What a wild week of trading as the price of gold hits $3,000. Take a look…

Alasdair Macleod’s audio interview discussing the gold price breaking above $3,000 has just been released (LINK BELOW)! In the meantime…

Gold and silver soar

March 14 (King World News) – Alasdair Macleod: In this report, we examine technical and market positions for gold and silver, concluding that $3,000 is not a hurdle for gold and that silver has significant catching up yet to do.

Gold and silver rose strongly this week, with gold going into new high ground, while silver, which has underperformed gold recently is catching up rapidly. In European morning trade, gold was $2999, up $90. And silver at $33.98 rose $1.48. That makes gold up 14% so far this year, while silver is up 18% — strong performances in sharp contrast relative to other asset classes which are sliding into bear markets.

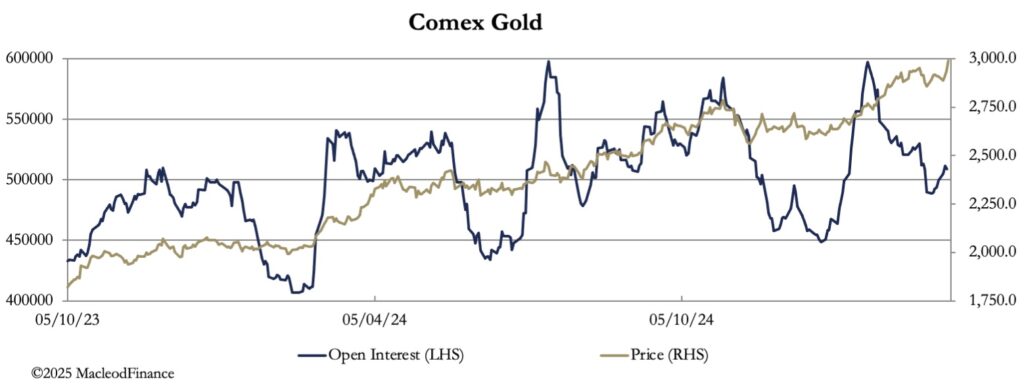

This performance is beginning to be noticed by the investment management industry, which is severely underweight. Beginning to reflect this, trading volumes for gold futures have picked up, along with open interest on Comex. In the chart below, note how open interest (the black line) can easily rise towards 600,000 contracts before indicating gold futures being overbought.

What does this mean?

Quite simply, because gold (and silver) are the only bull markets for hedge fund traders, they are likely to continue to buy futures and sell dollars — their classic pairs trade. With the Swaps short and being squeezed again, it would appear that the psychological $3,000 level will be easily overcome.

Next up is gold’s technical chart:

Clearly, gold is being rerated against a background of limited physical liquidity. Global liquidity has been sucked out of every nook and cranny into Comex warehouses, as shown by the next chart from MacroMicro:

Comex stocks are now the highest ever, but it appears that most of it is spoken for. In the last four calendar years, some 2,000 tonnes have been stood for delivery. The decline in stocks from 16 February 2021 to last October was 675 tonnes, leaving about 1,300 tonnes of stand-for-deliveries yet to be accounted for. And since 1 January, at 344.39 tonnes the pace of these deliveries has accelerated to an equivalent rate of over 1,700 tonnes for this year.

It looks like the bear squeeze is not over yet.

