The US dollar is on the verge of giving way as gold, silver and miners climb “A wall of terror,” but take a look at this…

Dollar’s on the verge of giving way

March 8 (King World News) – From Citi’s Naveen Nair: DXY is testing the 102.77 support, the lowest of a series of supports between 102.77-103.74 that we had flagged in CitiFX Techs – USD’s got a shoulder to lean on two weeks ago.

Why it matters: IF we complete a weekly close below, it would open a move towards subsequent support at 101.65-101.91 (76.4% Fibo and January 5 low). Below that, the key support lies at 100.62 (Dec lows).

ANOTHER GOLD BULL CATALYST:

US Dollar Index On The Verge Of Breaking Down To 100.6-101.9

To the upside, resistance is at 104.29 (March 1 high).

Technical indicators:

- We are on track for a weekly move across the 102.77-103.74 support range (Jan 24 low, 55d MA, 55w MA, Feb 22 low, 200d MA)

- A weekly close below (especially with NFP as a catalyst) would suggest we could see a further slide in the dollar.

- Weekly momentum has crossed over after scraping the overbought territory.

Weekly US Dollar Chart Shows Further Downside May Be At Hand, But Here Is The Key…

Key To The US Dollar

US 10y yields tested support at 4.03%-4.08% (55w MA, 55d MA) that we highlighted earlier this week.

In the near term, we continue think that this this support level is strong. Resistance is at 4.17%-4.19% area (200d MA, Jan 19 high, Feb 15 low).

US 10-Year Yield Close To Breaking Back To Recent Lows. That Would Be Very Bearish For The US Dollar And Bullish For Gold

Longer term implications: The weekly close today will be important in the broader techs narrative. IF we close on a weekly basis below the 55w MA, it would open a further ~25bps move lower towards subsequent support at 3.75% (Dec 2023 low).

A Weekly Close On The US 10-Year Below 4.07% Would Open Up The Way For Yields To Drop All The Way Down To 3.75%

King World News note: Gold is rallying vs all worthless fiat money including the US dollar, which is why gold keeps hitting new all-time highs in virtually every major fiat currency, with the notable exception being the Swiss franc. But in time the Swiss franc will also yield to gold because the franc is also just fiat money backed by nothing…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

The Slow Moving Train Wreck

Peter Boockvar: A few comments on New York Community Bank and CRE. With Janet Yellen and the federal government now implicitly guaranteeing all uninsured deposits as after all, if they bailed out a bunch of venture capitalists and their portfolio companies, are they not going to bail out others, it takes the drama out of these stressed bank balance sheet situations when looking big picture. The NYCB’s, definitely somewhat self inflicted, that are out there will be dealt with via the shareholders taking pain and maybe even some bondholders. And with the slow moving train wreck that is commercial real estate if one is overlevered and has debt coming due this year or next, there will be more small bank trouble. But, there is nothing systemic I believe. It is more about the viability of some over stretched banks and a multi year process of working through CRE pain.

“Brother, can you spare a loan?”

The other issue we face from challenges with mostly regional banks is the reduced credit being loaned out. In nominal terms, US GDP grew by about $1.5 Trillion in 2023. However, the amount of C&I loans outstanding shrunk by almost $40b. Could this be a form of a credit crunch? Or if one doesn’t want to use those words, credit tightness? Or just less demand for loans? The CFO of Bank America spoke yesterday at the RBC conference and said this on loan demand from both the consumer and commercial side:

“Well, it was a little slower than we would have liked last year. Normally you think GDP plus and you hope for a good GDP number and you hope for a lot of loan growth and was just a little quieter last year…It’s less about us extending commitments to clients, it’s more about clients finding it less interesting to borrow when the base rate is now at 5% plus…That’s continuing a little bit. I’d say loan growth this first quarter, we’re off to a slowish start.”

That said by him, many small businesses are likely facing tougher loan officers at smaller banks where they might have some demand but see little supply.

Also of note was this from the NY region in yesterday’s Beige Book:

“Activity in the region’s finance sector remained sluggish. Small to medium sized banks in the region reported ongoing declines in loan demand and weaker financing activity. Banking contacts also indicated that credit standards tightened, particularly for business loans and commercial mortgages. While deposit rates held steady, loan spreads narrowed, and delinquencies continued to rise.”

