It’s shocking what is happening with consumers across the globe. Take a look…

October 14 (King World News) – Peter Boockvar: I’ll start with China today. The two biggest pain points of their economy are the unwind of their epic residential real estate bubble and the excessive debts at the local government level. The NDRC (Nat’l Development and Reform Commission) press conference on Saturday focused on both with the continued goal of putting a floor under the former and helping relieve the financing pressures on the latter.

China’s Massive Savings

Also, there was more talk about giving local governments cheap financing to buy unsold properties that in turn can be rented out. What was not really discussed in detail was how to reinvigorate Chinese consumer spending. However, those looking for it via the hand out of checks was never going to get it. The Chinese consumer does not lack for savings. In fact, they have about $18 trillion of it. What they lack is confidence and hopefully a stabilization in the housing market, where much wealth is locked up in, will provide more of it.

Chinese stocks were mixed overnight with mainland trading higher but those in Hong Kong down. The offshore yuan is trading lower. Metals are mixed as iron ore is up while copper is down. We are sticking with the China/Asia related stocks we own, along with a variety of commodity related stocks.

Also out of China was softer than expected September trade data, particularly with exports. Loan data was about as expected. And lastly, both CPI and PPI came in lighter than expected. Deflation boogeyman is getting thrown around but at least for CPI flat pricing is a relief to many households and the definition of true price stability.

I probably get 5-10 private credit deal pitches emailed to me every day all with the same pitch. We’ll get you equity like returns at the top of the capital stack, senior secured and we’re filling the lending gaps left by the commercial banking sector. All sounds good for what is now a $1.5-$2 trillion market but a few things here. First, it is important to separate out the two forms of private credit. One focused on financing private equity deals and financial engineering. That incestuous relationship I have zero interest in investing in. The other, focused on direct lending to credits that need financing in lieu of commercial banks has more legitimacy I believe.

I bring this up because if there is one area of the financial system that reflects no monetary restrictiveness whatsoever is the money piling in to private credit and with no distinction between the different forms. And, the overflow of money is gotten so extreme, it is forcing private credit managers to invest in things they don’t really like, all because the money is there…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

If you didn’t see Friday’s Financial Times article titled “Debt resigned to backing private equity dividend recaps.” If there is one area of private credit financing that should stink to the investor it is funding a dividend payment from an already highly levered company on to its private equity backers who just piled more debt on to their portfolio company. https://www.ft.com/content/24a47b4b-760a-4882-b1d8-92e5fbcd855a

The article says “Fund managers are reluctantly buying up the debt being pumped out by companies to pay their private equity owners bumper dividends as a lack of new loan supply and low yields limits investors’ choice of other attractive investments.”

Here was an example cited, “Last month Belron Group, which owns car windscreen repair companies in the US and UK, launched a dividend recap in which it would raise 8.1bn pounds and pay a 4.4bn pound dividend in the largest such deal on record, according to PitchBook LCD. But even though the dividend nearly doubled Belron’s overall debt from less than 5bn pounds to almost 9bn pounds and led rating agencies Moody’s and S&P Global to downgrade Belron deep in to junk territory, the deal was still massively over subscribed – with demand more than 7 times higher than available debt.” Sheep being led to slaughter I say.

This is becoming a hugely important part of the financial plumbing to watch, especially if the Fed doesn’t end up cutting rates as much as the market anticipates and/or long rates continue higher.

By the way, the year end 2025 fed funds December contract is now yielding about 3.40%, exactly where the Fed’s September median dot plot stands. That December pricing got as low as 2.90% right before the September jobs report.

