Costa discusses two major catalysts for gold and silver including one of the most compelling opportunities of 2026.

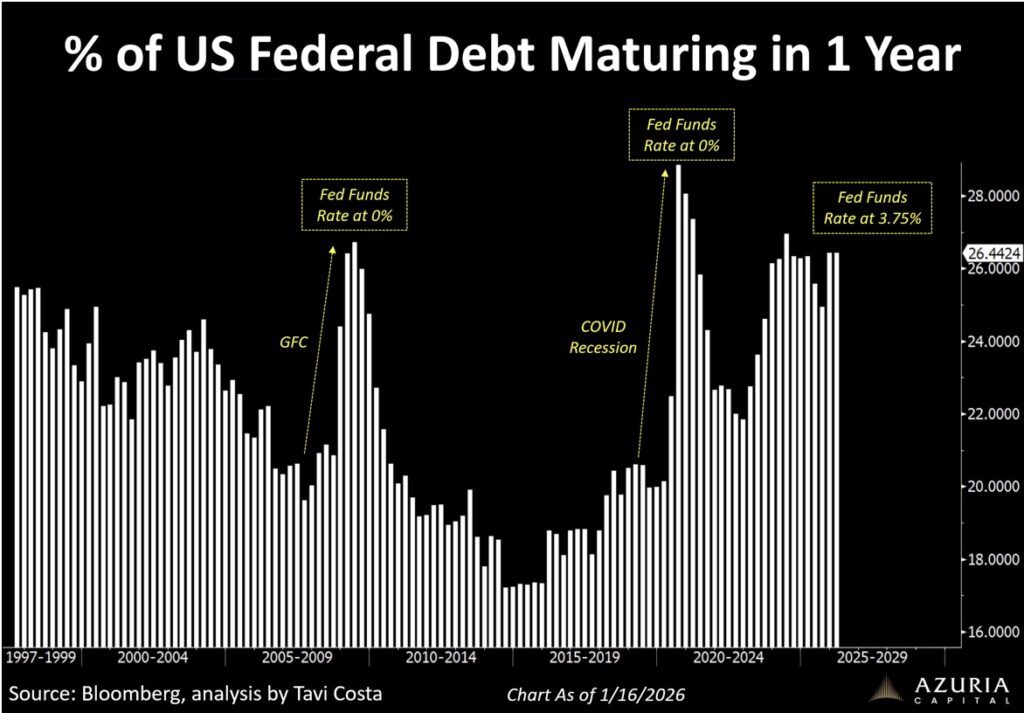

January 18 (King World News) – Tavi Costa: Approximately one-quarter of U.S. federal debt is scheduled to mature over the next 12 months, creating a significant refinancing requirement. Comparable episodes of refinancing pressure occurred in the aftermath of the Global Financial Crisis and the COVID recession — both periods characterized by extraordinary debt issuance to stabilize the economy. In each case, policy rates were anchored at or near zero. Today, the policy backdrop is fundamentally different: rates remain around 3.75%, a level historically inconsistent with absorbing refinancing needs of this magnitude without policy adjustment.

Despite this, markets appear to discount the likelihood of a meaningful shift in the policy regime, pricing fewer than two rate cuts by year-end. That assumption is difficult to reconcile with the arithmetic of debt servicing and refinancing at current rates. In my view, the path of least resistance points to a more aggressive easing cycle than markets currently expect. Should this assessment prove correct, the implication for asset allocation is clear: exposure to hard assets remains structurally undervalued in the current investment landscape.

