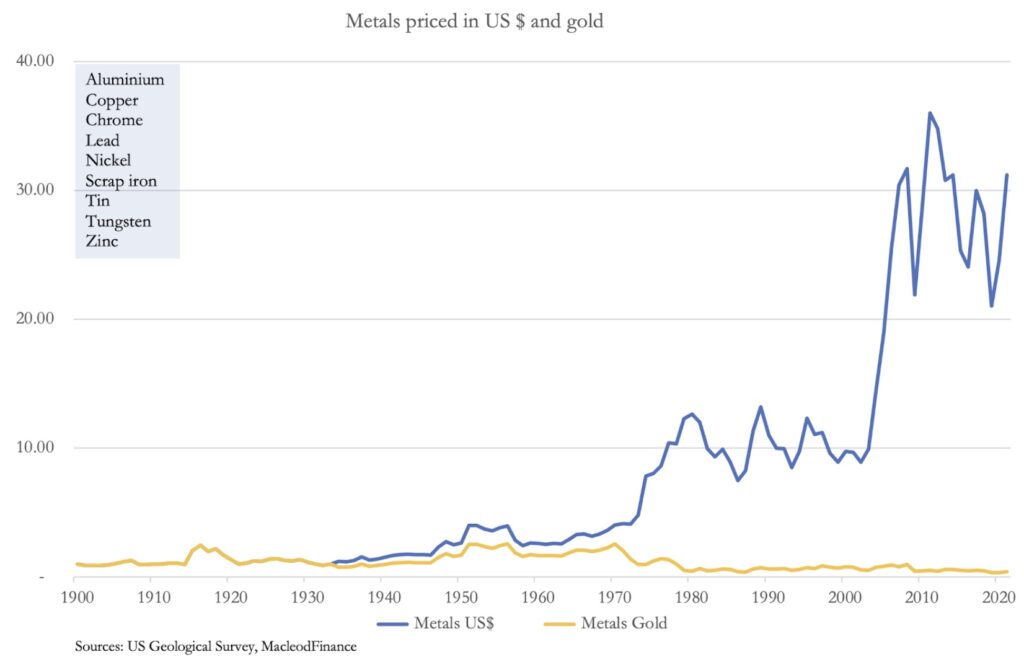

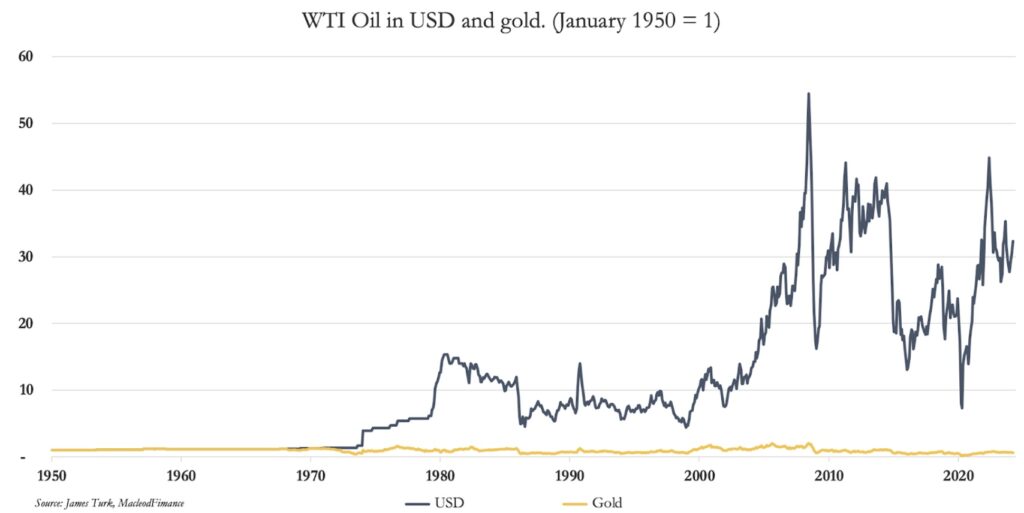

The relationship between dollars and gold has been a conundrum for many since the suspension of the Bretton Woods Agreement in 1971. The western financial establishment has lost all compass as to which is money and which is credit, with most actors not even aware of gold’s central importance. To illustrate this importance, the chart below shows average values for a range of industrial metals priced in dollars and gold, followed by a chart of oil similarly priced.

Priced in dollars, commodity and energy prices have risen multiple times and with great volatility, while they have been remarkably steady priced in gold. The point being made is that the approaching problems in paper gold contracts will almost certainly be transmitted into higher dollar prices for commodities generally, as paper hedging in the form of derivatives diminishes. And the catalyst for an implosion of commodity and energy derivatives is gold.

Just as derivatives have suppressed gold and other commodity values from the 1980s onwards, their ending is set to unleash an explosion of physical replacement demand. The contraction of outstanding commodity derivatives will not be without accidents. Banks will face enormous write-offs, and doubtless some rescues will have to be arranged by the authorities. And there’s no guarantee that other derivative markets, such as interest rate swaps and forex will go unscathed because of the commonality of derivative counterparties.

The rise in values for gold and commodities generally is the same thing as a decline in the value of the dollar for the purpose of dealing in commodities. Foreign holders of dollars will be acutely aware of the consequences, dumping dollars increasingly to hoard commodities.

Looking at oil and base metal values, they are already relatively cheaply priced in gold. Or put the other way, being moderately expensive gold appears to have begun to discount a wider currency crisis, while these commodities have not yet.

Forced by global markets, as opposed to those under the control of the US authorities, the wisdom of ancient Roman lawmakers in framing the origin of all their successor nations’ common law is being reaffirmed. The error being corrected today is the accumulation of fiat currency distortions of the last fifty-five years, which looks like it is coming to a financially violent end. This will link you directly to more fantastic articles from Alasdair Macleod, Egon von Greyerz and Matthew Piepenburg CLICK HERE.

Worried About The Action In Gold & Silver?

For anyone that is worried about the recent takedown in silver, gold and mining shares CLICK HERE OR ON THE IMAGE BELOW to listen to Nomi Prins discuss her latest price predictions for the metals and much more.

End Of COMEX Silver Price Rigging Scheme!

To listen to Alasdair Macleod discuss the end of the COMEX price rigging scheme and China’s push for significantly higher silver prices CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

Nomi Prins Says Despite Volatility Silver Price Will Hit $180 By The End Of 2026 CLICK HERE.

Here’s Why Gold & Silver Are Rallying After Thursday’s Takedown CLICK HERE.

Gold: The Anti-Bubble, Plus How Do I Keep My Money? CLICK HERE.

Is Another Gold & Silver Takedown About To Happen? Plus $369 Oil And Booming Commodities CLICK HERE.

Albert Edwards – Is The NASDAQ About To Crash? CLICK HERE.

People Are Being Deceived, The Gold Bull Market Is Not Finished CLICK HERE.

Michael Oliver – Gold Bull Market Nowhere Near Its Final Climax CLICK HERE.

Astonishing! The Super Wealthy Still Don’t Own Gold As Miners Near Blastoff CLICK HERE.

$10,000 Gold And The Vault Behind COMEX CLICK HERE.

Global Banking Elite Orchestrate Shadow Bailout To Survive $5,600 Gold Peak CLICK HERE.

Investing Legend Rob Arnott Says Silver vs Oil Ratio Reached Insane Levels CLICK HERE.

Gold & Silver Open Interest Has Collapsed To Historic Low! CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.