The price of gold has surged above $2,000 as the world edges closer to a global war.

One of Alasdair Macleod’s greatest audio interviews ever was just released! But first…

A World In Fear

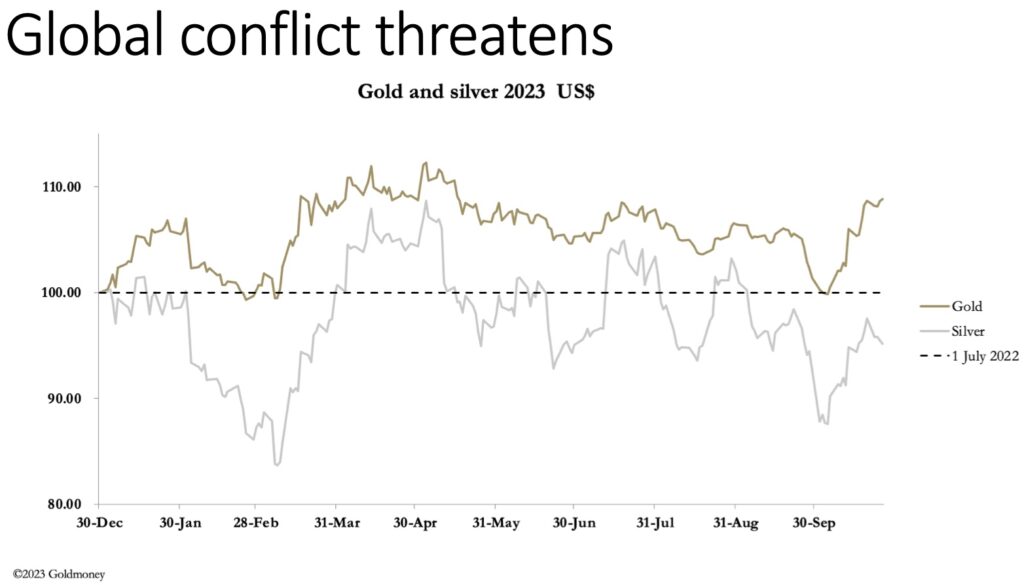

October 27 (King World News) – Alasdair Macleod: This week, gold and silver went their separate ways, with gold rising and silver falling. In European trade this morning gold was $1985, up $4 from last Friday’s close, while silver was 22.81, down 21 cents.

Gold is edging higher, while silver edges lower.

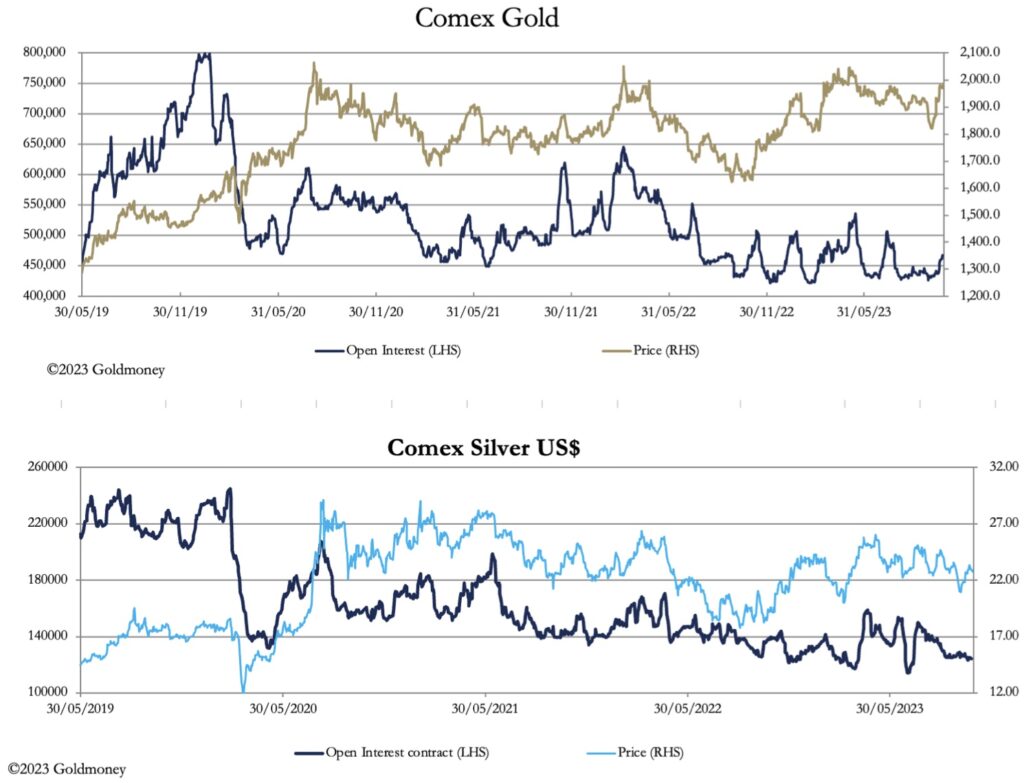

Indeed, all the action is in gold, with Comex Open Interest continuing to rise as our next chart shows, while that of silver is still subdued.

