On the heels of a rebound in stocks and the US dollar, it’s all about “extreme fear,” Investors Intelligence, the CRB and monetary madness.

“Extreme Fear, II, CRB & Monetary Madness

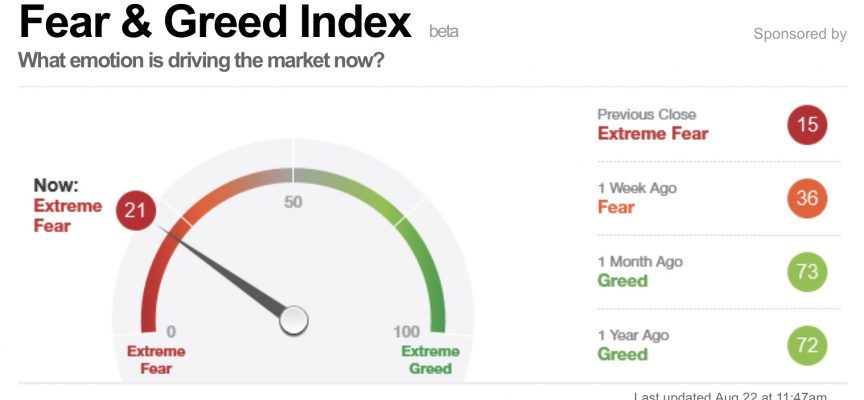

August 22 (King World News) – Here is what Peter Boockvar noted as the world awaits the next round of monetary madness: A day before we see the weekly II data, the CNN Fear/Greed index closed at just 15 yesterday (Extreme Fear according to CNN) vs 17 on Friday, 36 one week ago and vs 73 one month ago.

CNN Fear & Greed Index Showing “Extreme Fear”

With II (Investors Intelligence), twice this year when Bulls reached 60 the market cooled off and the same thing has certainly happened again. Thus, from strictly a sentiment standpoint, we might have gotten a bit overdone on the downside in the very short term. I emphasize ‘short term.’ It’s quite amazing that just a 2.5% fall from the intraday peak on August 8th to yesterday has led to ‘Extreme Fear.’ It’s comical. Maybe it’s the behavior of the broader market that has some worried as less than half (49%) of NYSE stocks are now trading above their 200 day moving average. That’s the smallest amount since before the election on November 4th when it was at 48%. If you are just looking at the DJIA, SPX and NDX for your full market picture, you aren’t looking deep enough…

IMPORTANT…

To find out which junior a leader in the gold mining

industry just bought a 20% stake in CLICK HERE OR BELOW:

Copper prices just keep on moving on with another 2/3 of a percent rally after yesterday’s 1.4% jump. Go back almost 3 years to see it costing more than $3 per pound. In light of this move higher in the metals, everyone is scrambling for demand side confirmation but if one is not looking at what has happened to the supply over the past two years, they are not getting the full picture. Starting in early 2016 there has been a sharp decline in mining investment. And just recently with aluminum in particular, there has been a big decline in what China calls “illegal capacity.” Some of this has been offset by new smelters but the point is, there is excess capacity being taken out of the Chinese metal markets. I’ll post again this chart in the CRB raw industrials index because it’s less than 1 pt from a 3 yr high just as everyone is now talking about slowing inflation (see chart below).

CRB Raw Industrial Index Just 1 Point From 3-Year High!

Maybe it’s due to the stronger euro in an export dependent economy or some recent softer than expected economic data or something else but investor expectations of the German economy in August fell to 10 from 17.5. That was 5 pts below expectations and the smallest print since October. Holding its own though was the viewpoint on the Current Situation which was 87.4 vs 86.4 in July. The ZEW said:

“The significant decrease of the ZEW economic sentiment indicator reflects the high degree of nervousness over the future path of growth in Germany. Both weaker than expected German exports as well as the widening scandal in the German automobile sector in particular have helped to contribute to this situation. Overall, the economic outlook still remains relatively stable at a fairly high level.”

While the euro is weaker on the day, back to $1.175ish, it’s been steadily declining all morning and well before the ZEW miss at 5am est. That weaker euro though is helping the DAX get back much of what it lost yesterday. As for business confidence data out of Germany, I prefer the IFO to the ZEW in its relevance.

The other data point of note in the UK was the CBI industrial orders figure which rose 3 pts m/o/m in August to 13 and that was 5 pts more than expected. This is the 2nd highest number since 1995 and while it’s a confidence figure, it is just another data point that shows the BoE estimates last summer from the Brexit impact were terribly wrong. The inflation component saw selling prices jump by 10 pts to 19, getting back almost all of the 14 pt fall in July. The CBI said:

“There are further signs that exporters are feeling the benefit from the lower pound in this month’s figure, and output growth is expected to power on over the coming quarter…But after a brief pause last month, expectations for selling prices have rebounded, indicating that the squeeze on consumers is set to persist.”

Notwithstanding the data beat, the pound is lower on broad US dollar strength today. We also know that the BoE is just completely paralyzed in its own mind over Brexit. I’ll say again, I’m just amazed at the lack of any dynamism within that institution in that after the UK economy has performed so much better than feared now a year after Brexit and the BoE can’t even find the will to at least take back the emergency rate cut that soon followed. Rate hike odds by year end are sitting at just 23%.

Who knows what he’ll say but BoJ Governor Haruhiko Kuroda has decided to take the flight to Jackson Hole this week to join his fellow interest rate planners. The BoJ of course is also in the equity business as a major holder of Japanese stocks due to the ‘portfolio balance channel’ theory which is another crackpot way of running monetary policy. As we await the appearances of Kuroda, Yellen and Draghi this week, just realize how so much monetary power has been given to them at the cost of a broken marketplace where true price discovery is specious. Three weeks ago the WSJ reported that “On average, $900mm of 10 yr Japanese government bonds was traded each day” in July. Compare this to about $75b-$90b of US Treasury’s “due in 7-11 years” that trade each day on average.

***To listen to the remarkable audio interview with Rick Rule that was just released CLICK HERE OR ON THE IMAGE BELOW.

***ALSO JUST RELEASED: Note On Industrial Metals & Silver, Plus Remarkable Charts Of Fed’s Balance Sheet, GDP, Inflation, Household Net Worth CLICK HERE.

© 2017 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.