As we approach the end of August in what has been a wild summer of trading in the gold and silver markets, today a legend in the business sent King World News a powerful piece about central banks heading toward trouble as gold is headed to $1,600 but here is the big surprise from China.

Gold’s Surge To $1,600

By John Ing, Maison Placements

August 25 (King World News) – In the ultimate reality show, America’s political scene has become a reality drama and to no surprise, reality TV star Donald Trump has capitalized on the public frustration, however his solution, is to build a wall. Ironically, Mr. Trump is viewed as the candidate representing change and Hillary Clinton does not. Despite behind in the polls, Mr. Trump may still win. Although if he can’t build a “coalition of the willing” within his own party, how is he going to unify a divided America?

Brexit illustrated that anger and the fickleness for change can alter the status quo, no matter the economic cost. Life here seems to be mimicking art. Indeed while it was outlandish six months ago to expect Mr. Trump to win the nomination of his party, here he is in a fight to become president of the greatest country in the world. And along the way there have been accusations that Mr. Trump and his buddy Russian President Vladimir Putin are intertwined as in a John le Carré novel. We just don’t know who’s a bad guy or who’s a good guy.

Meantime, the internal turmoil in Trump’s campaign and the almost takeover of the Democratic Party by Bernie Sanders has left a foul aftertaste in both camps. When both Trump and Sanders complained that the system was “rigged”, everyone thought the accusations were ridiculous.

However, after the embarrassing release of the Democratic party’s 22,000 emails by an unknown whistleblower, the system was indeed rigged in Clinton’s favor. Wikileak’s Assange even posted a reward for information on the 27 year old Democratic staffer who was recently shot and may well have been the whistleblower. John le Carré couldn’t come up with a better plot. Question, does it have a happy ending?

The Least Ugly Duckling

Unfortunately this US election is being fought with the least ugly duckling, the likely winner. Polls show neither candidate is popular. Hillary Clinton is making much of her experience and trust when that trustworthiness is being tested by a track record of ethical problems, ranging from Whitewater, Travelgate, to her own private email server and of course the usage of the Clinton foundation as a funding mechanism. Hillary is actually running against Hillary. Only Bernie Sanders emerged as the honest broker but so fed up with the process, he has gone back to the Senate to sit as an independent and, not as a Democrat.

And what about Mr. Trump’s bombastic promises and outrageous threats? Do we actually take seriously what a politician says during an election? Truth has been debased. Besides, no politician, it seems keeps their promises anymore. We do expect however they stop lying once elected. Sadly history shows that hasn’t happened, whether it’s over email servers, blurred redlines, $400 million “leverage” for hostage payments, Ryan Lochte’s sojourn or even the whereabouts of weapons of mass destruction. But politicians are far from alone. The US Bureau of Labor Statistics fabricates employment numbers, yet revises those numbers repeatedly. The widely followed Consumer Price Index excludes food and energy because they are too volatile, but instead is a deliberate attempt to mislead the public. Truth is obdurate. No wonder the cynicism.

There is no question that there will be a difference should Trump manage to get into power. Battered by the financial crisis and the slow recovery that followed, the US economy is slipping. America is not the financial superpower it once was and the dollar which has been the reserve currency for almost 100 years, is undermined by a debt load topping $20 trillion. No matter who wins, get ready for more government spending. Four times bankrupt, Trump plans infrastructure spending and tax cuts as a way to boost the economy and although contentious, trade and his stand on immigration has blurred his message. Mrs. Clinton’s view on the other hand seems to be the candidate for continuity, insufficient to lift the United States out of its debt trap.

Divided We Stand

Part of the problem is that President Obama’s legacy has left either Mr. Trump or Mrs. Clinton, the herculean challenge to clean-up a failing economy, a fractured Middle East, escalating terrorism and a runaway debt load. Not so easy. While Clinton is promising a better climate, she is also saddled with the realization that it’s a continuation of Obama’s policy who spent much of his Cleveland speech laying out his legacy, referring to himself 119 times, which must be some sort of endorsement record but short of the 144 times in his inaugural speech. And despite winning the Nobel Peace Prize in his first term, Obama’s legacy is that of the “war” president with a dubious record of fighting wars on several fronts, more than all the other presidents before him. Indeed, Hillary Clinton as Secretary of State supported the Iraq invasion and foreign policy initiatives which have been associated with a series of US international policy disasters.

