This is the second major update in two days for gold, oil, stocks and bitcoin.

TODAY: DETACHED FROM REALITY, U.S. STOCKS CONTINUE TO RISE

October 27 (King World News) – Gerald Celente: The Dow Jones Industrial Average had another strong day today and was up 337.12 points, or 1.07 percent, to 31,836.74 and the benchmark S&P 500 was also in the green, rising 61.77 points, or 1.63 percent, to 3,859.11. The tech-heavy Nasdaq Composite was up 246.50 points, or 2.25 percent, to close at 11,199.12.

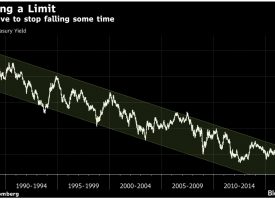

Stocks were on a two-session winning streak as Treasury yields fell. The 10-year note was down 12 basis points to 4.108 percent and the 2-year yield was down 3 basis points to 4.468 percent. Gerald Celente has said the Fed will go dovish on interest rates after its 1-2 November meeting to help give Democrats the edge before the midterms.

Weeks after Celente’s forecast, The Wall Street Journal reported that there is desire in the Fed to “slow down the pace of increases soon to stop raising rates early next year to see how their moves this year are slowing the economy.”

The Fed has raised interest rates to between 3 percent and 3.25 percent. The Federal Open Market Committee meets eight times a year to determine the federal funds target rate.

Economists polled by Reuters said they expect the Fed to raise interest rates by 75 basis points after the November meeting and said the central bank should pause once inflation is cut in half. Inflation in the U.S. came in at 8.2 percent in September.

TREND FORECAST:

As we thoroughly detail in this Trends Journal, we forecast the Feds may only raise interest rate up to .50 basis points next week to juice equity markets ahead of America’s mid-term elections on 8 November, since “It’s the economy, stupid.” Furthermore, if they do raise rates by .75 basis points next week, we forecast the message from the Fed Head will be lower rate rises in the future.

TRENDPOST:

Alphabet shed about 5.73 percent in after-hours trading after reporting weaker-than-expected earnings and Microsoft also shed $6.16 per share in after-hours trading after its cloud revenue came in lighter than expected.

We have noted that tech companies are preparing for softer demand and, in some cases, have announced restructuring. We have long noted that the world is headed into Dragflation: Declining economic growth and rising inflation…

ALERT:

Billionaire and mining legend Ross Beaty, Chairman of Pan American Silver, just spoke about what he expects to see in the gold and silver markets and also shared one of his top stock picks in the mining sector CLICK HERE OR ON THE IMAGE BELOW TO HEAR BEATY’S INTERVIEW.

Elsewhere, Britain’s FTSE was almost even, down 0.51, or 0.01 percent, to 7,013.48 and the STOXX600 was up 5.77, or 1.44 percent, to 407.61.

In Asia, Japan’s Nikkei gained 275.38, or 1.02 percent, to 27,250.28 and Hong Kong’s Hang Seng, which was bludgeoned yesterday, continued its losing streak and was down 15.10, or 0.10 percent, to 15,165.59. South Korea’s Kospi was down 1.09 points, or 0.05 percent, to 2,235.07.

In China, the Shanghai Composite was down 1.27, or 0.043 percent, to 2,976.28, and the Shenzhen Component was down 54.80, or 0.51 percent, to 10,639.82.

TRENDPOST:

The reality on the ground is much different than what we are seeing in the global markets, and it is just a matter of time before stocks begin to reflect the concerns shared by workers across the world who face rising inflation, a souring housing market, and soaring energy bills. As we report, protests have broken out in France, Germany, Italy and they will continue to escalate as economic conditions further deteriorate.

OIL:

Prices were little changed today as traders continue to consider global economic risks and OPEC+ output levels. Brent crude was down 31 cents, or 0.33 percent, to $92.95 per barrel and West Texas Intermediate was up 41 cents per barrel to $84.99 as of 4:07 p.m. ET.

The U.S. dollar index was down 0.9 percent, making oil less expensive for overseas buyers.

Vandana Hari, founder of oil market analysis provider Vanda Insights, told Reuters that much of the “souring outlook on demand has already been baked in” to prices “so any further downward pressure may be slow acting.”

Fatih Birol, the head of the International Energy Agency, said in Singapore today that the world is “in the middle of the first truly global energy crisis.”

