Gold’s 3rd bull market will usher in a new global monetary system. Plus expect more Fed rate cuts.

Fed To Do More Rate Cuts

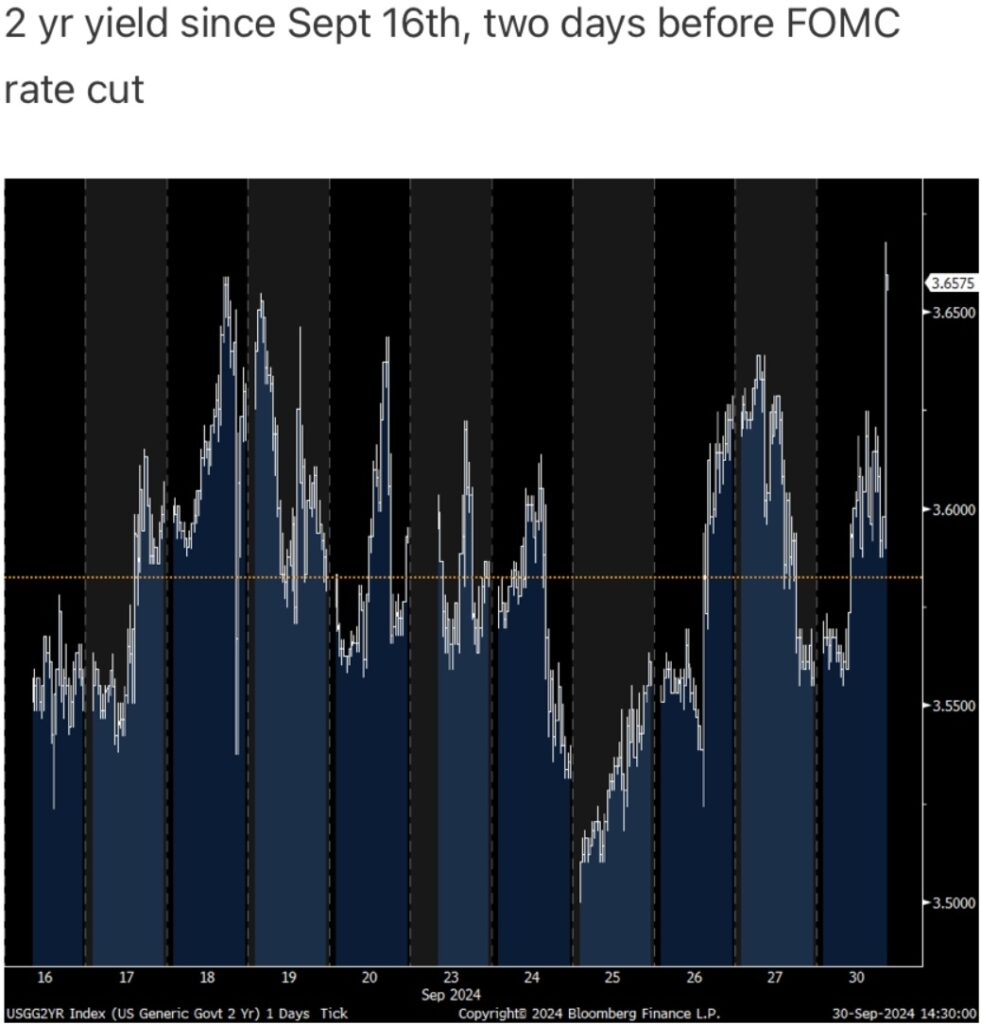

October 1 (King World News) – Peter Boockvar: With Jay Powell at the NABE coffee talk saying that under his base case the Fed will cut two more times this year, 25 bps at each of the remaining two this year but cuts past this will play out over time and they aren’t looking to rush them from here as they are not on any pre-set course, the 2 yr yield is now above where it stood on September 17th, the day before the 50 bps cut, rising by 10 bps today. The 10 yr yield is back to 3.80%.

Bottom Line

Bottom line, the market has priced in so many rate cuts with a 2025 year end fed funds rate at 2.85% as of Friday’s close (and today rising to 2.95%) and while it still might happen, his comments are not matching up with those expectations under his base case. Also note, while the dots are what they are, the median dot is at 3.40% by yr end 2025, also not, as of now, matching those market expectations…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

Gold

Graddhy out of Sweden: I noted gold’s historical breakout 9 months ago. We are on our way for the 3rd bull move.

Gold’s 3rd Bull Market Will Usher In A New Global Monetary System

So it begins. Always know the very big picture.

GOLD & SILVER: Just Released!

***To listen to Alasdair Macleod discuss the stunning things taking place behind the scenes in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.