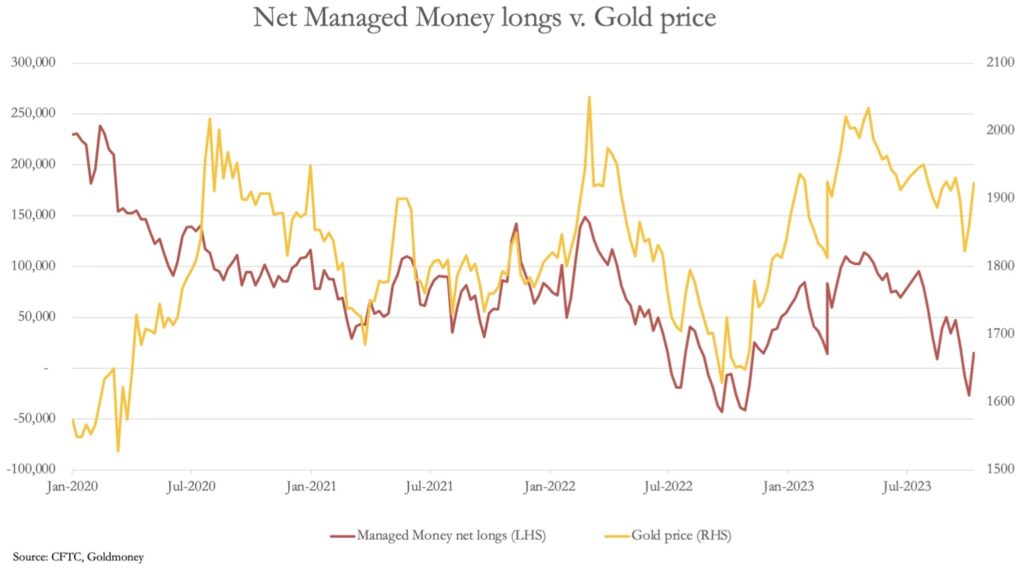

This month, the relationship has driven the gold/silver ratio higher, currently at 87. But it is not as if the hedge funds have been aggressive buyers of gold contracts. While in these markets the Commitment of Traders figures for 17 October are stal, they revealed that the Managed Money category was only net long 15,103 contracts. The next chart shows the position relative to the gold price.

The widening gap between the price and net longs is bullish. It means the gold price has held up well despite hedge funds not buying. With Open Interest having increased by under 30,000 contracts since the COT figures, hedge funds are unlikely to be more than 35,000— 40,000 contracts net long today against a neutral position of over 100,000 contracts. In other words, after a rise of $175 in this month alone, gold still looks oversold.

The slight caveat is that in the next few days, there is the month end contract expiry, when the Swaps and market makers could make a concerted effort to get prices down so that as many call options as possible expire worthless.

There are two reasons for this change in behaviour: geopolitics, and a growing awareness of the dire state of the US Government’s finances. The Israeli-Hamas situation is the most urgent. Yesterday, American jets attacked Hamas-related positions in Syria. At the same time, President PuFn has invited senior Hamas and Iranian leaders to Moscow for talks, probably to America’s annoyance.

With the western alliance unequivocally backing Israel and Russia with an eye on her Muslim interests, the conflict in Gaza is threatening to widen. For dealers in gold, it appears that we are early in a deteriorating situation. The fear must be that the western alliance pushes the boundaries as far as it can to protect the Israelis. The bigger picture is to not give any more ground to the Asian hegemons over influence in the Middle East. The Saudis are key in this, no longer kowtowing to the US, working with Russia and Iran to control oil prices.

This is the new reality. If the US has a pop at Iran, Iran will probably retaliate by closing Hormuz and driving oil prices considerably higher. And unlike in the past, led by the Saudis the Arab world will probably unite behind Iran.

One last word on America’s deteriorating finances: gold is now rising along with US Treasury yields, indicating that the dollar is becoming destabilised by Bidenomics, and a debt trap is being sprung on US Government finances.

JUST RELEASED! A World In Chaos & Skyrocketing Gold

To listen to Alasdair Macleod’s greatest audio interview ever discussing skyrocketing gold and a world in chaos CLICK HERE.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.