Although the gold and silver markets continue to see volatility, there have been massive Comex deliveries since Thanksgiving.

Massive Comex Deliveries Since Thanksgiving

December 13 (King World News) – Alasdair Macleod: In the last ten trading sessions on Comex, 62 tonnes of gold have been stood for delivery, and 1,303 tonnes of silver. What does this tell us?

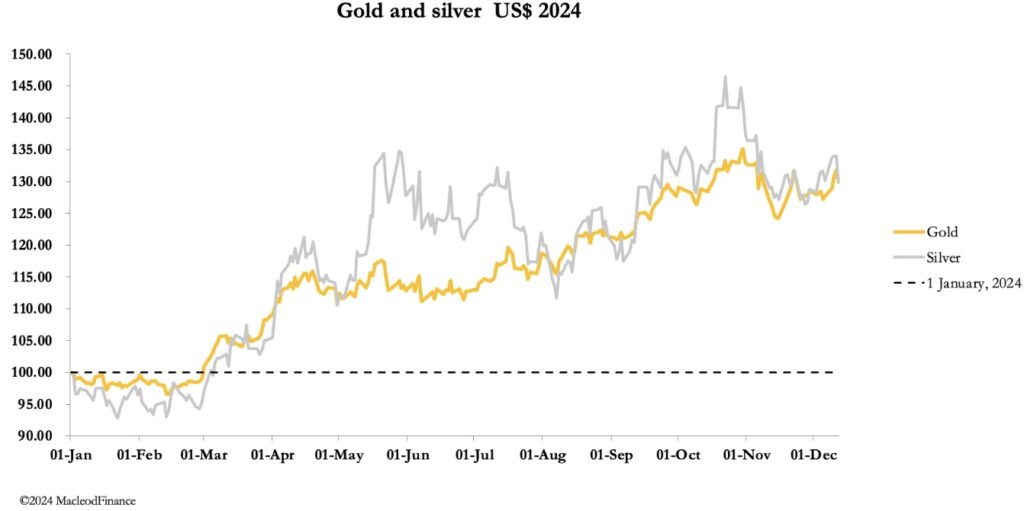

It was a week of two halves for gold and silver prices: rising strongly until Thursday when prices were smashed. In European trading this morning, gold was $2670, up $40 on balance from last Friday’s close having touched $2725 on Thursday morning. And silver was 20 cents lower on balance at $30.80, having been as high as $32.30. Trading volumes in the gold contract were moderate, but more active in silver.

A feature of this week’s trading was levitated futures’ premiums over spot, particularly noticeable in silver which before yesterday’s price smash represented a premium over overnight rates of as much as 7% annualised for the active February contract. While premiums and discounts in futures contracts over spot can and do vary, this detachment was unusually high. This sense of panic has now abated, and bullish hedge fund speculators are being stopped out.

This is very short-term stuff. Additional evidence of market strains is to be seen in the extraordinary level of stands-for-delivery associated with December’s Comex contracts running off the board. In the ten sessions since Thanksgiving, 62.13 tonnes of gold have been stood for delivery and 1,302.6 tonnes of silver. These are huge quantities, particularly for a derivatives market where delivery was not intended.

Almost certainly, there is a general bear squeeze on the establishment’s net short position. When derivative markets drove prices down in the first half of November, it provided the opportunity to buy futures specifically to take delivery of gold and silver. This development indicates that bullion demand exceeds supplies from other sources: mine output, scrap supply, and even buying for forward settlement in London. It suggests that we are unlikely to see those low prices again…

ALERT:

Look at which company has positioned itself to become the next K92 high-grade gold powerhouse! CLICK HERE OR ON THE IMAGE BELOW.

Could this be an early indication that both gold and silver need to be priced significantly higher for physical supply and demand to balance?

So far, excess gold demand from Asia over available supply plus central bank demand has been satisfied by western financial markets, including a reduction in ETF holdings. These sources have now dried up, which is what Comex deliveries may be telling us.

The actions of central banks in buying gold were always part of the story and a litmus test for a wider loss of Asian faith in western currencies. Sovereign wealth funds are also suspected of buying gold, and for the last forty years the numbers of rich families and individuals China and South-east Asia, and now India have increased substantially. Banks in both China and Russia offer gold accounts to savers which have become a hidden source of bullion demand.

In the west, we are almost certainly unaware of the true scale of gold demand from these sources and how it is evolving. In silver’s case, industrial demand has exceeded supply for the last four years, only satisfied by the drawdown of strategic stocks and investors’ holdings. That is also coming to an end, making far higher silver prices an increasing probability.

Finally, for chart followers here is the technical chart for gold:

Gold is finding support at the 55-day moving average. And given that the western financial system has been cleaned out of physical bullion liquidity, it appears to be on the verge of its next move higher.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.