From Philly region:

“Banks and business clients agreed that higher interest rates had lowered demand for loans, while tighter access to credit had lowered the potential supply.”

From Richmond:

“Financial institutions continued to report a modest softening of demand across all loan types. Higher interest rates and continued uncertainty with the overall economy continued to be the reasons noted for this softening.”

Now on commercial real estate, listening to Powell and others, one would think this is just an office pain point. While structurally that is true for a building that is not Class A, it is also very much a balance sheet issue for ANY piece real estate. As I’ve laid out the math a few times before, you could have a building (any building, multi family, industrial, student housing, etc…) that is 98% occupied but if the 3% loan priced pre 2022 is coming due this year and it’s repricing at 8-9%, and there is too much debt in the capital structure, that landlord is in trouble with that property. Thus, ANY piece of real estate is vulnerable this year that has too much debt coming due. There is by the way about $900b of CRE loans maturing this year.

Meanwhile In Canada

With the Bank of Canada leaving its base rate at 5% as expected, Governor Macklem also said “It’s still too early to consider lowering the policy interest rate.” And they repeated this, “The council is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation.” Higher for longer.

Another Wave Of Inflation

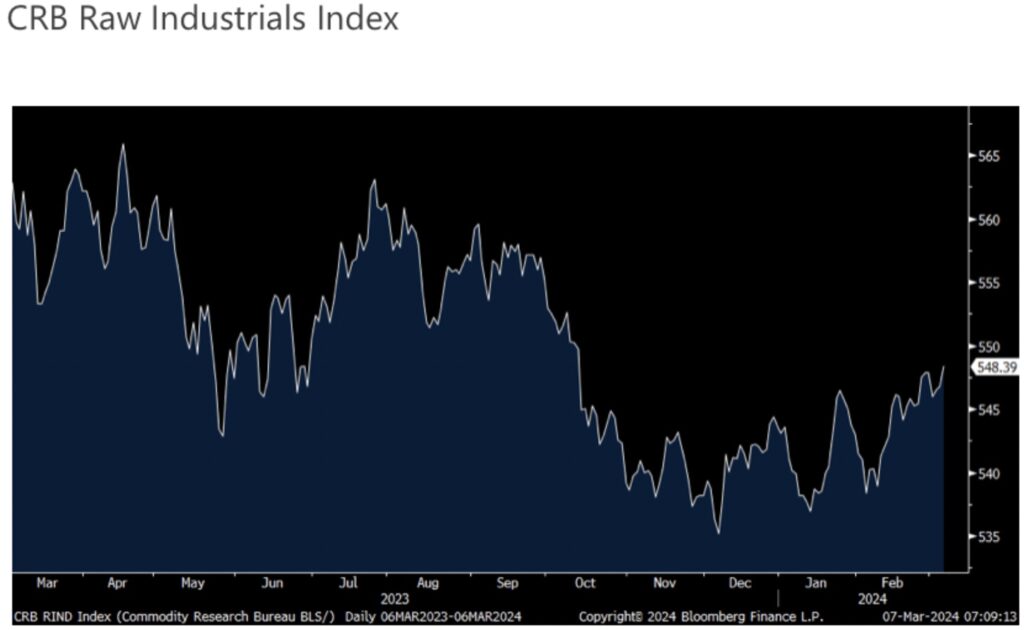

A quick comment here on commodity prices, the CRB raw industrials index closed yesterday at the highest level since mid October. The job of central bankers is pretty complicated right now. We’ll hear from the ECB today.

Commodities Hit Highest Level Since October 2023. This New Wave Of Commodity Inflation Is Complicating The Job Of Central Bankers Who Would Like To Raise Rates…But Into Already Existing Inflation???

Gold, Silver And Miners Climbing “A Wall Of Terror”

King World News note: The continued worries about the health of the banking system and the economy coupled with another wave of commodity inflation are two more bullish catalysts for the gold and silver markets as well as the deeply oversold and unloved mining and exploration stocks. The sector continues to climb a “wall of terror” as sentiment remains remarkably fearful considering the state of the world. For those accumulating physical gold and silver, continue to do so, but understand that time may be running out to purchase physical silver cheaply. You will still be able to buy physical silver, it will just take a lot more fiat money to buy it in the future.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.