Global interest rates are surging again and it is impacting world markets.

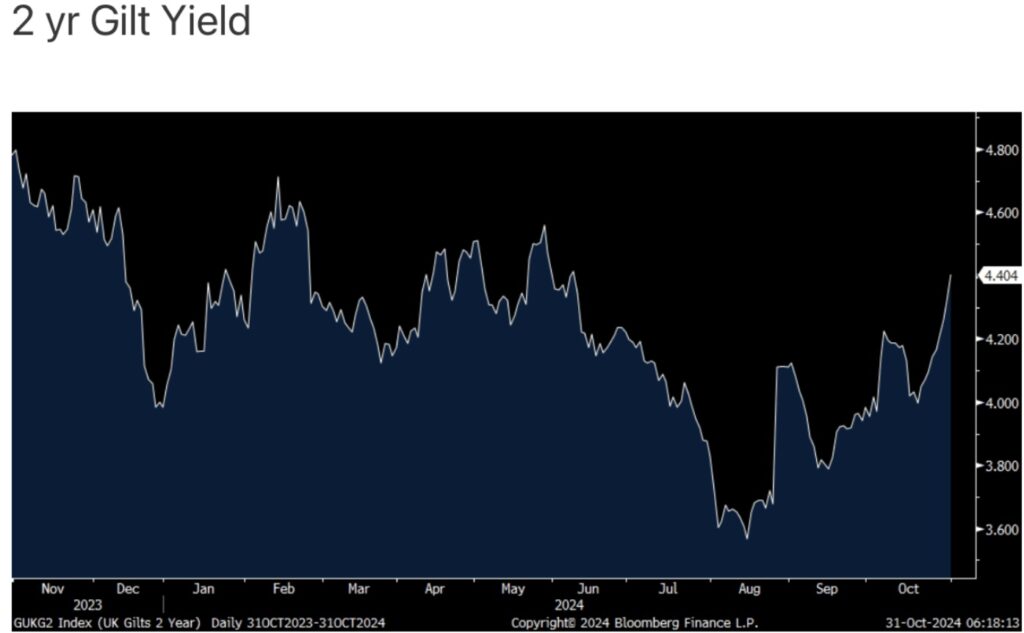

October 31 (King World News) – Peter Boockvar: Do debts and deficits matter now we all continue to debate? Looking at the UK gilt market in light of the UK government’s new budget and the need for more debt issuance is highlighting that it is not just a question for the US government but one for others too. The 2 yr gilt yield is up for the 9th day in a row to 4.40% which is the highest since June.

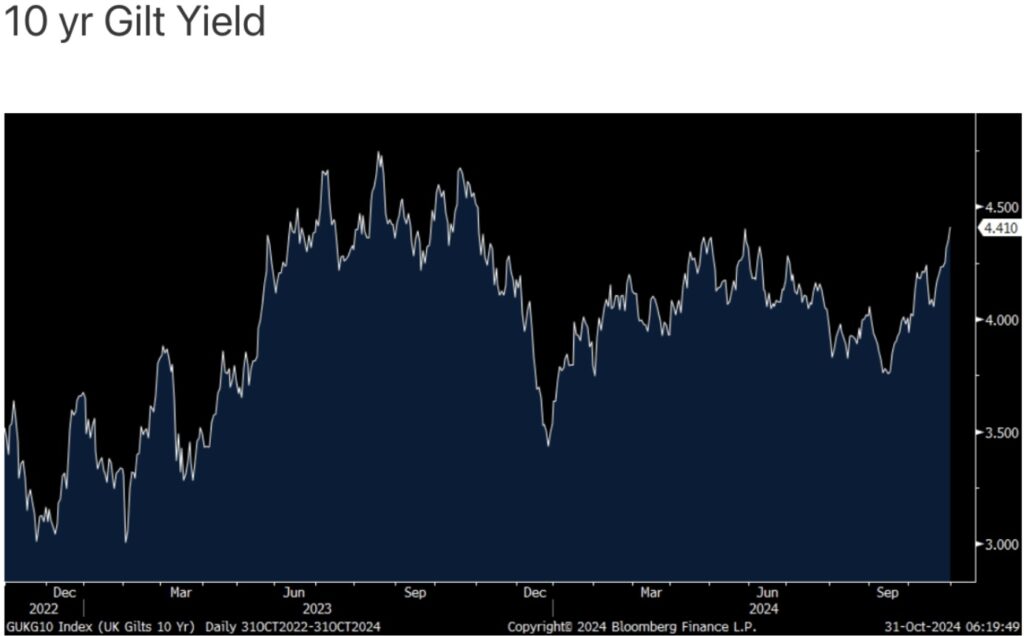

What is most interesting about that move is that part of the yield curve should be tied to expectations for BoE policy, not as much market driven as the long end is but maybe too much supply finally matters regardless. The 10 yr yield is up for the 8th day in 9, by 6 bps to 4.41% and that is the highest level in one year.

I will argue again, we are in a bond bear market that didn’t just end in a few years after a 40 yr bull run. Debts and deficits now matter for those profligate governments, gold clearly reflects that, and we still prefer short duration bonds to longer duration bonds.

Speaking of profligate governments and an easy central bank, the BoJ held policy unchanged as fully expected but it sounded like Governor Ueda was greasing the wheels again for another rate increase. He said, “When we look at the latest Tokyo CPI data, there are signs the pass-through of rising wages on services prices is broadening. We’d like to scrutinize whether such broadening will happen at the nationwide level…Looking at domestic data, wages and prices are moving in line with our forecast. As for downside risks to the US and overseas economies, we’re seeing clouds clear a bit.”…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

When will they hike rates again? “As for the timing of the next rate hike, we have no preset idea. We will scrutinize data available at the time at each policy meeting, and update our view on the economy and outlook, in deciding policy.” So the economic comments hinted that they are getting ready again while this last comment was more vague.

The market’s response? JGB yields are actually little changed but the yen is stronger and the Nikkei fell .50%. Don’t stop watching what the BoJ will do because it influences bond markets around the world and they continue to trim QE as other central banks continue to shrink their balance sheets. The liquidity spigot is slowing.

Gold & Silver!

To listen to James Turk discuss how fortunes will be made in this gold bull market CLICK HERE OR ON THE IMAGE BELOW.

Gold & Silver!

To listen to Alasdair Macleod’s KWN audio interview that was just released CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.