One Of The Most Compelling Opportunities In 2026

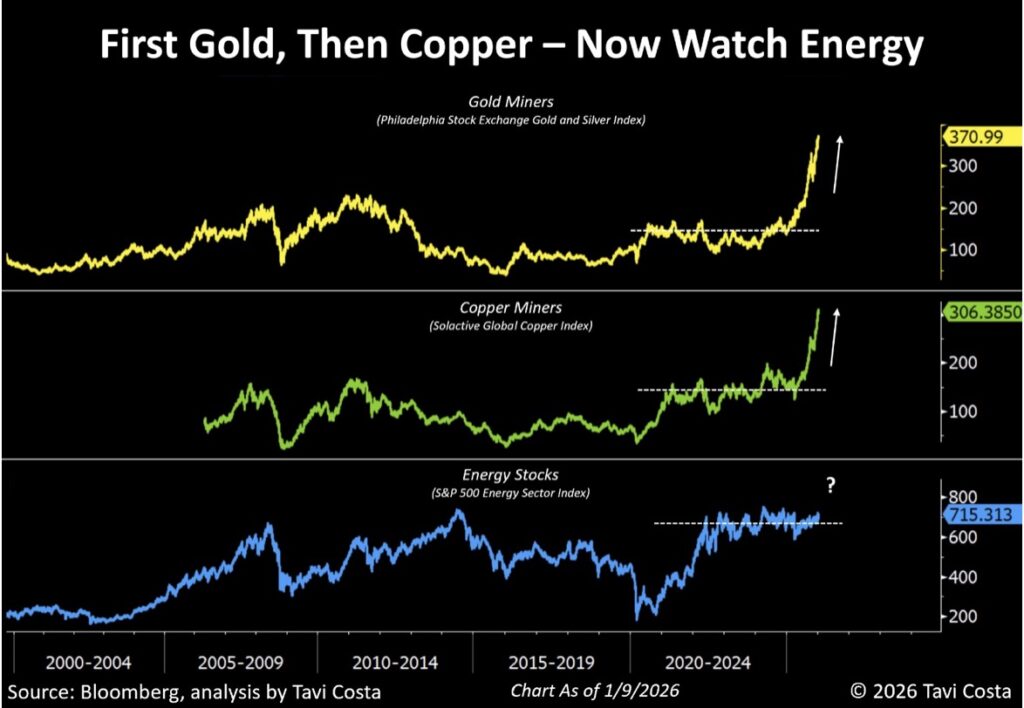

While metals remain highly compelling, it is equally important to recognize how deeply undervalued energy equities appear within an environment of accelerating fiscal repression. The setup suggests that the next leg higher in energy stocks could be explosive. The chart below speaks for itself, yet investors continue to interpret commodity price moves as isolated events. That view misses the broader picture.

Commodity markets are highly interconnected, particularly in inflationary and fiscally dominated regimes. Energy sits at the core of that system, and its relative underperformance is increasingly difficult to justify. In my view, energy is next in line — setting up what may be one of the most compelling opportunities heading into 2026.

Asymmetry is written all over it.

King World News note: Increasing oil prices will feed even more inflation into the system in 2026 and beyond. The twin problems of increasing inflation and soaring US debt will provide two major catalysts for gold, silver, and high-quality mining & exploration stocks as the bull market in energy begins in 2026.

$150-$180 Silver In 2026

To listen to Nomi Prins and her jaw-dropping price predictions for gold, silver, uranium, and mining stocks CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

Nomi Prins Just Predicted A Jaw-Dropping $150-$180 CLICK HERE.

Michael Oliver – Gold & Silver Pause But Look At This Massive Upside Breakout CLICK HERE.

This Kicked Off The Bull Market In Gold CLICK HERE.

What’s Next For Silver? CLICK HERE.

Silver’s Spectacular Rise Has Become Disorderly, But Silver Remains Radically Undervalued CLICK HERE.

GOLD HITS ANOTHER RECORD HIGH: The Global Hyper-Debt Bubble And Gold CLICK HERE.

This Bodes Well For Continued Bull Market Action In Gold CLICK HERE.

Historic Gold & Silver Surge Continues, But Look At This Bull Market That Is Just Getting Started CLICK HERE.

GOLD & SILVER HIT RECORD HIGHS! Could Gold Be Set Up For Yet Another Upside Explosion? CLICK HERE.

Gold & Silver Melt-Up Continues, But Look At This Shocker CLICK HERE.

Celente’s Shocking Top Trends Predictions For 2026 CLICK HERE.

Look At Who Just Became One Of The Largest Holders Of Gold In The World CLICK HERE.

NEXT BIG BULL MARKET: Look At Who Just Predicted $369 Oil CLICK HERE.

Is It Possible Silver Will Hit This Jaw-Dropping Price? CLICK HERE.

This Shows Silver Would Have To Skyrocket To $917 To = 1980 Peak CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.