Gold futures hit a new record high approaching the $3,700 level, but look at this…

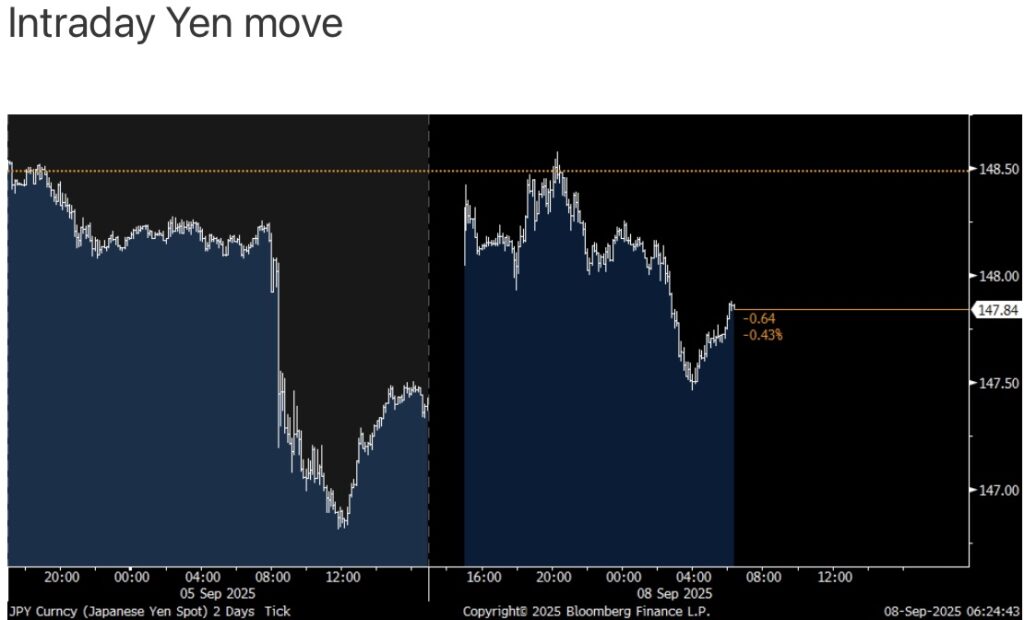

September 8 (King World News) – Peter Boockvar: The initial belief of markets after Japanese Prime Minister Shigeru Ishiba announced his resignation, not surprisingly with timing the only real uncertainty, is that his replacement, whoever it might be (seems to be down to two candidates), will lean more on fiscal stimulus. That as the political pushback by the Japanese citizenry has been disgust with inflation that the Bank of Japan keeps dragging its feet in addressing with its overnight rate at just .50%. The short end of the JGB yield curve fell slightly but longer term rates were higher as was the Nikkei. The yen, after initially selling off to 148.5 ish, is trading just below 148 and down just modestly. Inflation breakevens were little changed overnight.

With OPEC+ now on to unwinding the 1.66 million barrel per day production cut implemented post Covid, after completely reversing the 2.2 million cut, the initial step of 137,000 barrels was a small enough start that WTI is bouncing by 2%. And from what has been seen so far with the actual production increases seen so far from the group, the quota increases seem more a catch up to existing production than anything.