Americans no longer feel confident that government can solve their problems with schisms along family, religious, income and especially trust in institutions. Simply the remedies offered were bogus. The rise of special interest groups has reduced the collective mindset to pandering to the tyranny of the minority. Instead of solutions, there is blame. If there’s unemployment that must be because of the “one percenters”. Or, if home buying is a problem, it must be because of Wall Street’s greed.

By pandering to the special interest groups or lobbyists, government thinks they have solved the problem. Wrong. The tendency to cater to the minority misses the point. The emergence and dissatisfaction of so many citizens is because they no longer believe they have a voice, and thus the electoral surprises of a Trump, or Brexit. The mainstream is frustrated with being fractionalized and no longer feels comfortable with the rhetoric of hope and change. They just want to be heard. This lack of trust in government, the economy and currencies has driven people to look for alternatives. The sad part of America’s election is that there must be a winner.

Mortgaging Tomorrow’s Future

Another problem is that for most of the century, central bankers were custodians of the value of currency but altered this role when they became handmaidens of the government after the financial crisis. The central banks’ orthodoxy created money in the form of quantitative easing (QE) and subsequently ultra-low interest rates (the lowest in 3,000 years) to fill the vacuum left by governments’ reluctance to use fiscal policy. When the smoke and mirrors clear: central banks have printed money in the form of deficit financing, funded by short-term borrowings. Significantly, neither US candidate has addressed this problem, nor the need for structural reform or bold fiscal policies or the need for Capital Hill’s cooperation. Instead, we have the name calling, media baiting and a war of words. The politics of division.

Meantime, to close yet another $500 billon plus budgetary gap this year, the Fed will issue $1 trillion in new debt. Both Clinton or Trump must deal with a federal debt that climbed from 39 percent in 2008 to over 100 percent of GDP today which excludes the 100 odd trillion dollars of unfunded liabilities like Social Security, Medicare and federal pensions. Americans long ago dropped spending and deficits as major concerns. Yet the deficits won’t vanish and the next president who tells us that the country can keep spending without a day of reckoning will signal the end of an era and imminent danger to the United States and the world.

And now because QE and negative rates have failed, there is talk of “helicopter spending”. Helicopter money is the ultimate monetary stimulus where the government prints money and drops cash from the skies on the theory that more money in circulation will chase fewer goods, which would revive prices and of course inflation. Helicopter spending is currently in Venezuela, Argentina, Nigeria and recently in Russia but before that, Weimar Germany in the early 1920s.

The subtle difference, with quantitative easing is that the Fed prints money, purchases bonds with that money hoping to inject liquidity into the system yet the bonds remain on the Fed’s balance sheet. In other words, while rates shriveled, the Fed’s balance sheet exploded. Yet after buying up this government debt, the Fed also purchased other asset-like mortgage backed paper as well as ETFs. Japan’s central bank today has become the largest player in the Japan market. The Swiss National Bank has purchased US equities. Central banks have become glorified hedge funds. Consequently the Fed’s balance sheet is the largest ever and the most leveraged, yet no one is talking how the Fed will exit or dispose trillions of these bonds. By borrowing from the future, governments are subsidizing today’s consumption, leaving tomorrow’s generation with the bill.

Spend More, Save Less

Another problem is that almost half of all Western debt is in negative territory. Credit has become free. However, negative interest rates, bring negative returns. Negative rates have so far propped up real estate and stock markets because the cost of carry is near zero. Corporate America also used much of this largesse to buyback shares instead of financing growth. But negative rates also hurt savers and pensioners and by slashing rates to record lows, the strain on the financial system has escalated, particularly affecting some $35 trillion of savings and pensions.

And rather than spark growth, negative rates seem to reflect fear, encouraging investors and corporations to adopt a more defensive investment stance, building up cash and savings. Negative rates was last seen in the Depression and a prelude of bad things to come. Further, the traditional spread between dividends and bonds has been altered in this topsy-turvy world of central bank alchemy. Dividends in the nifty fifties were higher than bonds reflecting risk. However in the seventies, inflation hit double digit levels and subsequently bond yields reflected the inflation risk and were higher than dividends. Today these spreads have been tossed aside.

