More wisdom from Jesse Livermore and some key market notes on Friday the 13th.

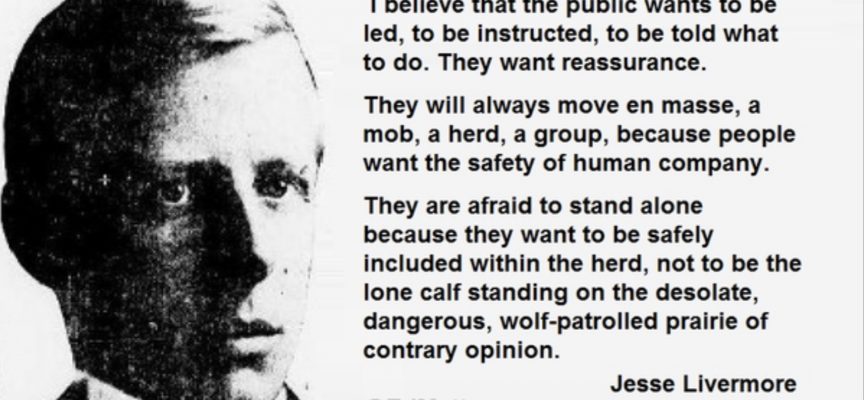

Some nuggets of wisdom from Jesse Livermore were passed along to KWN by Jeff Saut today:

“There were times when my plans went wrong and my stocks did not run true to form, but did the opposite of what they should have done if they had kept regard for precedent.” — Jesse Livermore (1877 – 1940), also known as the Boy Plunger and the Great Bear of Wall Street, was an American stock trader.

“There were times when my plans went wrong and my stocks did not run true to form, but did the opposite of what they should have done if they had kept regard for precedent.” So said Jesse Livermore, as chronicled in the brilliant book Reminiscences of a Stock Operator by Edwin Lefevre. Stock market historians will recall that Jesse Livermore is to this day still considered one of the most colorful stock market speculators of all time.

Livermore Was Actually Blamed For The 1907 & 1929 Stock Market Crashes

Livermore Was Actually Blamed For The 1907 & 1929 Stock Market Crashes

To be sure, the “boy plunger” was blamed for the market crashes of 1907 and 1929, as well as precipitating every market swoon from 1917 to 1940. Jesse’s investing success was driven by his ability to develop certain indicators, combined with an investing discipline that spawned such stock market axioms as:

1) fear your losses and let your profits run; 2) it was never my thinking that made me money, but my sitting tight; 3) markets are never wrong, opinions are; and 4) the tape knows all (for more rules see page 2).

Years ago I studied the tactics of Jesse Livermore, along with a number of other stock market operators, and have found many of those strategies to be just as valid today as they were decades ago.”

Also of importance…

A portion of today’s note from Art Cashin: Triskaidekaphobia (A Reprise) – It’s Friday the 13th and all of the negative myths surrounding it pop up. Friday the 13th actually has a mild upward bias in stock market history. It’s up 55% to 60% of the time. Those numbers get stood on their head if Friday the 13th falls in the month of November. In November, Friday the 13th has a 70% negative bias, falling a little under 1%

We think the overall negative myth may be based on a novel published back around 1910. It told of a plot by an evil stock trader (ain’t they all) to crash the market on Friday the 13th.

Prior to 1988, floor brokers used to have fun with the myth by declaring Friday the 13th “Hat Day”. Brokers would don silly and bizarre headgear pretending to ward off evil spirits.

It was colorful and a bit of fun. But, shortly after the 1987 crash, we had the biggest and maybe wildest “Hat Day” ever. Inspired by a sense of post-crash survival, it featured a parade on the floor and best in class awards.

Unfortunately, there was a newspaper “stringer” on the floor. He was doing an interview with a specialist who had gone out of business in the crash by making “too good a market”. The stringer would later sell a piece to the papers called “The Fat Cats In The Hats”. It was a caustic misrepresentation of Hat Day. We have not had one since.

Without the lucky charm of “Hat Day”, there were occasional problems. On Friday, October 13, 1989, the attempted leveraged buyout of UAL collapsed and the Dow plunged 190 points (equal to 1200 points today).

By a numerical oddity, the 13th of the month falls on a Friday more than any other day. In the last 400 years, we have had over 688 Friday the Thirteenths.

One last note on Friday the 13th. Triskaidekaphobia is actually fear of the number 13. Fear of Friday the 13th is actually Friggatriskaidekaphobia but that sounds like something that would cause your mom to give you an oral rinse with Lifebuoy. So, Dr. Donald Dossey coined the term paraskevidekatriaphobia. He says that by the time you manage to pronounce it, your phobia’s gone.

Overnight And Overseas – Late last night Kuroda spoke and said that Tokyo was prepared to intervene if the yen strengthen further. Counterintuitively, some reports indicate the yen rallied a bit after he spoke.

Asian markets moved lower with Tokyo getting clocked for the equivalent of 250 Dow points. Other markets were also hit but just a bit less severe.

In Europe stocks are also lower but more on the scale of a 125 point Dow drop. IMF joins the chorus warning on negatives in a Brexit vote.

The dollar firms against the Euro and gold inches higher. Crude dips down below $46. Treasury yields are down a smidge.

Consensus – Lots of speculation on this morning’s Retail Sales release. Futures trade a bit lowers perhaps responding to crude softness. Stick with the drill – stay wary, alert and very, very nimble. Have a wonderful weekend!

***KWN has now released the extraordinary audio interview with Bill Fleckenstein and you can access it by CLICKING HERE OR ON THE IMAGE BELOW.

***Also just released 50-Year Veteran – What’s Next After Massive Gold & Silver Shorting By Bullion Banks? CLICK HERE.

© 2015 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.