On a day where gold and silver are once again surging to the upside, James Turk spoke with King World News about what is so unbelievable about today.

Is It This Easy To Predict The Gold Price?

James Turk: “I have an amusing story to tell, Eric. Anyone who trades gold will appreciate it. Earlier today when the Apr Comex gold contract was up 1% from Friday’s close, I sent a message on the internal Goldmoney system saying:

“Gold is up 1%, so the algos are out. With Comex option expiry tomorrow and OTC option expiry ending Thursday, we are probably at a short-term top for gold.”

Literally minutes later gold was hit by a wave of selling by these “algos.”…

Sponsored

I use this short-hand term for “algorithms,” which are a mathematically derived set of trading rules executed by computers.

We’ve all heard the news reports about high-frequency trading in the stock market, where trades are entered by computers based on mathematical models. These algos are not the same as high-frequency trading, but the principle is the same. They are both computer-based trades that originate from proprietary ‘black-boxes.’ They are trading models that are known only to their creators. But these two approaches to using computers to trade have entirely different objectives.

Unmasking The Con Artistry Of Central Banks

Unmasking The Con Artistry Of Central Banks

High-frequency traders are out to make a profit by scalping small margins that exist between buyers and sellers. But the objective of the algos that we see in the gold market is not focused on profit. The algos are instead focused on capping the gold price. And we saw clear evidence of that today. But here’s the important question: How did I know the algos had started when April Comex gold was up 1%?

Here Is How The Con Works…

Here Is How The Con Works…

It was not a good guess. Today was not a one-time event. This capping of the gold price has been going on for years. To my knowledge it was first discovered years ago by James McShirley. I had the good fortune in 2011 to meet James, who is an experienced commodity trader, and have been following his work since then. Seasoned commodity traders have a natural knack for picking up and recognizing recurring patterns as James has done with what he calls the “1% rule.” Namely, a rising gold price will be stopped on any day when the active Comex contract rises 1% from the previous day’s close.

There are exceptions, but the times that gold has been stopped for the day at a 1% price jump has far exceeded the exceptions over the years that I have been watching this rule being applied. Of course occasionally the algos get overrun because the buying is too intense, which I usually note occurs when the spread between spot gold and the active Comex contract becomes too backwardated. That by the way didn’t happen today. Spot was only 30-cents above the April contract for most of the day. It takes a bigger backwardation for the algos to say “enough is enough” and retreat to cap gold at higher price levels. They tend to “circle-the-wagons” at 1.5%, and if still overrun, again at 2%.

How Can Investors Take Advantage Of The Con?

How Can Investors Take Advantage Of The Con?

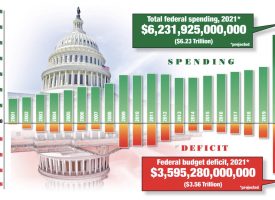

So the key takeaway from this discussion, Eric, is one with which we are already familiar: The gold market is rigged, but not by the profit-seeking high-frequency traders who focus their trading on shares. The gold market is rigged by entities seeking to cap the gold price. They are not seeking profit, and there is only one possibility of who falls into that group. Only central banks don’t care about making a trading profit. They don’t care if they end up losing money because if they do, they just print more money to cover their losses.

Central banks only have one objective. They want their currencies to look good relative to gold. Unfortunately, central banks no longer follow time-tested prudent central banking practices to manage a sound currency – as was the case during the classical gold standard era. Instead, they try to make their currencies look good by capping the gold price. Central banks recognize, as most of the world recognizes, that the gold price is the barometer that measures how well, or as has now been the case for decades, how poorly central banks are doing in preserving the purchasing power of the currency they issue.

So here is how investors can take advantage of the central bank con, Eric. Forget about what happens in the paper markets. Focus instead on physical gold, and in this regard, 2017 is shaping up to be a great year for gold, and the same thing can be said for silver as well. But the really great news is this: Because of the central bank con, the prices of both gold and silver are still remarkably undervalued. So all you have to do as an investor is to accumulate as much physical gold and silver as you can before the prices radically explode to the upside.”…To be one of the first people in the world to look at what the biggest money and sovereigns across the globe will use to maximize their investing returns CLICK HERE.

***To listen to the extraordinary KWN audio interview with legend Rob Arnott CLICKING HERE OR ON THE IMAGE BELOW.

***ALSO JUST RELEASED: Greyerz – Get Prepared, A Massive Global Collapse Is Coming CLICK HERE.

© 2017 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.