In flooding the world with dollars, the rest of the world has pursued monetary ease to keep their currencies from rising, resulting in a competitive devaluation race to the bottom. In 1971, President Nixon took the United States off the gold standard to end a currency war. Today, ironically the return to a gold standard is needed to end this current stealth currency war. The US has been living beyond its means for over half a century. Our politicians and the current two candidates are all glibly questioning globalization and urging financial protectionism. Protectionism in the guise of economic patriotism is still as Samuel Johnson famously opined in 1775 on patriotism, “the last refuge of a scoundrel”. Gold which has already gone up 27 percent will be a good thing to have. This bizarre world could be another John le Carré plotline.

The Horses Have Already Left the Barn

There are side effects though. Some believe that the market must be expecting deflation. Investors historically expected a two percent real rate of return but today with a 50 basis point negative yield on bonds, it implies that the market expects a deflation rate of 2.5 percent. There is a mismatch. Deflation of this magnitude would be disastrous for the economy and profits. And what would happen if rather than deflation, instead we had inflation, then the results would be equally as disastrous. We believe that ultimately there will be an inflationary outcome, particularly since some $7 trillion has been injected into the system.

Both candidates want to reintroduce the Glass Steagall act of 1933 that separated commercial banking from investment banking. Ironically this act was repealed by Mrs. Clinton’s husband in 1999 and is considered one of the main reasons behind the collapse in 2008. Unfortunately history shows that it was not the Glass-Steagall act which was the problem, but it was the Fed’s intervention that fueled the housing boom, creating billions of liquidity which resulted in overleverage and, the collapse.

Stuffed with bad mortgage bets, Fannie Mae and Freddy Mac, two government owned institutions required bailouts and are much larger today and able to make more bad debt decisions. Lost on everyone, was that the traditional banking sector did not require these big bailouts. It was those big mortgage providers, AIG and brokers Merrill Lynch, Lehman Brothers and Bear Stearns which created and distributed the risky securitization products. In the aftermath, government introduced reform bills like the Dodd-Frank Act to prevent commercial banks from trading in risky activities yet today both Citigroup and Deutsche Bank are bigger derivative players, placing again , the system at risk. Déjà vu.

Lies, Lies and More Lies

So what can be done? It is essential to curb our spending ways. Central banks have become the grandees for governments, accommodating their deficit funding with short term borrowings and radical monetary experiments, creating an artificially priced financial market. They must return to become custodians of our currency. Today that means repairing balance sheets by deleveraging including their own and encourage, not stifle growth.

Second, kickstart capitalism. Low productivity over a longer period than any time since the war is unfortunately a fundamental fact of life. Layers and layers of regulation have crippled the financial industry – there is a bull market, in lawyers. The financial market is also undermined by too much debt because governments eliminated moral hazard. Bring back risk and reward.

Third, focus on merging the “haves” developed world economies with the goals of the “have nots” emerging economies. Taxation issues, currencies and open trade links are a way to develop cooperation, not walls.

Above all, to encourage growth and increase productivity capacity, restore confidence in money by linking money to gold to create faith in currencies as it was until Nixon stopped converting dollars to gold in 1971. The gold price rose from $35 an ounce to more than $800 in the next decade. Fiat currencies had their day for much of this century and as a result we suffered a never-ending series of world economic calamities. A gold standard would prevent central bank fiddling. The last time we were on a gold standard, it lasted 500 years.

After a year of political and economic turmoil gold’s recent move shows investors are nervous. Quantitative easing, Brexit, zero interest rates are short term influences. They are an important message. The world has been losing confidence in the currencies issued by central banks. We are in uncharted territory. The United States has a serious problem as the world’s largest debtor and its finances are in shambles. Debt keeps piling up on more debt. Investors remain oblivious to the outcome. To be sure, the cure will be painful.

