Today the price of silver vaulted above $80 as gold surged to $4,500, but this is the shocker of the day.

Shocker Of The Day Is In The Silver Market

January 6 (King World News) – Otavio Costa: Silver prices continue to move yet speculative futures positioning remains close to two-year lows.

Regardless of how much you care about silver futures, but this is not evidence of an overheated asset.

KING WORLD NEWS NOTE: Silver Futures Positioning Close To Two Year Lows As Bull Market Continues To Climb A Wall Of Worry

Silver

Peter Schiff: Silver is back above $79. It’s only six days into the new year, and silver is already up more than 10%. Gold is up over $20 this morning too, trading above $4,470. Even though 2025 was the best year for precious metals since 1979, 2026 looks like it could be even better.

True Price Discovery

Otavio Costa: And this, my friends, is what price discovery looks like.

KING WORLD NEWS NOTE: Copper Melt-Up Just Beginning

In my view, we are experiencing one of the most important moves in copper prices in decades.

Game on.

Copper Bull Igniting

Peter Schiff: Copper is trading above $6 per pound for the first time ever. Both industrial and precious metals prices will soar in 2026 as a weak dollar and inflation propel prices to unprecedented heights. Metals are signaling that we’re on the cusp of the greatest inflation in U.S. history.

Silver Above $80

Peter Schiff: With silver above $80 and gold about to rise above $4,500, it’s really amazing how cheap precious metals mining stocks still are. In the very near future, investors will likely look back on today’s low prices and wonder why they didn’t take advantage of the obvious opportunity…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

BULLISH CONTRARIAN INDICATOR: Public Still Terrified To Buy Miners

Peter Schiff: What’s most unique about this precious metals bull market is that I doubt there has ever been one this big with investor enthusiasm this low. Individual demand for physical precious metals remains muted, and stock investors are too worried about a price decline to buy miners.

Why Do They Not Own Gold?

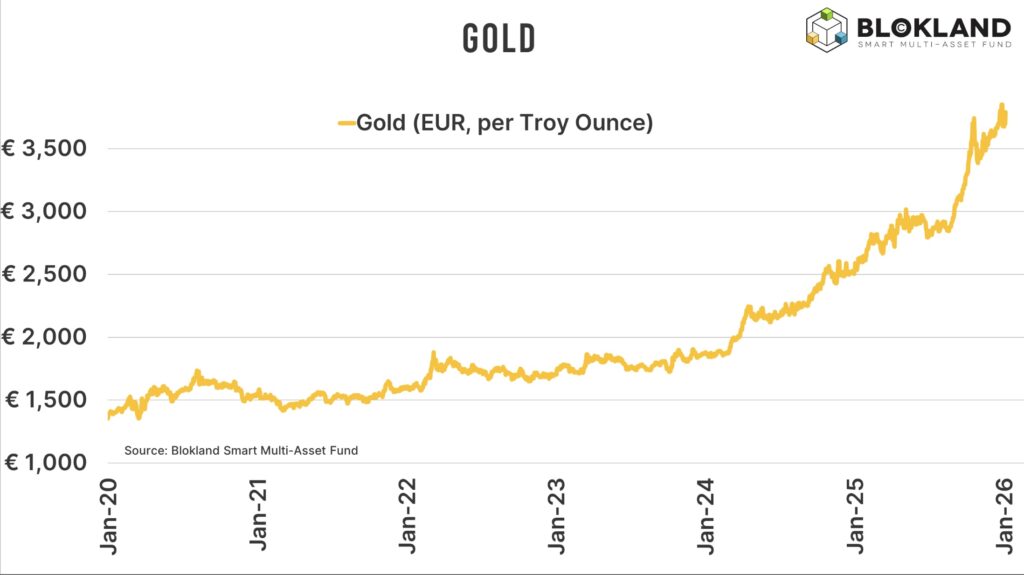

Jeroen Blokland: – The euro is not the currency of the world’s superpower

– The euro is not the global reserve currency

– The euro is the currency of a flawed regional experiment

– The euro is at the mercy of the region’s weakest link (currently, France)

– The euro is being printed at large to buy GDP growth

– The euro is vulnerable to inflation to deflate high debt levels

– The euro offers little return with still very low interest rates

Why do most Eurozone investors not invest in gold at all?

By the way, the same applies to many, many other countries and regions.

JUST RELEASED!

To listen to Alasdair Macleod discuss what to expect for gold, silver and the miners in 2026 CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

Silver Futures Surge Above $80, Plus This Major Bull Market Is About To Kickoff CLICK HERE.

This Man Predicted Silver Will Soar Above $100 In A Matter Of Months CLICK HERE.

It’s Not Just Gold & Silver Skyrocketing, The Stock Market Is Going To Crash CLICK HERE.

Silver Sparkles & Gold Shined In 2025 But Look At What’s Ahead In 2026 CLICK HERE.

Silver, And What Stood Out To Me The Past Two Weeks CLICK HERE.

Here Is The Remarkable Big Picture Setup For Gold As We Head Into 2026 CLICK HERE.

CNBC Antics About The Silver Market CLICK HERE.

Turnaround Tuesday As Silver & Gold Soar, But Take A Look At This… CLICK HERE.

Black Monday For Gold, Silver & Platinum Markets. Here Is Where Things Stand CLICK HERE.

Costa – Here Is The Big Picture After Silver & Gold Prices Tumble CLICK HERE.

Tavi Costa – What A Week As Silver Explodes To The Upside! CLICK HERE.

Historic Silver Short Squeeze Sends Price Soaring Over 7% On Friday! CLICK HERE.

An Astonishing Christmas Prediction From Legend Richard Russell CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.