Today the price of silver futures traded as high as $59.36 as the price of silver remains in the early stages of a move that will take the price well above $100. And look at what is happening with gold, copper and oil.

$58 Silver

December 1 (King World News) – Peter Schiff: Silver is now above $58. This is an incredible run, but it’s just getting started.

Gold & Silver Surge As Yields In Japan Continue To Rise

Peter Schiff: The yield on the 10-year JGB is now 1.84% and rising. That’s causing investors to sell risk assets. Stock futures are down, and Bitcoin and other cryptos are getting killed. But gold is now up over $20, trading above $4,240, while silver is surging $1.20, trading above $57.50.

Silver: New All-Time High

Peter Boockvar: In case you didn’t see on Friday but silver is trading at a record high in nominal terms as more investors notice the multi year supply deficits at the same time industrial demand is benefiting from electrification uses, the metal still plays a monetary role as gold does, though not nearly to the same extent and it has been anointed as a critical mineral by the US Geological Survey. We remain long and positive on silver, along with gold and platinum (as hybrid vehicles win the market share battle vs full EVs and which use more platinum per hybrid than an ICE vehicle). Expectations of an Easy Money Man in the Fed next year is also helping.

This long term silver chart is a generic futures chart so doesn’t capture the around $50 level it touched in 1980.

KING WORLD NEWS NOTE: Silver Hits All-Time High. Chart Doesn’t Properly Show $50 High In 1980

Copper Bull

Copper on the LME as of Friday’s close but trading up again today. The copper price trading on the London Metals Exchange is … trading at a record high, over $11,000 per ton.

KING WORLD NEWS NOTE: Copper Coiled To Soar As It Prepares To Enter Major Upside Bull Run

Cheap Oil

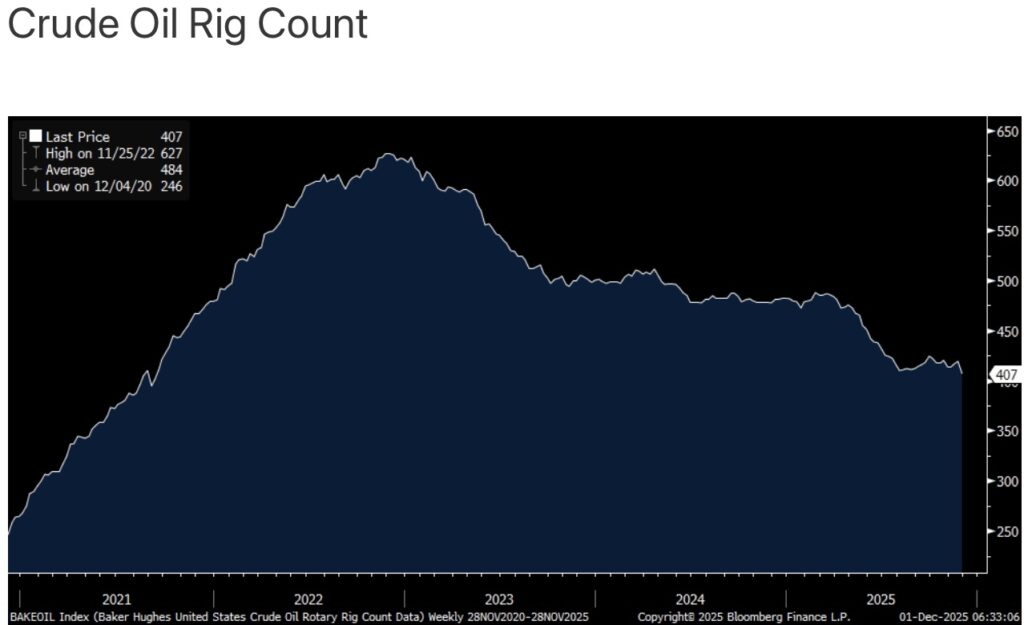

Also of note on the commodity front, the US crude oil rig count as of 11/28 fell by 12 rigs to 407, the least amount since September 2021. I’ll argue again that a barrel of oil is right now one of the cheapest assets in the world and we are long oil and gas stocks.

