Here is a look at another big bull market as well as what is happening overseas.

Another Big Bull Market

August 12 (King World News) – Graddhy out of Sweden: Uranium miners did 580% in its baby bull move. Still, just getting started.

Below is a brilliant, bullish roadmap setup for this ratio. That is a very symmetrical, blue inverse head & shoulders pattern.

KING WORLD NEWS NOTE: Uranium Miners Will Outperform S&P 500 By A Jaw-Dropping 920%!

The glorious commodities bull market will be the greatest opportunity in your lifetime to get out of the rat race.

As said now for 5 years – DO NOT MISS IT!

Global capital has clearly started to flow from the stock market into commodities, as posted.

So it begins.

And down the road, commodities will be the only game in town.

Economy, Inflation And Rate Hikes

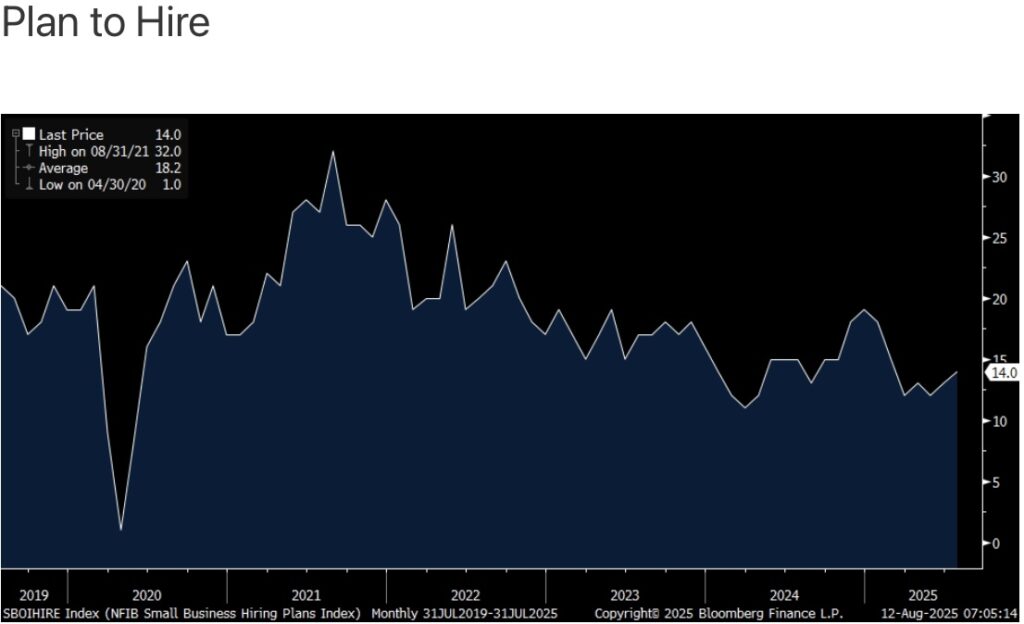

Peter Boockvar: The July NFIB Small Business Optimism Index did improve to 100.3 from 98.6 and that is the best since February.

Plan to Hire rose 1 pt to 14% and that is also 1 pt above the 6 month average.

Job openings that couldn’t be filled though fell by 3 pts to the lowest since December 2020 and the compensation components both were down. Capital spending plans rose 1 pt after falling by 1 pt last month but still remains 7 pts below its long term average while there was a 2 pt rise in Plan to Increase Inventory.

Those that Expect a Better Economy was up 14 pts but fell 1 pt for those that Expect Higher Sales. Positively, Good Time to Expand was up 5 pts but there was no change in the earnings picture. After rising by 4 pts last month, Higher Selling Prices fell 5 pts to 24% and there was a 4 pt drop in plans for higher prices to 28% but “this is well above its historical average and is a signal of continued inflation.”

The NFIB’s bottom line was this, “Optimism rose slightly in July with owners reporting more positive expectations on business conditions and expansion opportunities. While uncertainty is still high, the next six months will hopefully offer business owners more clarity, especially as owners see the results of Congress making the 20% Small Business Deduction permanent and the final shape of trade policy. Meanwhile, the labor quality has become the top issue on Main Street again.”

Also of note, “When asked to rate the overall health of their business, 13% reported excellent (up 5 pts), and 52% reported good (up 3 pts) and with declines in those saying business was ‘fair’ and ‘poor.’ However, “The percent of small business owners reporting poor sales as their top business problem rose 1 pt to 11%. This is the highest level of poor sales since February 2021.”

“11% of owners reported that inflation was their single most important problem in operating their business, unchanged from June’s lowest reading since September 2021.” Encouraging in light of the tariff regime we’re currently in but many of these companies are in the service industry.

The big problem with the labor market is the skills mismatch. “Of the 57% of owners hiring or trying to hire in June, 84% reported few or no qualified applicants for the positions they were trying to fill.”

The cost of capital remained elevated at 8.7% for the average loan, though down from 8.8% in June.

Overseas

The Reserve Bank of Australia cuts rates by 25 bps to 3.60% as fully expected and “our forecasts are conditioned on a couple more cuts.” On that comment the Aussie dollar is lower but the 2 yr yield was little changed.

