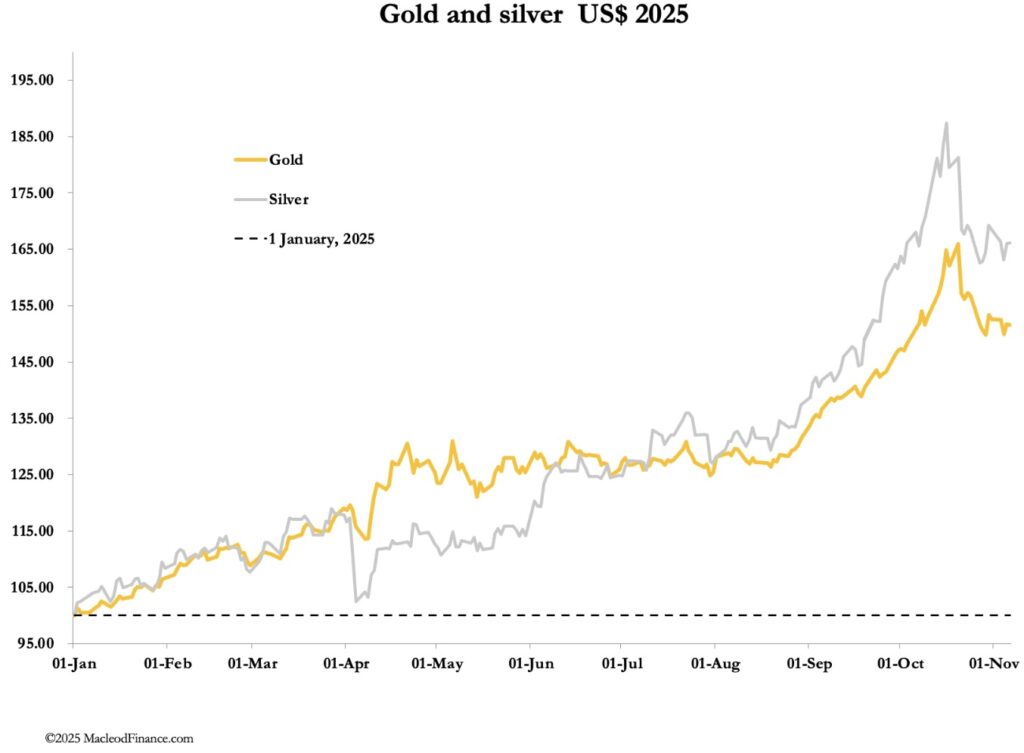

When it comes to riding the gold and silver rockets, the volatility will “light people’s hair on fire.” Is the gold and silver correction already over? Take a look…

Riding the gold and silver rockets

November 7 (King World News) – Alasdair Macleod: Most goldbugs believe that they face months of price consolidation. Evidence is mounting that the correction is over and that profit-takers are wrong to be on the sidelines.

This market report looks at the evidence behind a continuing silver squeeze, which theoretically can only be alleviated by higher prices. But higher silver prices are set to fuel further demand and insufficient supply. And the Fed abandoning its inflation target to rescue a liquidity-strapped credit bubble can only lead to a debauching dollar and far higher gold prices.

After their recent sharp pullbacks, gold and silver steadied this week in light trade. This morning in European trade gold was $4005, up $5 from last Friday’s close, and silver at $48.74 was up only 8 cents on the week.

Silver’s shortage still persists, with a backwardation between London spot and the active Comex contract, though it has declined to 20 cents or so. What is notable is the drying up of volume on Comex:

45,000 contracts turnover is unusually low, indicating that in the absence of speculative interest the price is being driven by fear rather than greed: fear of being short in the absence of sellers, confirmed by the backwardation over London’s spot. The swaps on Comex who are net-short would love to see prices lower, but they appear unable to achieve it.

There are two separate factors squeezing the paper shorts. Industrial demand continues apace and is being accelerated by fear of not obtaining metal while supplies are tight. And ETF demand, which may be paused for the moment will have a dramatic effect if it returns, as seems likely.