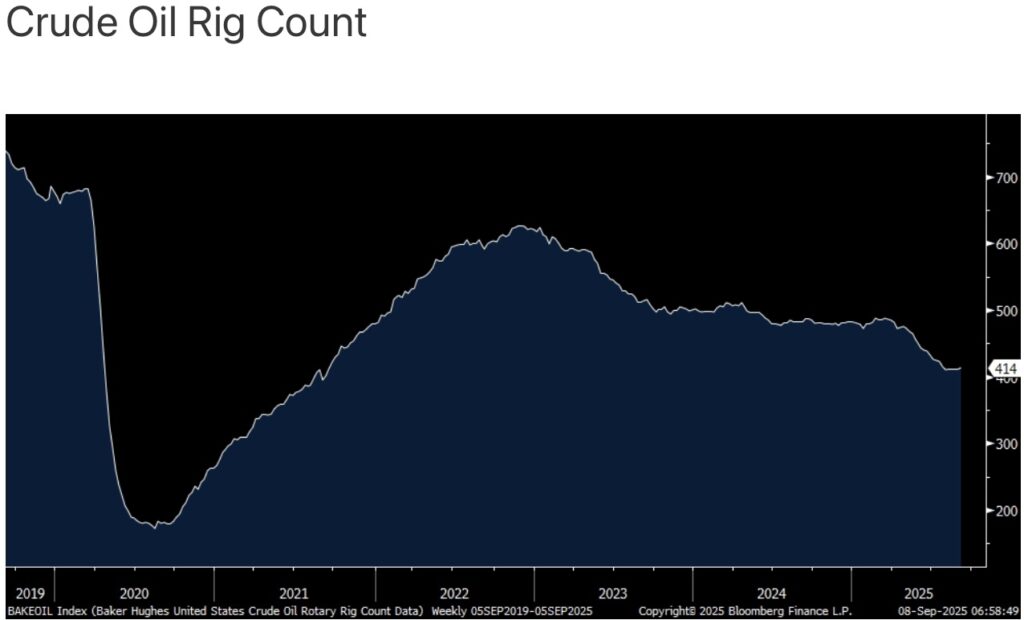

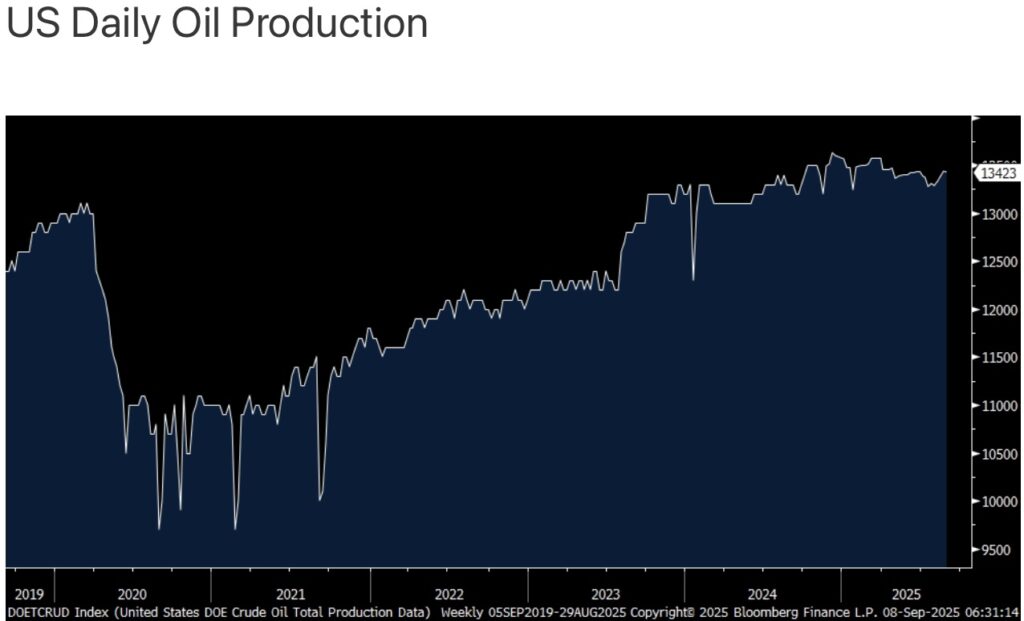

With regards to US production, the crude oil rig count did tick up by 2 rigs in the week ended 9/5 to 414, bouncing along the bottom, around 3 yr lows. And US oil production at 13.4 million barrels per day is not much different than it was a year ago and I expect it to actually fall next year if rig counts don’t increase. In the low $60’s I still believe crude oil is very cheap and we’re long oil and gas stocks.