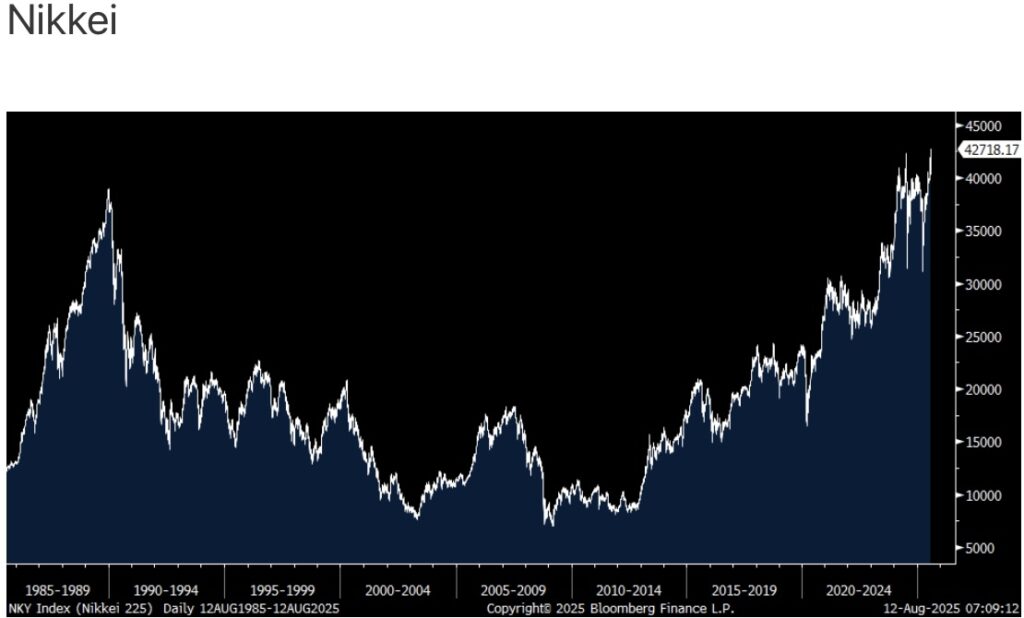

Also in Asia of note is the continued rally in the Nikkei and which closed at a record high. We remain positive and long Japanese stocks.

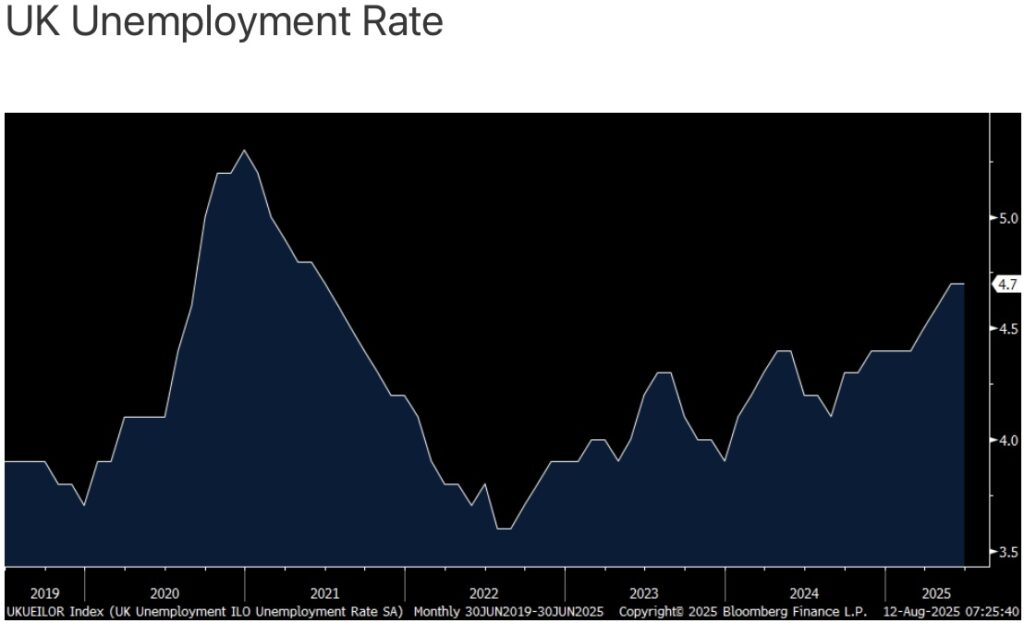

UK Unemployment Rising

The UK saw another drop in July payrolls but not as much as expected and June was revised up to less of a negative. Also, jobless claims were down in July. Thru June, their unemployment rate held at 4.7% which is the highest since 2021.

Wage growth continued to be solid, rising 5% y/o/y ex bonus, as expected and above the rate of inflation. The UK economy continues to be weighed down by the higher insurance and wage taxes that the Labor government piled on to business and the result is a slower economy and poll numbers for Labor that are down sharply. The pound is higher on the better data while gilt yields are higher and the FTSE 100 is little changed. There remains a bunch of cheap stocks in the UK that are attractive.

Tsunami Of Crypto Money Will Flow Into Gold Market!

Billionaire Pierre Lassonde shares with King World News listeners around the world many of his top stock picks in this remarkable audio interview and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

To continue listening to Alasdair Macleod discuss the short squeeze that is beginning to unfold in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.