TRENDPOST:

Oil prices face several issues ranging from China’s COVID-19 lockdowns, the Ukraine War, rising interest rates, slowing economies, and geopolitical tensions between Washington and Riyadh.

The Biden administration has tried to blame OPEC+ for cutting supply and driving up prices, but the price of oil is lower today than before OPEC+’s production announcement. The oil cartel said it will cut its crude oil production target by 2 million barrels per day.

There has also been tension between the Biden administration and Big Oil, which has seen its second-largest profits amid the economic hardships many Americans face.

Bloomberg noted that Exxon, Chevron, Shell, and TotalEnergies will report $50.7 billion in combined earnings last quarter. Abhi Rajendran, adjunct research scholar at Columbia University’s Center on Global Energy Policy, told the news outlet, “It’s definitely awkward.”

“These companies won’t want to be beating their chest over strong business results that are coming at the expense of consumers and a difficult economic environment,” he said.

Exxon Mobil Corp., Chevron Corp., Shell Plc, TotalEnergies SE and BP Plc will report combined earnings of $50.7 billion in the third quarter, down from the second quarter’s record of more than $62 billion, according to data compiled by Bloomberg.

GOLD:

The precious metal benefited from a weaker dollar and lower Treasury yields and was trading up $4.10 per ounce, or 0.25 percent, to $1,658.20 as of 4 p.m. ET. Silver was also up 0.186, or 0.97 percent, to $19.36 an ounce.

Gold, which is a non-yielding asset, performs better in the foreign market when the U.S. dollar is depressed and when Treasury yields come down. Both came down today.

Gerald Celente has said the price of gold should be much higher due to economic and political uncertainties. And when U.S. interests come down, gold will go up as the U.S. dollar goes down.

BITCOIN:

Crypto traders have taken to social media to express new-found enthusiasm over the cryptocurrency and insist that it is a good time to buy these coins at a discount. Bitcoin passed $20,000 for the first time in 20 days.

The world’s most popular crypto was trading up $918.90, or 4.75 percent, to $20,242.50 per coin as of 4 p.m. ET.

Bitcoin has been trading in the $19,000-$20,000 range and has hit resistance at the $21,000 mark. Much has already been said about crypto-friendly Rishi Sunak’s appointment as the new British prime minister.

The House of Commons, Britain’s lower house, voted today to recognize cryptos as financial instruments and products.

“The substance here is to treat them [crypto] like other forms of financial assets and not to prefer them, but also to bring them within the scope of regulation for the first time,” Andrew Griffith, a parliamentarian, said, according to CoinDesk.

The Trends Journal has warned that government regulation will eventually hurt cryptos. Part of their appeal is that they are unregulated. Odell, a popular crypto Twitter account, appears to agree with us, and posted, “This new British prime minister is no friend of bitcoin, the “news” accounts are misleading you for engagement. He wants total control and surveillance of money.”

Despite the macroeconomic pressures, bitcoin enthusiasts, known as HODLers, have been loyal and have not parted with coins. About 78 percent of bitcoin supply has not moved in at least six months despite the massive losses, Will Clemente, the co-founder of Reflexivity Research, said.

TREND FORECAST:

If the Federal Reserve announces any interest-rate hike less than .75 basis points, watch for bitcoin to head to the $25,000-$30,000 range on optimism and the likelihood of Treasury yield declines. If stocks take a hit after the November announcement, watch for bitcoin to return to its $19,000 range.

ALSO JUST RELEASED: Michael Oliver – Silver Price Is Very Close To A Major Upside Breakout CLICK HERE.

ALSO JUST RELEASED: $370 Silver Target, Plus Major Economic Trend Forecasts Issued By Gerald Celente CLICK HERE.

ALSO JUST RELEASED: China On The Cusp Of A Full-Blown Banking & Currency Crisis CLICK HERE.

ALSO JUST RELEASED: Bullion Banks Short Covering In The Gold & Silver Markets Continues CLICK HERE.

ALSO JUST RELEASED: Look At These 5 Stunning Charts CLICK HERE.

ALSO JUST RELEASED: This Is Very Good For Gold, Plus Future Of Rate Hikes CLICK HERE.

ALSO JUST RELEASED: Greyerz – The World Is Now On The Verge Of Another Lehman Moment CLICK HERE.

***To listen to James Turk discuss the world hurtling into a financial panic that will rival 2008 CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss the global collapse that will rival the Great Depression CLICK HERE OR ON THE IMAGE BELOW.

© 2022 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.