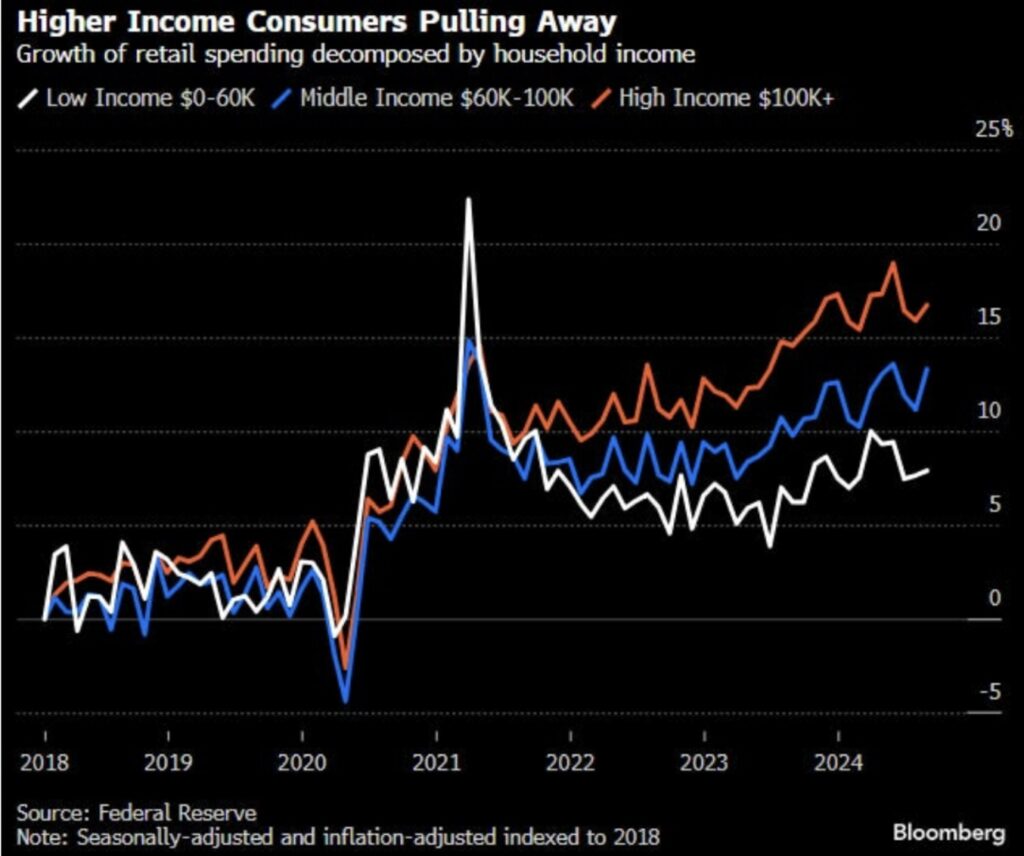

Before I get to the important bank earnings comments from Friday’s call, this was a great chart I saw in a Bloomberg News article visualizing the bifurcated nature of the US consumer as it segments the spending growth rate by income categories. Painting a broad brush on whether the economy is strong, weak, or whatever, needs some under the hood understanding of its drivers.

JP Morgan:

Capital market activity led the growth and net interest income was above the previously lowered guidance. “In the middle market and large corporate client segments, we continue to see softness in both new loan demand and revolver utilization, in part due to client’s access to receptive capital markets.”

To a question on how they will further deploy a lot of their excess capital, Jamie Dimon said “cash is a very valuable asset sometimes in a turbulent world. And you see my friend Warren Buffett stockpiling cash right now. I mean, people should be a little more thoughtful about how we’re trying to navigate in this world and grow for the long term for our company.”

To a question of whether the Fed rate cut and interest rate drop prior to it has generated any further interest in client borrowings? “we did see, for example, a pickup in mortgage applications and a tiny bit of pickup in refi. In our multifamily lending business, there might be some hints of more activity there. But these cuts were very heavily priced, right? The curve has been inverted for a long time, so to a large degree, this is expected. So, it’s not obvious to me that you should expect immediate dramatic reactions, and that’s not really what we’re seeing.” What companies are taking advantage of are the capital markets, if they have access to it, as they are “wide open” said Dimon.

U.S. MASSIVE CONSUMER SPENDING:

On the consumer, this was from the CFO:

“So I think what there is to say about consumer spend is a little bit boring in a sense because what’s happened is that it’s become normal. I mean, I think we’re getting to the point where it no longer makes sense to talk about the pandemic. But maybe one last time, one of the things that you had was that heavy rotation into T&E (travel and entertainment) as people did a lot of traveling and they booked cruises that they hadn’t done before and everyone was going out to dinner a lot, whatever.”

Highest Income Earners (ORANGE LINE) Spending At Historically High Pace!

And more, “So you had the big spike in T&E, the big rotation into discretionary spending. And that’s now normalized. And you would normally think that rotation out of discretionary into non-discretionary would be a sign of consumers battening down the hatches and getting ready for a much worse environment. But given the levels that it started from, what we see it as is actually like normalization. And inside that data, we’re not seeing weakening, for example, in retail spending.”

Lastly, “So, overall, we see the spending patterns as being sort of solid and consistent with the narrative that the consumer is on solid footing and consistent with the strong labor market, and the current central case of a kind of no landing scenario economically. But you know, obviously, as we always point out, that’s one scenario and there are many other scenarios.”

Egon von Greyerz’s Stunning Prediction For The Price Of Gold

***To listen to one of Egon von Greyerz’s most powerful audio interviews ever where he makes a stunning prediction for the price of gold, and discusses what every investor must know heading into 2025 CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.