KING WORLD NEWS NOTE:

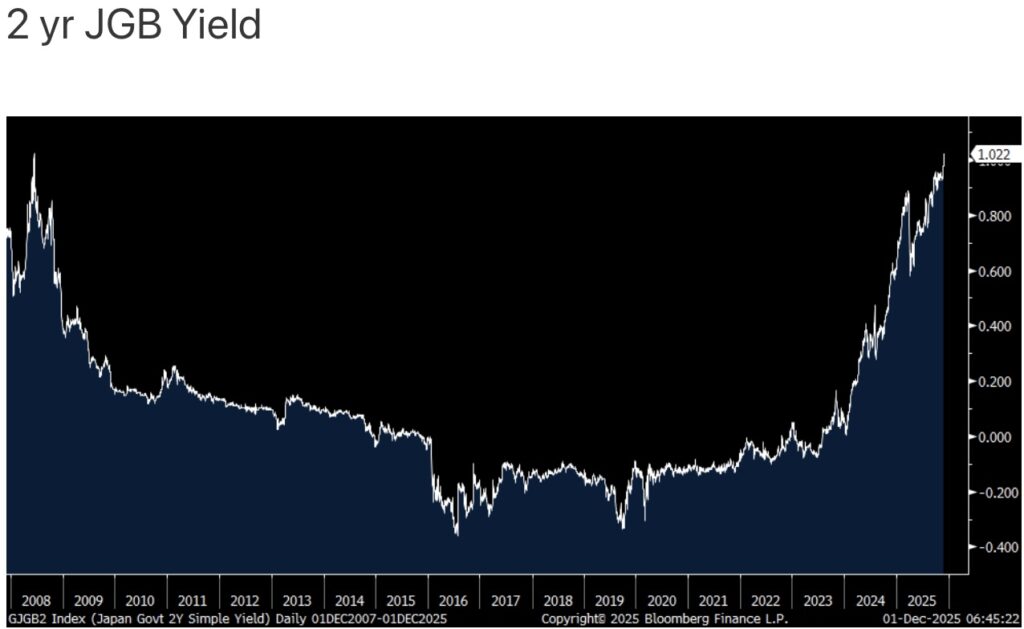

Interest rate hike odds for the Bank of Japan on December 19th is now up to 82% vs 30% just two weeks ago. Governor Ueda himself today in a speech is setting us up for a rate rise.

He said:

“Raising the policy interest rate under accommodative financial conditions is about the process of easing off the accelerator as appropriate toward achieving stable economic growth and price developments, not about applying the brakes on economic activity.”

And they will

“examine and discuss economic and price developments at home and abroad, as well as market moves…and consider the pros and cons of raising interest rates.”

Finally in what seems like a clinching of the hike,

“Being too late in adjusting the degree of monetary support could cause very high inflation and force us to respond rapidly, which would cause turmoil.”

Another Gold Bull Market Catalyst

The market reaction was instant with the 2 yr yield rising 4.3 bps to above 1% for the first time since 2008 at 1.02%. The 10 yr yield was higher by 6 bps to 1.87%, also a 17 yr high. Yields further out on their curve rose too and the yen is rallying to a two week high. I point my finger here as to also why European and US Treasury yields are higher. AGAIN, this is a really big deal for global bond yields I continue to believe. The Nikkei closed down 1.9%.

KING WORLD NEWS NOTE: Rising Interest Rates In Japan Are Impacting The Yen Carry Trade. As It Unwinds, Expect Volatility In US Stocks And The Dollar

Just Released!

To listen to James Turk discuss the Comex shutdown on Friday and the wild trading that occurred after it reopened CLICK HERE OR ON THE IMAGE BELOW.

Just Released!

To listen to Alasdair Macleod discuss the Comex shutdown as well as the wild trading on Friday CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: More Metal Shortages Plus The Road To $10,000 Gold CLICK HERE.

ALSO JUST RELEASED: Friday’s Comex Shutdown And The Wild Trading In Silver After It Reopened CLICK HERE.

ALSO JUST RELEASED: COMEX Shutdown Sparks Wild Stories About A Meltdown In The Silver Market CLICK HERE.

ALSO JUST RELEASED: Silver Sees Historic 50-Year Upside Breakout As Gold Continues Its Parabolic Pattern! CLICK HERE.

ALSO JUST RELEASED: The MegaBubble In Stocks And The Gold Bull Market CLICK HERE.

ALSO JUST RELEASED: Long Term Silver Target A Jaw-Dropping $370 As Miners Prepare To Blastoff CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.