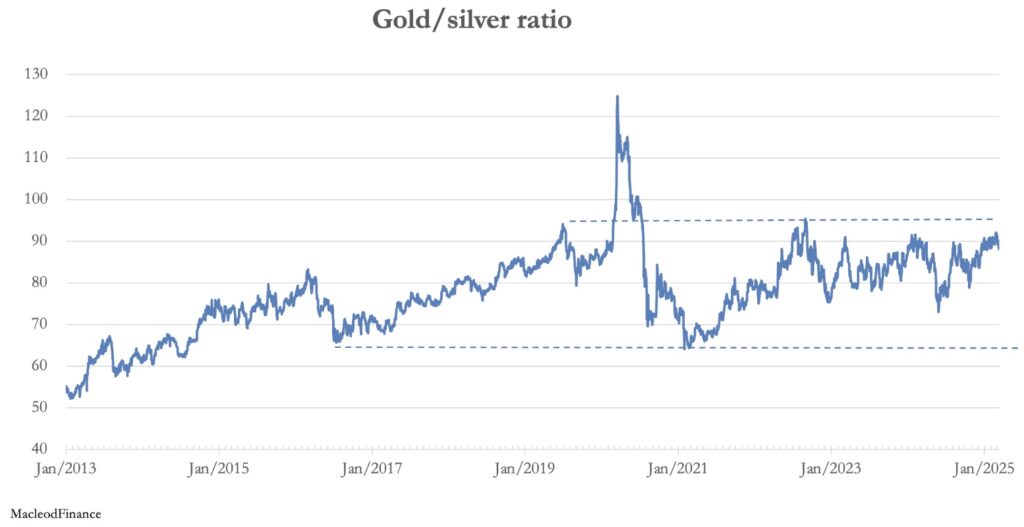

Silver has woken from its recent slumbers and started to outperform gold again, with the gold/silver ratio dropping from end-February highs of 92.4 to 88.2 currently. Silver’s technical chart is next:

This is one of the most bullish technical positions you are likely to see. The price having tested support on the rising 55-day MA and broken above its recent minor consolidation range should find the $35 level no impediment to further gains.

Other than the long-term physical supply shortages in silver, it should be noted that the rise in gold surely anticipates future weakness in fiat currencies and is therefore leading key industrial metals higher, priced in them. Copper is up 23% since 1 January, and hot-rolled coil steel up 32%. Admittedly, other metals are yet to follow. But we can see every reason why as an industrial metal which has lagged gold silver has significant catching up yet to do.

In an attempt to quantify this, we need to look at the gold-silver ratio chart.

Firstly, we must discount the extraordinary spike to 125 on 19 March 2020, just ahead of Covid when silver was sold down to $11.64. Otherwise, there has been a cap on the ratio at about 93 (the upper pecked line) and an apparent floor in the mid-60s. A ratio of 65 would take silver to $46 at the current gold price, but it would need a bullish gold market to make that prospect meaningful.

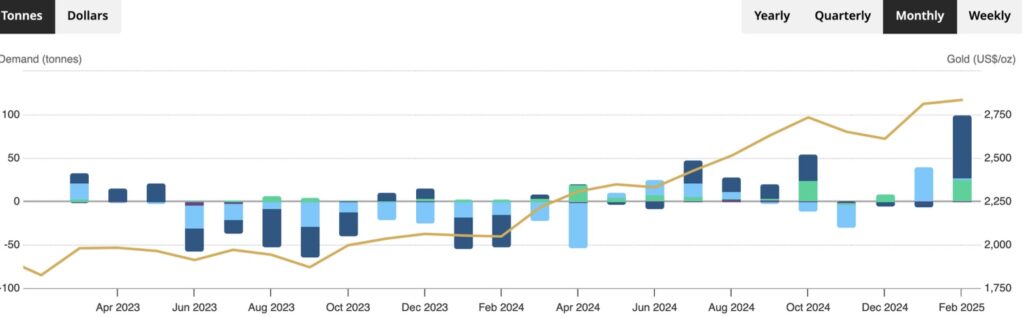

That’s what we have. ETF demand is at last beginning to have a positive effect, illustrated by the World Gold Council’s chart, which is next.

The drama5c pickup in physical ETF demand is an additional factor catching the gold market short. It is evidence that having ignored gold so far, the wider investment community is now getting on board. The hedge funds see it and are set to increase their buying of futures and leveraged ETFs — nothing else is performing so well. The bullion banks also now see it, and for them the jig is up.

In conclusion, only now are western capital markets with their massive buying power turning bullish for gold and silver. To listen to Alasdair Macleod discuss the gold price breaking above $3,000 and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.