Investors should expect a big bear market in stocks. How will this impact gold? Take a look…

Expect A Big Bear Market In Stocks

September 26 (King World News) – Alasdair Macleod: US equity markets seem ripe for a significant pullback, or even a severe bear market, with bond yields unlikely to fall much before rising again. If so, how will it play out for gold?

The Fed’s 50 basis point cut in its fund rate was more than expected, other than by optimistic equity bulls. But realistically, it means that in the absence of solid statistical information that the US economy is entering a slump, there are unlikely to be further significant cuts in the foreseeable future. Additionally, there are signs that US Treasury yields along the curve are unlikely to fall much from recent lows and could even be turning higher. This would be consistent with a growing funding crisis, which so far has not tested demand for longer maturities other than from US pension funds.

Consequently, the US Government’s debt profile has been shortening. It is not for nothing that the Treasury has been paying higher rates by issuing T-bills of up to one-year maturity. The cut in the Fed’s rates lowers T-bill discount rates, and perhaps that was an objective. But it confirms that not taking advantage of lower yield maturities out along the yield curve for funding makes them artificial, temporarily suppressed by minimal debt funding supply. Whatever the short-term outlook for them, they should be higher.

The biggest myth in markets is that inflation is diminishing as a problem and that the outlook for interest rates is therefore to continue falling. This belief is fuelled by relatively recent experience, whereby suppressed rates persisted seemingly without inflationary consequences for a prolonged period. Furthermore, bond market bulls grab every piece of statistical evidence to interpret a risk of recession unless rates are lowered.