China’s trade data continues to be interesting to look at as they notably shift around who they do business with. Exports in August rose 4.4% y/o/y, just below the estimate of a gain of 5.5% but the internals stand out. Exports to the US plunged by 33% y/o/y and imports from the US were down by 16% but exports to Southeast Asia jumped by 22.5%, led by a 31% increase to Vietnam and exports to the EU were higher by 10.4%.

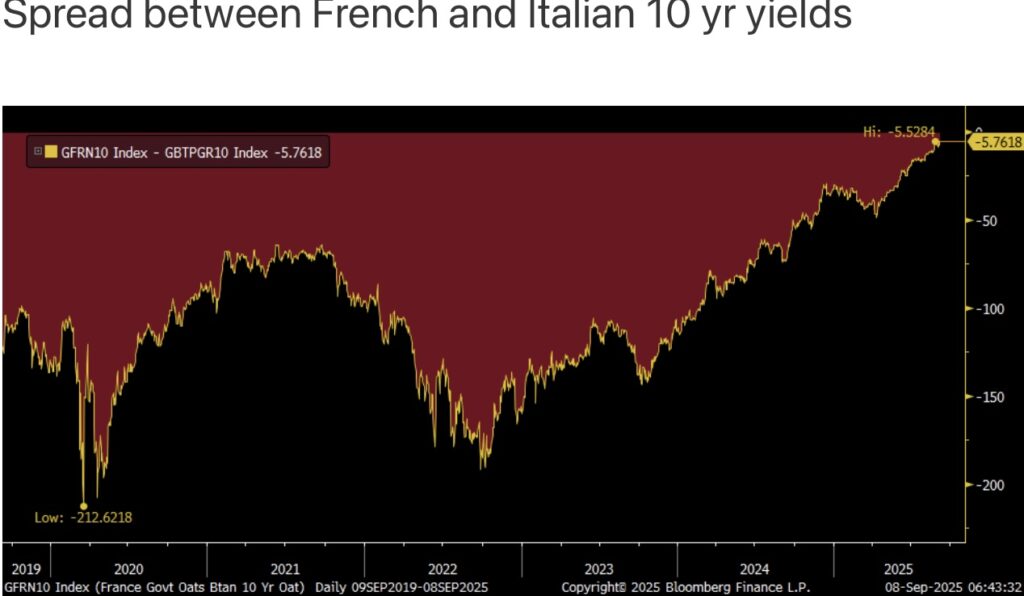

As we await the results of today’s French confidence vote (results likely out in the afternoon US est time) where Prime Minister Francois Bayrou will most likely lose his job, the French 10 yr Oat yield is down slightly by 1 bp at 3.43%. For perspective, that is only 6 bps below the Italian 10 yr yield and clear evidence of the change in fiscal focus of investors in European sovereign bonds. The euro is slightly higher vs the US dollar and with all the economic and French political challenges the EU is dealing with, the euro at just above $1.17 is at the highest level since late July and not far from the best level in 3 years.

Combine this with the tanking of the US dollar vs the price of gold (at a record high) and it highlights the issues the US dollar has currently.

After the soft factory order figure for July seen late last week, the German industrial production number was better with a June upward revision too. The Economy Ministry is hopeful that German manufacturing is trying to stabilize by saying “The latest data paint a slightly more favorable picture of the current industrial economy and point to a slow stabilization of industrial production. Despite the overall cautious mood, the upward trend in business expectations points to the industrial economy bottoming out in the further course of the year.”

$10,000 Gold

To listen to Gerald Celente discuss his prediction for $10,000 gold CLICK HERE OR ON THE IMAGE BELOW.

Gold Blastoff!

To listen to Alasdair Macleod discuss $100,000 gold and the wild trading this week in gold, silver and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.