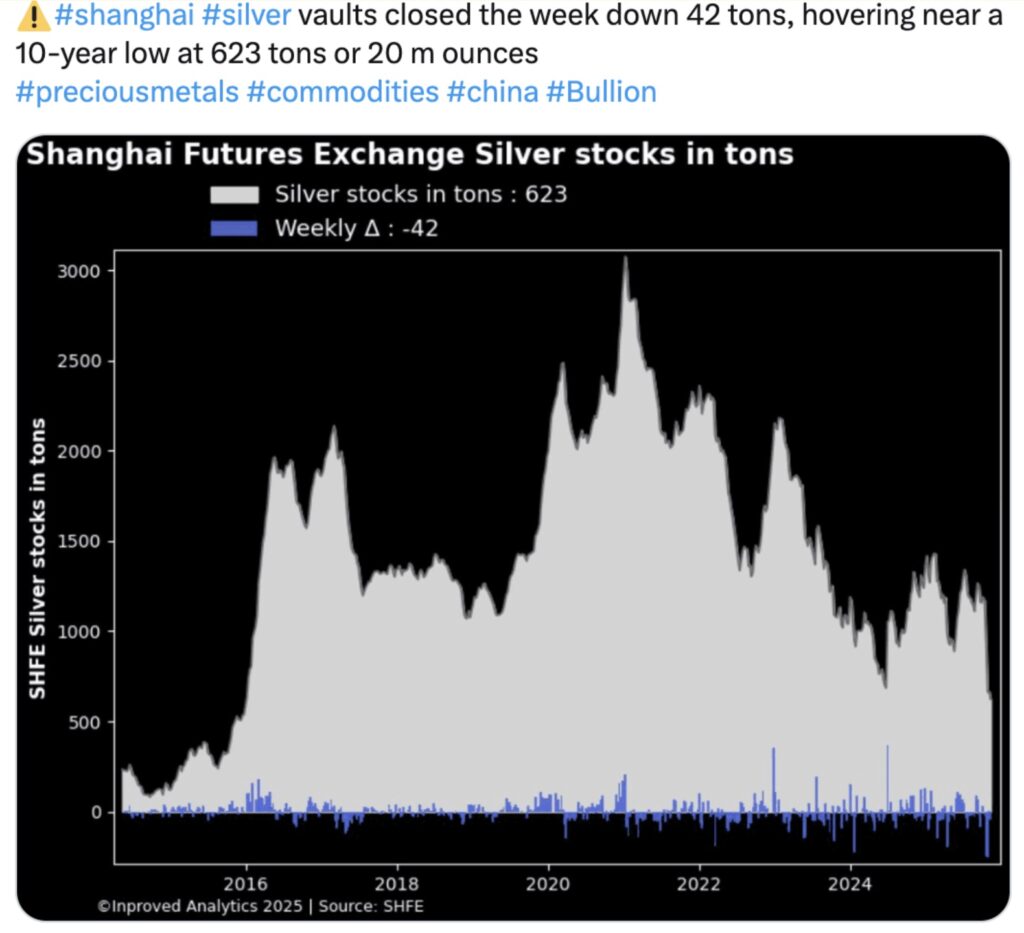

While we naturally focus on London and New York, both gold and silver have been rising during Shanghai trading hours, only for interest to subside subsequently in London and New York. The following tweet lays out the situation for silver in Shanghai:

So, Shanghai has liquidity problems as well. And another tweet from yesterday confirms a developing situation:

To summarise: There is still a physical liquidity problem in London which refuses to go away, and now similar conditions are emerging in China. These are circumstances set to drive the silver price higher sooner rather than later. The evidence is therefore that the current price correction, which most traders expect to continue for a few more months, is over and profit-takers will miss out from a rapidly rising price.

Relative to gold, silver also looks bullish:

After rallying into the mid-80s, supply for the gold/silver ration at the 55-day moving average limits upside ,suggesting a decline at least into the low seventies is now due and likely beyond. But not only does silver look likely to outperform gold, gold itself is likely to rise on a combination of continuing central bank demand, withdrawal of leasing facilities in London, and global portfolio reallocation. Furthermore, the fundamentals to back such a move are now staring us in the face.

Recently, the Fed has given up on managing the inflation outlook, being forced to address tightening liquidity in credit markets. Accordingly, the FOMC cut its federal funds target rate to $3¾% to 4% as expected, ended QT and is reintroducing QE.

For those who care to notice, it is print, print print.

The reputational cost is that Jay Powell will probably go down in history as a latter-day Rudolf Havenstien, who is still mocked for his role over the collapse of the reichsmark in 1918—1923. But the Fed has no option unless it is prepared to stand back and watch a liquidity crisis wreck markets. That is the reality of the Fed’s unenviable position.

Tellingly, the yield on the long bond started rising again from the moment the cut in the funds rate was announced:

The inflation penny has dropped in the bond market. But under the influence of a widespread belief that they need to consolidate even further, it has yet to do so for gold and silver. But the implication is clear: the Fed’s printing machine is being warmed up to keep the credit bubble alive. In which case, gold is going far higher reflecting the fiat dollar’s path to oblivion, and silver is going even higher, even faster.

ALSO JUST RELEASED: DC’s “Financial Apocalypse” Playbook REVEALED CLICK HERE.

ALSO JUST RELEASED: CAUTION: Expect Higher Inflation In 2026 CLICK HERE.

ALSO JUST RELEASED: Bank Crisis: Banks Are In Trouble…Again CLICK HERE.

ALSO JUST RELEASED: The US Economy Is Beginning To Implode CLICK HERE.

ALSO JUST RELEASED: AI, Massive Layoffs And The Coming Stock Market Crash CLICK HERE.

ALSO JUST RELEASED: Silver & Gold: Do Not Get Beat Down By The Declines CLICK HERE.

ALSO JUST RELEASED: The Devil’s Box And The Gold Market CLICK HERE.

ALSO JUST RELEASED: Fear Index Reaching Levels Last Seen Prior To 2008 Global Collapse CLICK HERE.

ALSO JUST RELEASED: John Ing: When It Comes To Gold “We Haven’t Seen Anything Yet” CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.