Today gold futures surged above $2,750, but look at gold miners, silver and food prices surging.

Silver

December 11 (King World News) – Graddhy out of Sweden: I have been saying for 3 weeks that the backtest of $30 level and quadruple support for silver should hold. So far it is.

The low at $30 level is most probably a weekly cycle low, which means metals are now most probably in the advancing phase of a new weekly cycle. This means there are months of upside ahead.

I also said $35 was a clear target for the previous upmove. Silver hit $35.07. The next target for silver is $37-42.

Silver Will Break Above $35 To New (Recent) High

Gold Miners

Graddhy out of Sweden: Gold miners have turned a huge corner vs the general stock market.

Note that the chart already has a false (downside) breakout, so no need to go there again.

GDX Gold Miners Set To Skyrocket vs S&P 500

This is a very bullish chart for precious metals…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

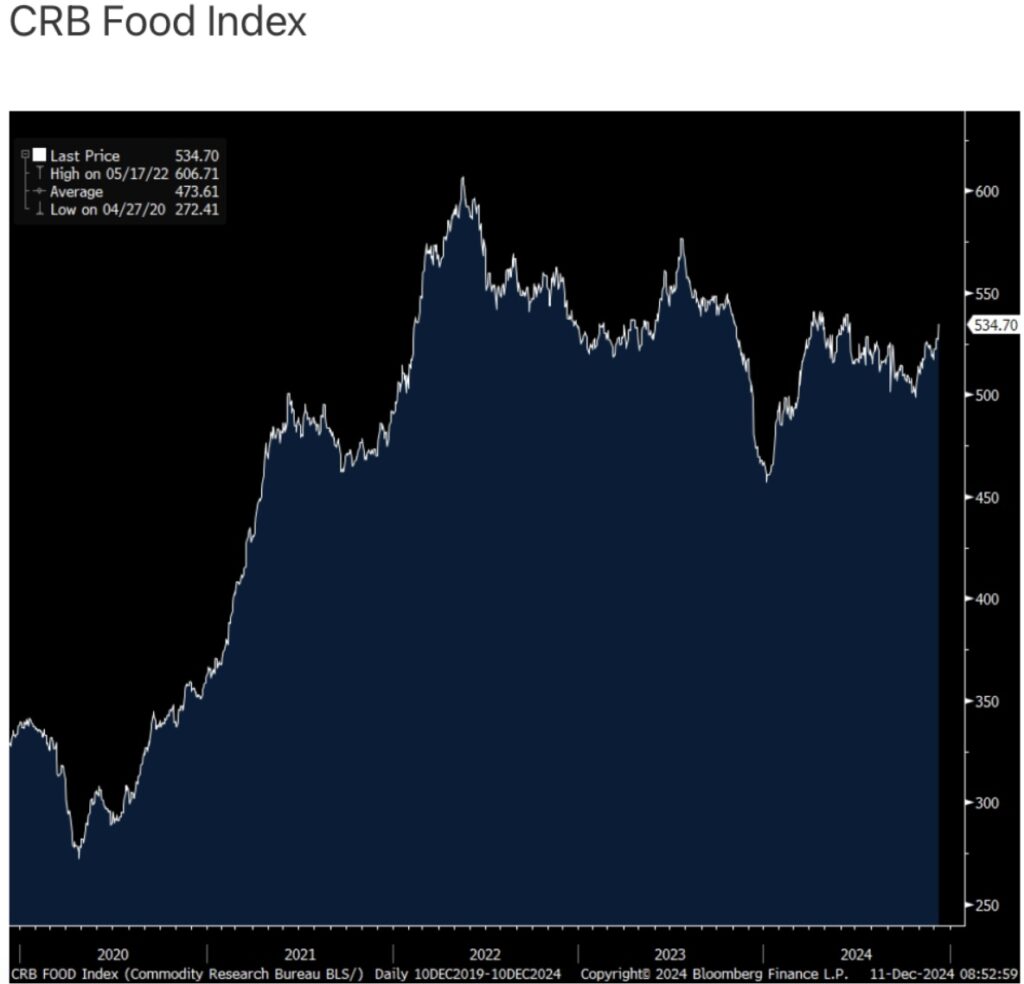

Food Prices Surging Higher

Peter Boockvar: November CPI was as expected, rising .3% both headline and core. Versus last year, they were up 2.7% and 3.3% respectively vs 2.6% and 3.3% in the month prior. Energy prices rose .2% m/o/m but down 3.2% y/o/y. Food prices were higher by .4% m/o/m and 2.4% y/o/y. Food prices at home jumped by .5% m/o/m and by a more modest 1.6% y/o/y. Food away from home is still pricier, higher by .3% m/o/m and 3.6% y/o/y.

By the way, if you didn’t see, the CRB Food Stuff index closed yesterday at the highest level since June.

Prices for auto insurance flattened out for a 2nd month, up by .1% after a .1% drop last month. They are still up 12.7% y/o/y. Vehicle maintenance costs rose .2% m/o/m after a 1.1% rise in October and are up 5.7% y/o/y. Airline fares were up by .4% after two straight months of 3.2% gains. They are up almost 5% y/o/y and responding to the industry’s recent capacity reductions. Hotel prices jumped by 3.7% in the month and also up 3.7% y/o/y.

I highlighted this morning the difference in calculation between CPI and PCE in healthcare, both in terms of methodology and weightings, with the former in particular measuring out of pocket expenses. Health insurance prices rose 5.9% y/o/y. Hospital and related service prices were up by 4.3% y/o/y. Professional services, like physician services, dental and eye care, saw prices up by 3% y/o/y.

How Can Powell Have Confidence To Lower Rates?

Bottom line, core CPI has been between 3.2% and 3.3% y/o/y for the past 6 months and up by .3% m/o/m for 4 straight months. While rental price gains should continue to slow, thus capping service price inflation, core goods prices are possibly bottoming out as seen with the rise in used car prices and stability in apparel, to name a few key items. While bond yields are lower in response because of some short covering with no surprise in the data, and the S&P futures are popping higher, inflation breakevens are slightly higher.

As for the Fed, one of the main themes Jay Powell gave us before September as underpinning his desire to cut rates this year was his confidence in both the trajectory of inflation and the sustainability of keeping it low. How can he right now have much confidence in this that would lead to another cut next week?

Billionaire Pierre Lassonde – Gold & Silver Will Soar In 2025!

To listen to legend Pierre Lassonde discuss how you can become rich investing in 2025, what he is buying right now with his own money, what people should be buying with their money, what to expect from gold, silver, miners and crypto in 2025 and beyond CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.