On the heels of a squeeze in the silver market pushing prices close to record highs, Sprott says the silver short squeeze may vault price well beyond $50 all-time high. But first, here is an email from a King World News reader claiming gold shops have been cleaned out in Bangkok.

Gold Shops Cleaned Out In Bangkok

October 9 (King World News) – From King World News reader Ian Casely: Hello folks. What crazy times we are living through. Thanks for the wonderful news articles.

My partner (who now deals gold like a fund manager, lol) tells me of some incredible gold sales activity here in bkk [Bangkok]. Some shops are out of gold and giving out vouchers instead of physical for people to collect at a later date…. Can you imagine handing over paper cash for…. More paper? People just don’t understand. Also people queuing for hours, like 8 hours in a queue to purchase physical gold. And another thing that has attracted some is physical silver – I’m told dealers are giving out tickets for collection of physical silver dated three months away. These are indeed crazy times.

But, this does reflect a mass desperation to ditch currency for metal, the bear market in currency is truly underway. I think it’s early days yet.

Bless you all

Ian Caseley

Silver Market: Potential Price Squeeze

Paul Wong, Market Strategist at Sprott: Spot silver increased $6.93 per ounce (or 17.44%) in September to close the month at $46.65, its highest closing price since April 2011, and just below its all-time closing high of $48.44. By month-end, spot silver was up 61.39% since the start of the year, its best year-to-date performance since 1979. Like gold, it is well on its way to being one of the best-performing asset classes for a second straight year. During the third quarter, spot silver increased $10.54 per ounce (or 29.18%), making for another exceptional quarter.

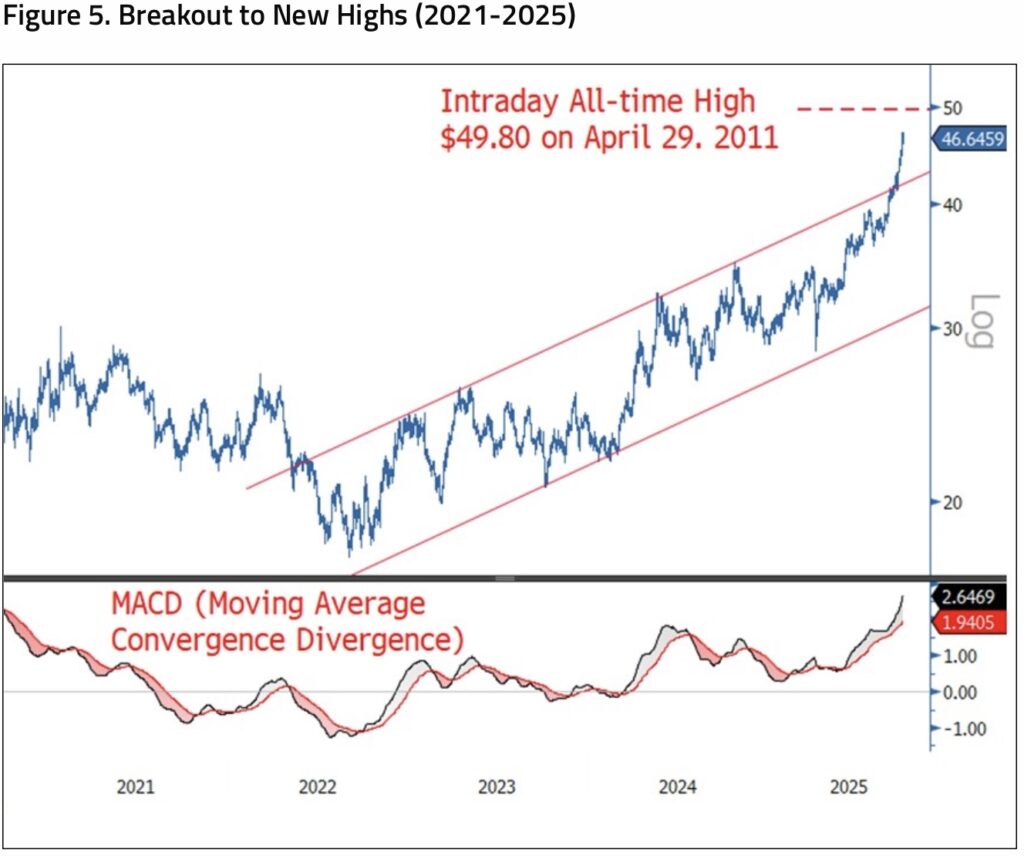

Silver advanced steadily through the month, tracking the gold price movement higher. CFTC net silver (non-commercial) positioning rose only modestly in September (and was still below June’s peak), but ETF buying increased by 2.2% (17.9 million ounces) and has now increased eight months in a row. Year-to-date, silver buying in ETFs has totaled 107.7 million ounces, the most since 2020. In prior commentaries, we have noted the possibility that silver could be entering a potential price squeeze situation as the amount of available free-trading silver (per LBMA vault data) is reaching its limits. In Figure 5, we show how the silver price has broken out of its rising channel in a squeeze-like manner and is quickly approaching its all-time intraday high of $49.80 made on April 29, 2011.