The supply and demand of the US dollar keeps growing. However, the dollar is undermined by America’s towering debt load and the Fed’s policy of printing dollars leaves the dollar only one way to go. We thus believe gold’s move will be the most important global movement of the decade. The unintended consequence of the central bankers’ unorthodox experimental monetary policies, will have a precarious drift towards global instability. Whilst stock markets post daily record highs, professional investors are becoming more defensive. Meantime the geo-political climate grows murkier and most leaders are up for elections, starting in November. France and Germany’s turn is next year. In October, Italy has an important referendum. Of concern is the overwhelming impression of the impotence of government.

As such, we believe gold is expected to continue to rise as long as the budget is in deficit, rates remain negative and Americans’ political scene remains dysfunctional. While gold is up 27 percent so far, it’s bull run has only just begun. Gold rose nearly 3,000 percent from 1971 to 1980 but is only up some 430 percent from its low in 2001. We thus believe gold will reach $2,200 per once within 18 months.

Conclusion

Gold is back in demand amid increasing concerns over the health of the global economy and the inability of the central banks to engineer much of a recovery. Higher gold prices are helping mines outperform gold providing about four times more leverage to the gold price. Gold shares have jumped almost 200 percent, while bullion has increased 27 percent since year-end. Gold miners have slashed costs, deferred projects and rebuilt balance sheets which expanded margins and at long last, free cash flow enabled them to reduce debt built up during the boom times.

The Big Surprise!

The Big Surprise!

Gold miners are finally making money. The new reality has helped Barrick which led the industry in reducing costs, focusing on profitability. Barrick also slashed its debt load, focusing on developing the world’s largest in situ gold reserves of 90+ million ounces. Newmont paid down debt. We believe the major asset of the gold miners is their in-situ gold reserves.

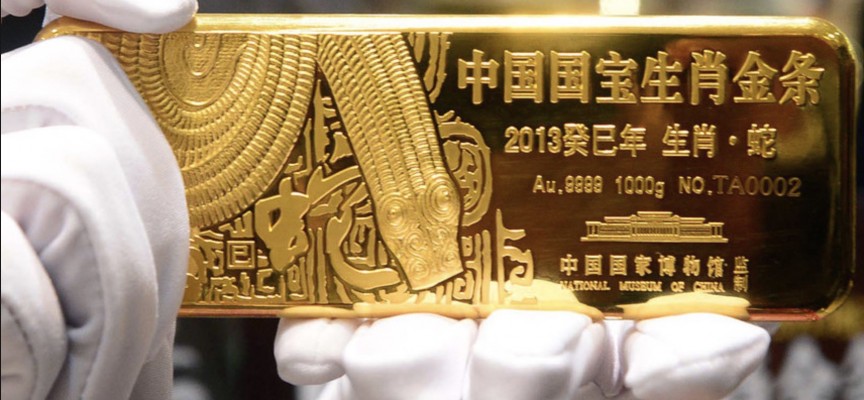

But An Even Bigger Surprise From China

But An Even Bigger Surprise From China

North American gold miners have more than 15 years of reserve life which is in sharp contrast to the world’s largest producer, China, whose gold mines will run out of reserves in a few years…

IMPORTANT:

To find out which high-grade silver mining company billionaire Eric Sprott just purchased

a nearly 20% stake in and learn why he believes this is one of the most

exciting silver stories in the world – CLICK HERE OR BELOW:

The dilemma for the mining industry is that the lack of exploration spending has caused a dearth of mine projects to replace declining reserves. Last year all but two mines saw a reduction in reserves. For spending to increase, in our opinion we will need a $1,600 gold price. Gold miners are undervalued.

We thus believe we are at the beginning of the second leg of gold’s bull market. The current rally sparked by negative interest rates will likely see $1,400 per ounce near-term and $1,600 per ounce the next interim target.

***KWN has now released the extraordinary audio interview with 50-year veteran John Embry, where he discusses the big picture in the gold and silver markets, the coming global financial carnage and much more, CLICK HERE OR ON THE IMAGE BELOW.

***Also just released: We Have Just Witnessed A Very Rare Event In The Gold Market CLICK HERE.

***KWN has now released the riveting audio interview with Egon von Greyerz CLICK HERE OR ON THE IMAGE BELOW.

© 2016 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.