Here is more proof that most people are broke, but look at this surprise…

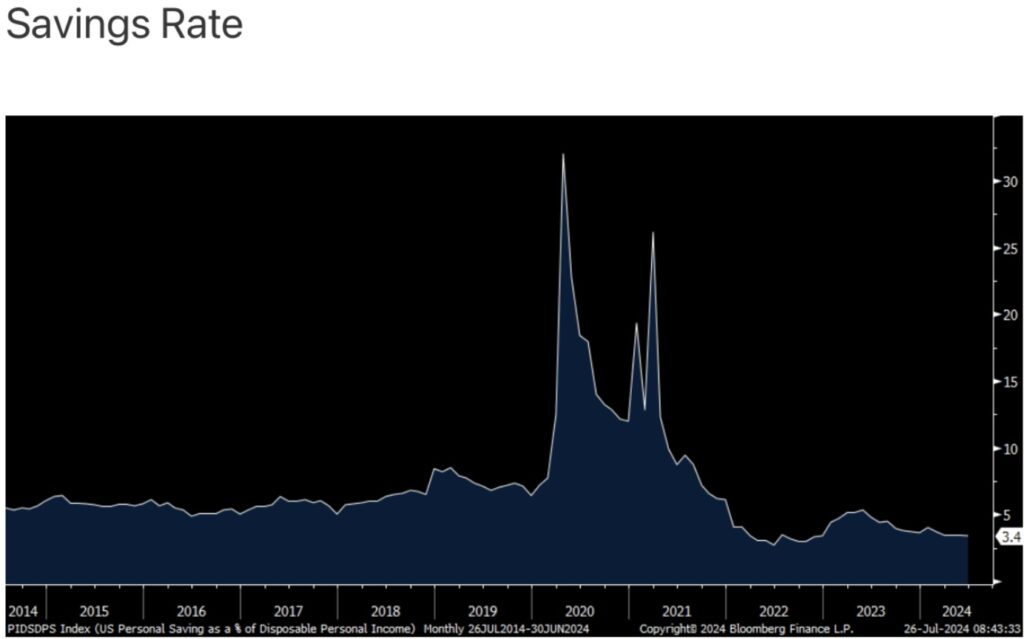

July 27 (King World News) – Peter Boockvar: With respect to the consumer, that savings rate drop points to little cushion and helps to explain why so many are price conscious and budget seeking, as we’ve heard countless times.

More Proof That Most People Are Broke

On the other hand, those that have savings are certainly enjoying getting paid well on it via higher interest rates. Ironically, many who have that savings don’t want the Fed to be cutting short term rates.

While the Fed has the data to cut rates next week, the market has already fully priced in two cuts this year already so it really doesn’t matter. The bottom line from here is whether we are going to see a rate tweaking cycle or a real rate cutting cycle, where the former would be driven by both moderating growth and inflation but with each still holding up or the latter which would be because the unemployment rate continues to inflect higher and disinflation really catches on. I expect a complicated middle where growth continues to slow, unemployment moves higher, and inflation remains stuck above 2%.

Cruise Control

From Royal Caribbean: “The demand and pricing environment remained very strong since the last earnings calls. Booking volumes were higher than the corresponding period in 2023 and at record pricing levels. The company continues to be in a record booked position for 2024 sailings. Consumer spending onboard, as well as pre-cruise purchases, continue to significantly exceed 2023 levels driven by greater participation at higher prices.” Just Released! To listen to Alasdair Macleod discuss the volatile trading in the gold and silver markets click here or on the image below.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.