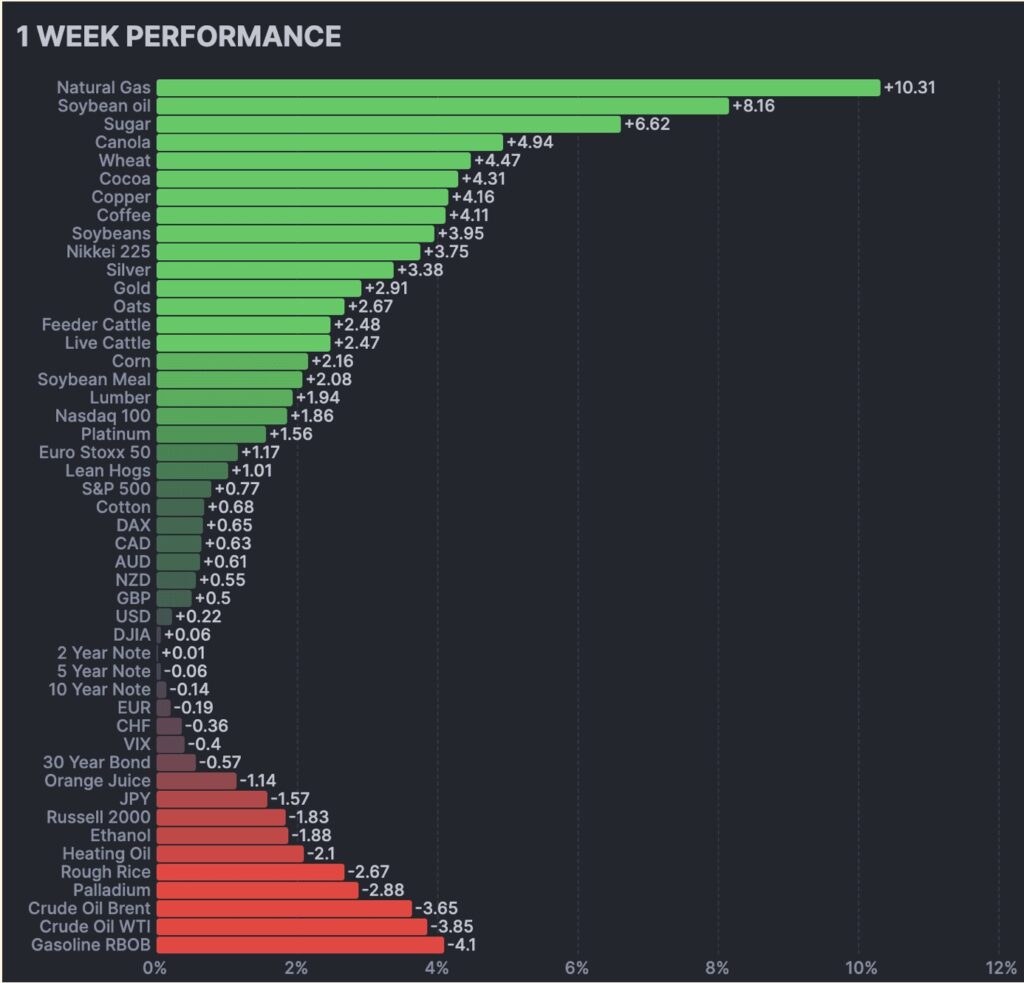

However, by cutting the funds rate by 0.5% the Fed has signalled it has demoted inflation’s priority, even abandoning it in favour of sustaining economic activity, and keeping the equity bubble from deflating. Market responses were immediate, with gold, oil, copper, and many other commodities soaring. The chart below from Finviz.com shows how commodities have risen priced in dollars in only the last week.

When almost the entire commodity complex shifts to higher dollar prices, read correctly it is a decline in the dollar’s purchasing power for commodities.

How Will The Bear Market In Stocks Impact Gold?

King World News note: As commodity prices boom, feeding into inflation, this will be yet another bull catalyst for the gold bull market. Also, as the bear market begins to take hold of the stock market, large amounts of money will begin to rotate out of the general stock and into gold and gold equities. This will create a boom as well for silver and the underlying companies that mine that metal. It is also important to note that a bid will begin to enter the high-quality junior exploration stocks. This will help to ignite many of those names that haven’t yet participated in the bull market in gold and silver…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

CALL TO OFFICE: Remote Work Ending For Many

Gerald Celente: Seventy-nine percent of CEOs told KPMG’s 2024 CEO Outlook Survey that remote work will largely be over within two years. Earlier this year, only 34 percent held the view that “corporate employees whose roles were traditionally based in-office” will be back five days a week.

“CEOs increasingly favor a comprehensive return-to-office but the need for flexibility still holds,” Paul Knopp, KPMG U.S. Chair and CEO, said in a statement announcing the survey’s findings.

Last week, Amazon mandated that all office employees be in the office every workday starting on 2 January, saying that bringing workers together every day will strengthen company culture and boost efficiency.

Amazon has been in a tug-of-war with its office staff over the issue. It directed all employees back to the office at least once in the past but large numbers of workers defied the dictate.

Many still do, saying Amazon’s new directive is short-sighted and a morale buster. “I’d rather go back to school,” one worker grumbled to Reuters.

And as for going back to work full-time, according to Kastle Systems, the office occupancy rate in the U.S. is only at 51.9 percent.

TREND FORECAST:

As noted by Flex Index, so far this year, only 33 percent of all U.S. firms demand that employees must come to the office five days a week, and in the tech sector with companies employing over 1,000 workers, just 7 percent demand that they work full time.

Thus, the financial damage to the commercial office building sector is real and lasting.

This was a headline article in today’s Pittsburgh Post-Gazette:

No relief: Pittsburgh office market continues to struggle with high vacancy rates and little rent growth, report finds

Pittsburgh’s office market is in recession, plagued by increasing vacancy rates, low to negative rent growth, and low to moderate new construction, according to one national real estate appraisal firm.

But the Steel City is far from alone in such struggles.

In its mid-year commercial real estate report, Integra Realty Resources listed office markets in 39 cities across the U.S. as in recession, including New York, Chicago, San Francisco, Philadelphia, Cincinnati, Cleveland, Boston and Los Angeles.

Yet, in the entire article, as with all of the mainstream media, not a peep about how there will be massive defaults on office building loans that will cause Banks to Go Bust.

TREND FORECAST:

Again, as we detail with the factual data, bosses are reclaiming their power to dictate terms. When they tried to do that in the past, they largely failed. Now they will succeed, but only partially.

Enough workers will continue to resist that employers will need to find a balance between productivity and innovation on one hand and employee morale and retention on the other.

Bottom line: remote work will endure but less widely.

Any uptick in workers returning to central offices will buoy the office real estate market, which has been in a tailspin since the beginning of the COVID War.

However, companies expanding their office footprint will do so in newer buildings. A significant portion of the nation’s office blocks—as much as 25 percent, by some estimates—will remain empty or only partially leased, will continue to be unprofitable for their owners, and eventually will be abandoned or foreclosed.

One Of The Most Important Interviews Of 2024

To listen to one of Michael Oliver’s most important interviews of 2024 where he issues a major crash warning for the US stock market and discusses what will happen with gold and the rest of global markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.