Another day in clown world – look at what just collapsed.

November 13 (King World News) – Simon Mikhailovich: Via Citi: A 0.1% increase in household allocations to gold would require doubling annual mine supply. Raising average allocations from 3.5% to 5% would need 18 years of mine supply — about half of all jewellery and coin stocks ever produced.

Another Day In Clown World

Sven Henrich: If $2,000 stimulus checks don’t work perhaps try $4,000 stimulus checks…

Consumer Confidence Has Utterly Collapsed

Gerald Celente: Americans’ outlook on the nation’s economy is within reach of a record low set during the COVID War, the University of Michigan’s twice-monthly survey of consumer sentiment discovered.

November’s early reading dropped by 3.3 points to 50.3. Only one economist in a Bloomberg survey had forecast such a low number.

The lowest score in the survey’s record dating back to 1978 was 50.0, set in June 2022.

This month’s decline was shared among all age and income groups and political affiliations. Democrats and independents showed gloom scores not seen in the survey since 1985.

The sub-measure of current economic conditions did fall to a record low of 52.3, down 6.3 points on the month and worsened by what had become the longest federal government shutdown in history…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Consumers’ outlook for inflation was the poll’s only measure that improved. Households see prices rising at 3.6 percent annually over the next five to 10 years, the slowest pace forecasted in the past three months.

“Consumers perceive pressure on their personal finances from multiple directions,” survey director Joanne Hsu said in reporting the survey’s result. “Consumers also anticipate that labor markets will continue to weaken and expect to be personally affected.”

Seventy-one percent of respondents expect unemployment to rise in the next 12 months, twice the proportion saying so a year previous. The number of people expecting to lose their own jobs was the largest since March.

That view was echoed in a survey last week by the Federal Reserve Bank of New York, which found 43 percent of people now see a greater likelihood of losing a job within the next year.

The Michigan poll’s sub-index asking about the state of personal finances slumped to a six-year low. Households see this as the worst time since mid-2022 to buy a big-ticket item such as a car or refrigerator.

People’s expectations for the future registered 49, the lowest since May.

“While any recovery when the shutdown ends would leave sentiment low by historical standards, we still expect fairly healthy consumption growth this quarter and into next year, as the link between sentiment and spending has been weak in recent years,” North America economist Thomas Ryan at Capital Economics wrote in a note.

TREND FORECAST:

We see nothing on the economic horizon that would spark optimism among consumers in the near term. As we have detailed, by the facts, the middle class in America is in decline as the rich get richer and the plantation workers of Slavelandia get poorer.

Need more proof? A newly released report by Oxfam found that the top 10 richest people in the U.S. saw their combined net worth increase by $698 billion in the past year, highlighting the widening gap between the countries richest and everyone else.

The report, which was published on Monday, found that the 10 richest people in the U.S. saw their wealth increase by, on average, 40 percent—from $1.79 trillion to $2.5 trillion. Elon Musk led the way and saw his net worth jump from $264 billion to $469 billion, along with Larry Ellison, who saw his net worth go from $187 billion to $323 billion at the time of the report.

Silver

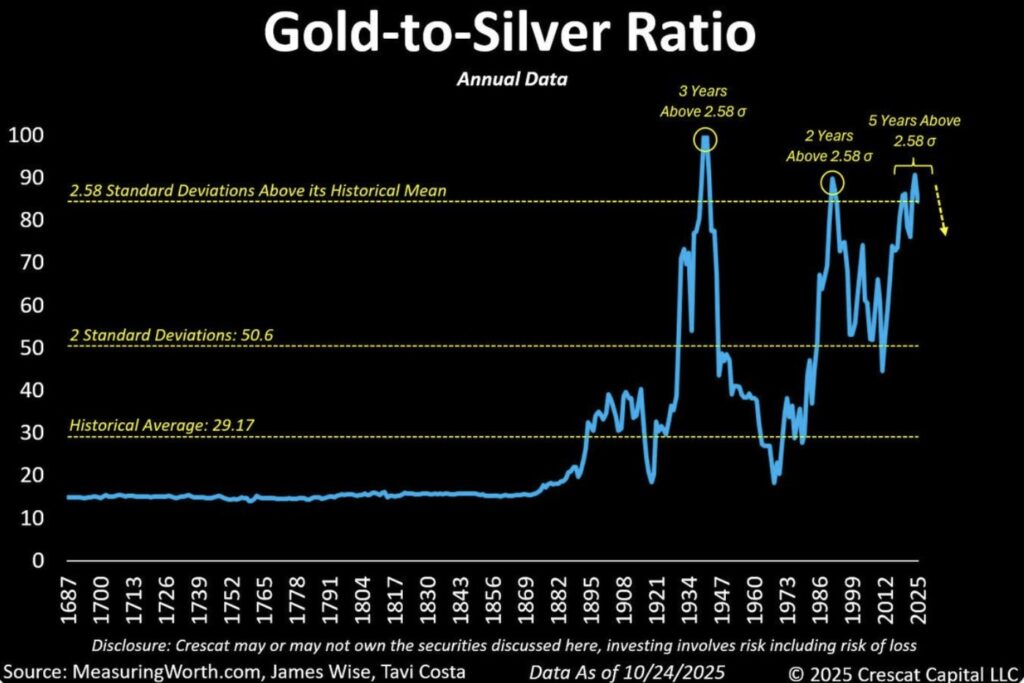

Otavio Costa: Silver is about to enter a true price discovery phase, in my view.

Here is a reminder that this is all happening while the gold-to-silver ratio remains near historically high levels.

Game on.

KING WORLD NEWS NOTE: Gold/Silver Ratio Is Set To Collapse As Silver Coiled To Radically Outperform Gold

Wild Trading But Gold & Silver Prices Remain Firm

Peter Schiff: Bond yields are rising, stocks are tanking, and everything crypto is melting down. Gold and silver are down too, but gold is still above $4,150 and silver is still above $52. Bitcoin broke below $98K. Despite massive hype, in terms of gold it’s now 37% below its record high.

ALSO JUST RELEASED: Silver Bull Market Just Getting Started, Plus Gold & Silver Email CLICK HERE.

ALSO JUST RELEASED: END STAGE: We Are Witnessing The Liquidity Addiction That Will End Disastrously CLICK HERE.

ALSO JUST RELEASED: Remember 2008? Risk Has Never Been Higher CLICK HERE.

ALSO JUST RELEASED: 3 Fascinating Emails And Gold Will Soar Even Higher CLICK HERE.

ALSO JUST RELEASED: Fascinating Email From A Man Who Grew Up In The 1970s CLICK HERE.

ALSO JUST RELEASED: CHINA GOLD MARKET IN TURMOIL: West vs East At The Poker Table CLICK HERE.

ALSO JUST RELEASED: Gold Price Remains Radically Undervalued vs 1980 High CLICK HERE.

ALSO JUST RELEASED: Boockvar – Silver’s Inflation-Adjusted Price Is A Jaw Dropping $200 CLICK HERE.

ALSO JUST RELEASED: Colombo – This Is Where Things Stand In The Gold & Silver Markets CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.