Here is the real reason for gold’s continual rise.

Gold’s Continual Rise

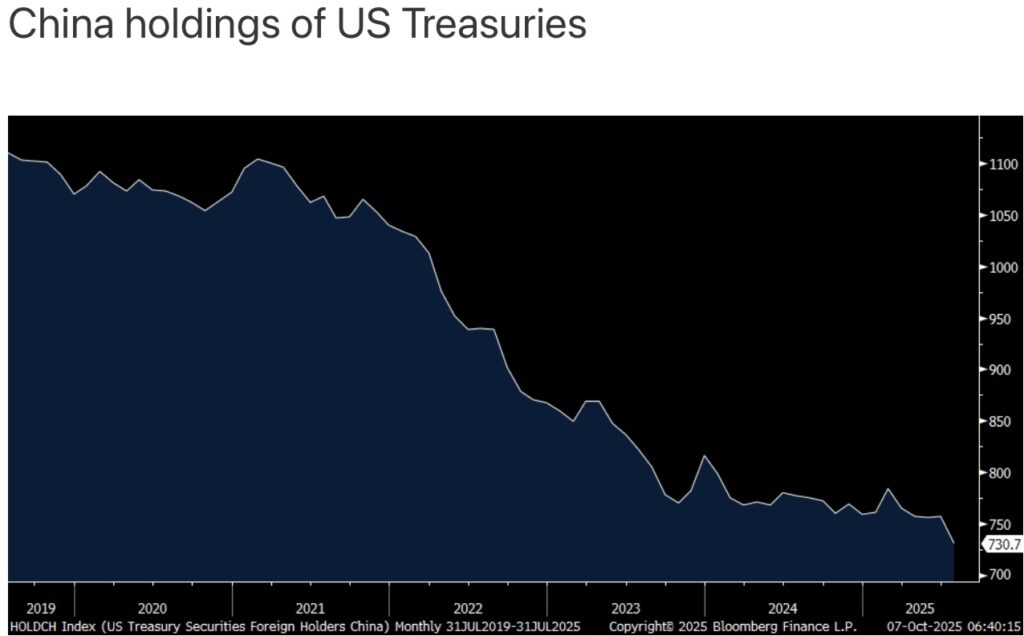

October 8 (King World News) – Peter Boockvar: Gold is rising for a variety of reasons but the main one is that it’s become a wanted reserve asset around the world and no better a highlight than what we’ve seen with China’s holdings. In today’s September reserve asset data from China, its gold holdings have almost tripled over the past three years as seen in the chart below to $283b. And as seen, the holdings really took off in Q4 2022, soon after the US and EU decided to freeze half of Russia’s central bank reserves.

Imagine the look on Xi Jinping’s face when that happened as they owned at the time about $1t of US Treasuries. Those holdings are now down to $731b. The difference is about what the increase in their gold holdings have been. No coincidence.

“They” Will Own All Of Your Assets

Gregory Mannarino, writing for the Trends Journal: Let’s begin…

The global debt-based system is illiquid and functionally insolvent. So, policymakers are building controlled, programmable rails (full-asset tokenization) to keep it moving and to control the fallout. THIS IS JUST THE BEGINNING…

The Current System Is A Time Bomb.

Why?

Debt Rollovers.

Trillions of dollars in US debt must be refinanced/rolled over every week. The US Treasury must redeem maturing bills/notes/bonds at par, and It pays them off using cash in its Fed account.

KEY POINT: (The US Treasury has a general account with the Fed called TGA, (Treasury General Account). This TGA is the US Treasury’s checking account at the Federal Reserve).

New Borrowing. On top of rollovers, The US Treasury must sell additional Treasuries to cover the current deficit and interest. That’s net new debt. Without this mechanism, liquidity vanishes as natural buyers of U.S. debt are GONE. No one wants our debt, especially with artificially suppressed rates, and no one wants our devalued dollars.

The current environment exists only by perpetual debt expansion. Governments must issue more and more debt on increasing amounts, just to stand still…

Government debt backstops are everywhere. Standing repos, swap lines, emergency facilities, NEW Fed QE. Without these mechanisms in place, A SYSTEMIC LOCKUP/CREDIT FREEZE OCCURS… and it all shuts down.

With Tokenization, Who Owns “Your” Assets?

With system tokenization, there is total visibility and questionable ownership. Who actually owns what?

Let’s break this down…

Every pledge/transfer/transaction is logged… perfect/total surveillance, tracked down to the smallest fraction.

Programmable control. Accounts can be whitelisted/blacklisted or frozen by code. Only “approved” identity bound wallets.

With tokenization, INSTANT one-click control… Freeze/seize assets, claw backs… no court.

The Con-Job.

Tokenized rails will be sold to the public as “for stability,” for “your safety.” Of course, AFTER they deliberately take down the current system by some SHOCK event making the general public beg for a solution…

Tokenization… what does not change.

It’s still fiat, still debt-based. Money is created against liabilities, and deficits get funded by new debt.

What does change.

Tokenization will encompass NOT JUST THE CURRENCY.

TOKENIZATION WILL TURN THE ENTIRE SYSTEM ITSELF INTO A DERIVATIVE. As an example… your home, assets, even your bank accounts, will be “represented/become a derivative of” a token. (A token in the custody of/controlled by another party).

KEY POINT: Tokens will be used to represent assets “you own,” and be controlled by another party.

How Tokenization Lets Others Control “Your” Assets.

When a house deed or bank balance becomes a token, “ownership” is just an entry on a ledger controlled by an issuer/admin (bank, registry, platform). Whoever controls the keys, contract, or permissioned network, controls the asset.

The control levers.

Admin keys/smart-contract controls.

Tokenized assets live in smart-contracts/permissioned chains with rules that can be changed. With tokenized assets, the institutions controlling the rails can freeze, refuse withdrawals, or even move funds/assets on instruction (policy, dispute, or error).

Examples.

Home (tokenized deed).

- Deed is a token on a permissioned chain. A dispute, unpaid tax, or policy flag admin flips “freeze”.

- You can’t sell, borrow against, or transfer the deed token.

- If ordered, admin claws back the token to an escrow address, title moves.

Bank account (tokenized deposits).

- Your “checking” is now tokenized bank money.

- Bank detects a rule trigger = frozen account.

Swapping paper roads for high-speed tokenized rails. It’s the same destination, (fiat debt), but with programmable tracks/smart contracts where “ownership” of YOUR ASSETS can be contested/questioned.

YOU OWN WHAT YOU HOLD… PERIOD.

But if your assets are represented by a token that is held by another party- THEN WHO REALLY OWNS THE ASSET!

Tokenization turns ownership into permission. PERIOD!

If someone else controls the keys, contract, whitelist, etc. then they control “your asset.”

Man Overseeing $180 Billion Warns Investors To Protect Themselves From Coming Wealth Destruction

To listen to Rob Arnott discuss what investors can do to protect themselves and even prosper during the coming wealth destruction CLICK HERE OR ON THE IMAGE BELOW.

Gold & Silver!

To listen to Alasdair Macleod discuss the massive gold deliveries from Comex as well as the price of silver surging toward an all-time high CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.