Take a look at which major economy just rolled over, plus another surprise.

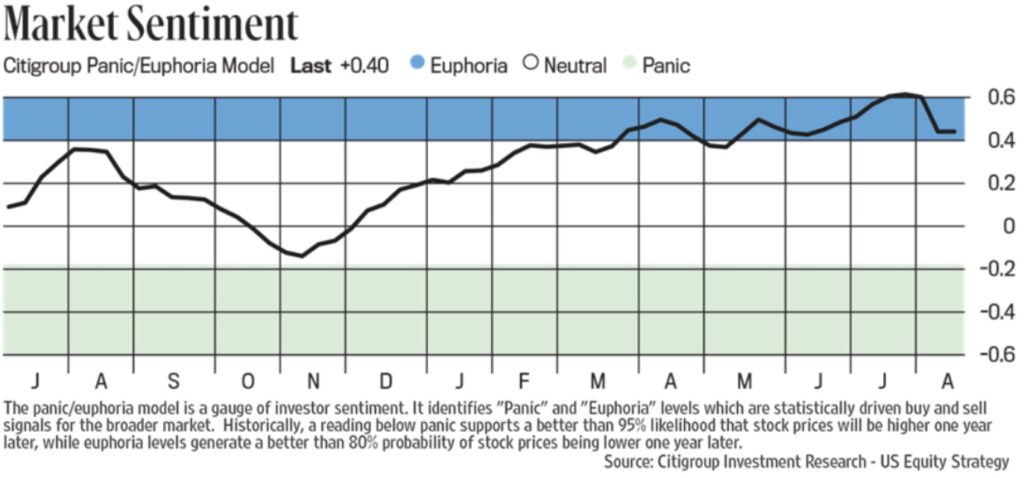

August 13 (King World News) – Peter Boockvar: As seen last Wednesday with the cooling of the extreme bullish sentiment, as it ALWAYS follows price, in the weekly Investors Intelligence survey, the Citi Panic/Euphoria index seen over the weekend did as well but still remains a touch in Euphoria territory. The extreme market positivity seen in early July was the perfect set up for a market pullback and the easing of that bullishness was needed.

Investors Remain Euphoric On The Stock Market

Digging into yesterday’s NY Fed’s Consumer Expectations survey for July saw one year inflation expectations stay unchanged at 3%. The 5 yr guess was unchanged too at 2.8% but for some reason the middle 3 yr guess fell .6 percentage points to 2.3% which was the lowest since they have data back to 2013. I can’t explain why the one and five yr forecasts were unchanged and the three fell so much but the NY Fed said “This decline was most pronounced for respondents with a high school education or less and those with annual household income under $50,000.” Expectations for gasoline and food declined but was up for medical care, college and rents. Home price growth guesses were unchanged.

13.3% Delinquencies

Here were other things of note. “Delinquency expectations increased, with the average perceived probability of missing a minimum debt payment over the next three months increasing by 1.0 percentage point to 13.3 percent, its highest level since April 2020.”…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

Expectations for a higher unemployment rate fell by 1 pt but expectations for income growth were down.

Also, “Median household spending growth expectations fell by 0.2 percentage point to 4.9%, the measure’s lowest reading since April 2021.”

On credit, “Perceptions of credit access compared to a year ago deteriorated in July, with the share of households reporting it is harder to obtain credit than one year ago increasing. However, expectations for future credit availability improved in July, with the share of respondents expecting it will be harder to obtain credit in the year-ahead decreasing.”

And highlighting the stress on lower income people, “The average perceived probability of missing a minimum debt payment over the next three months increased by 1.0 percentage point to 13.3%, the measure’s highest reading since April 2020. The increase was most pronounced for those with an annual income below $50,000 and those with a high school degree or less education.”

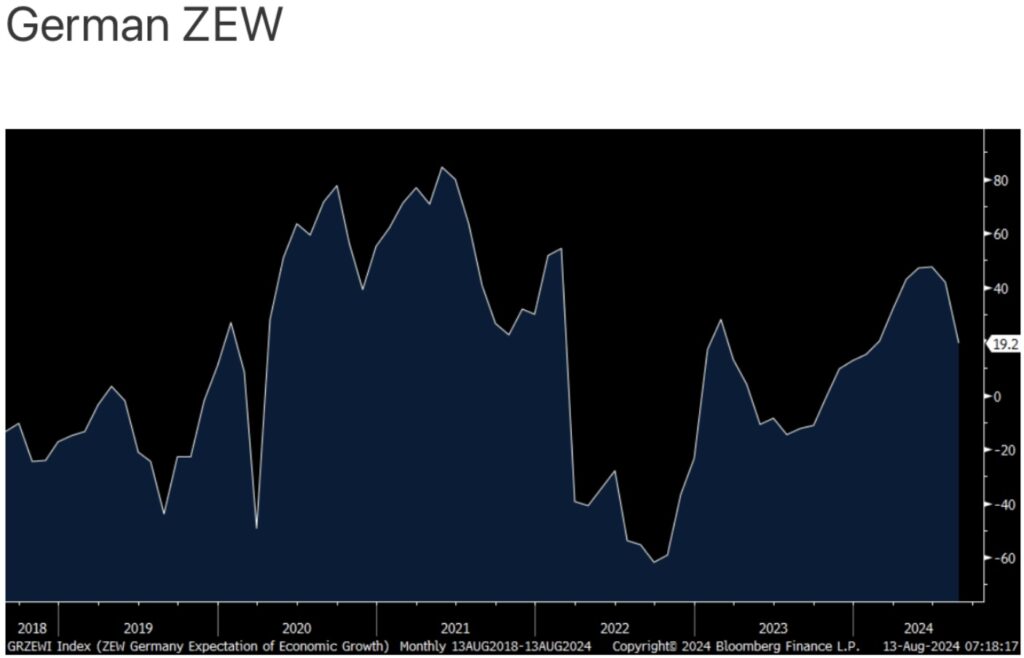

Meanwhile In Germany

In Europe, the August ZEW German investor confidence index in the German economy weakened a lot to 19.2 from 41.8 and that’s the lowest since January. The estimate was 34.

German Economy Rolling Over

“The Economic Outlook For Germany Is Breaking Down”

The Current Situation component was -77.3 vs -68.9. The ZEW said, “The economic outlook for Germany is breaking down…It is likely that economic expectations are still affected by high uncertainty, which is driven by ambiguous monetary policy, disappointing business data from the US economy and growing concerns over an escalation of the conflict in the Middle East. Most recently, this uncertainty expressed itself in a turmoil on international stock markets.” Notwithstanding the weak sentiment, this number is not market moving and the DAX is little changed as is the euro. Bund yields are down 2 bps. If there is an economy that needs an inventory restock it is Germany.

JUST RELEASED!

To listen to James Turk discuss the wild trading he expects to see in gold, silver, the mining stocks, the stock market and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.