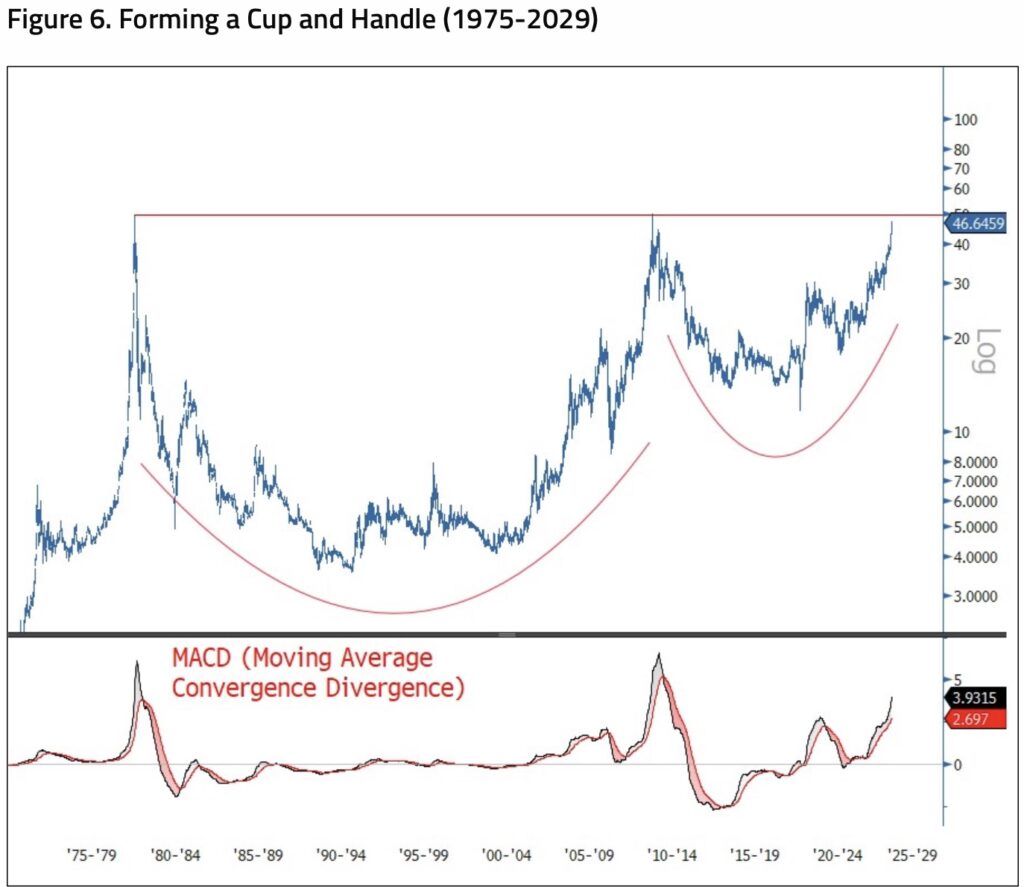

As silver approaches its all-time price high, the very long-term secular chart (Figure 6) shows silver is forming possibly the largest cup and handle pattern we have ever seen. In our view, for the silver price to keep rising, there would need to be severe demand destruction in lower economic value-added end uses for silver, like photography and silverware. Meanwhile, there would need to be a growing demand for higher economic end uses, such as electrical and electronic demand from AI-related spending, photovoltaics and other technology-related demand. Supply demand data confirm both trends. However, as we have noted, investment demand remains the wild card. Historically, investment demand can swing wildly and can become relatively price inelastic given market conditions. The Silver Institute provides a supply and demand table that illustrates these trends.

As far as we are aware, there is no central bank or sovereign entity that views silver as a neutral reserve asset, but there are investment funds and other investors that do consider silver to have a reserve value. Silver’s correlation to gold over any time frame has stayed consistently high. If silver were to trade above $50 sustainably, it could be a sign that silver’s economic worth and store of value function was being re-evaluated, or it could be a mark-to-market reality repricing of the metal.

The move in silver prices relative to CFTC and ETF positioning (proxy investment fund holdings) is another way to illustrate that a potential silver price squeeze may be in play. In Figure 7, the upper panel shows the silver price accelerating while the positioning data remains flat (lower panel). Since central banks and sovereigns are not buying silver (unlike gold), most of the silver pricing is in the hands of investors. In the prior 2020 cycle, there was a notable increase in CFTC + ETF silver holdings commensurate with the silver price (see the green arrows). Today, that pricing relationship is diverging, possibly an early indication of the long-awaited silver demand squeeze.

Man Overseeing $180 Billion Warns Investors To Protect Themselves From Coming Wealth Destruction

To listen to Rob Arnott discuss what investors can do to protect themselves and even prosper during the coming wealth destruction CLICK HERE OR ON THE IMAGE BELOW.

Gold & Silver!

To listen to Alasdair Macleod discuss the massive gold deliveries from Comex as well as the price of silver surging toward an all-time high CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.