This was a wild week of trading in gold and silver, but look at this…

Nomi Prins audio interview to be released within hours. Until then…

December 20 (King World News) – Alasdair Macleod: Strong dollar and rising UST yields are destabilising GBP, EUR, JPY, and their bond markets. These are the precursor of a global debt crisis — the ideal setup for higher gold prices next year.

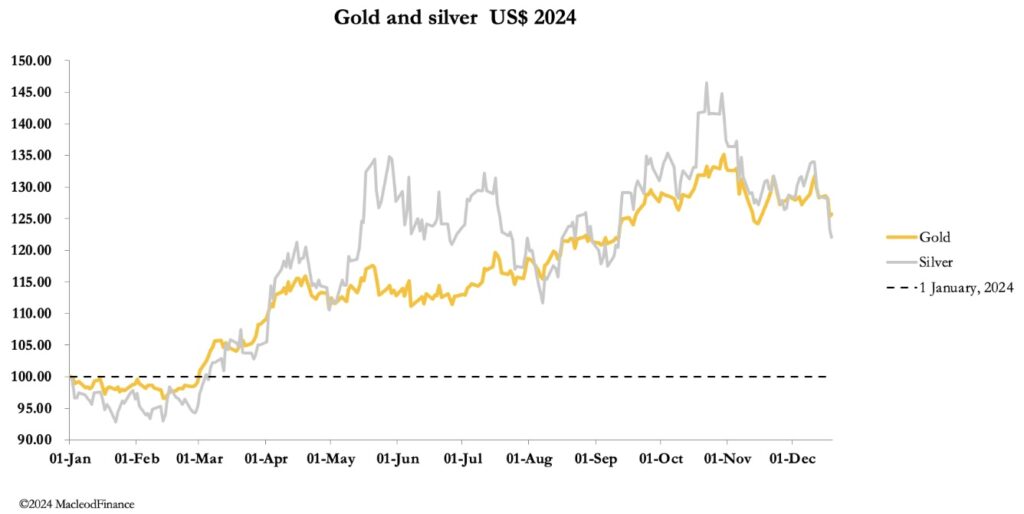

Gold and silver declined further this week, after Jay Powell’s comments having cut the Fed Funds rate by ¼% to 4.25%—4.50% range. In European trade this morning, gold was $2606, down $41 from last Friday’s close, and silver $28.90, down $1.65. Turnover in both Comex contracts was light in the week ahead of Christmas.

All eyes were on the Fed as Powell delivered the expected cut but downplayed the prospects for further interest rate cuts next year. He justified this by saying that he was optimistic about the economic outlook, and the economy is “… in a really good place. I expect another good year next year”.

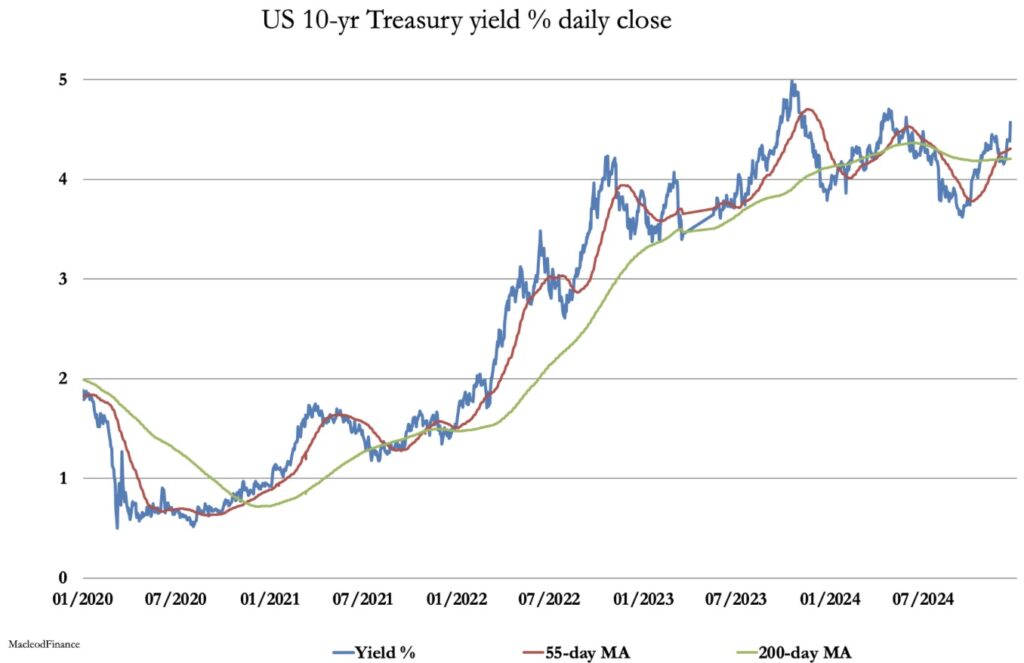

Consequently, the yields on US Treasuries rose towards the highest post-covid levels. The next chart is of the 10-year UST Note yield, which with a golden cross under the yield’s value indicates it has further to rise:

Macroeconomic opinion is that higher bond yields are bad for gold, which is why gold and silver were marked down. It is a myth borne out of the 1980—2000 carry trade whereby gold was leased at 1.5%, sold, and the proceeds invested in T-Bills. But the myth persists, and consequently hedge funds and others sell paper gold to buy dollars on an interest rate shock such as we saw this week.

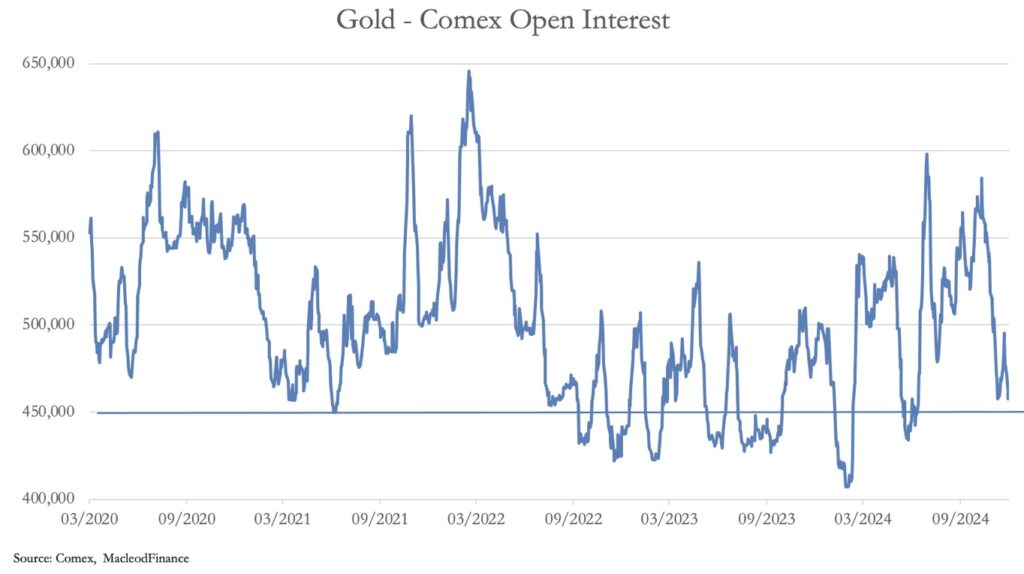

It may go further, because light trade in these thin markets reflects an absence of paper traders leading to volatility. Bullion banks with short positions will also want to see year-end mark-to-market values as low as possible. However, looking at Open Interest, we see that Comex futures are approaching oversold territory, which I take to be 450,000 contracts:

The problem for the shorts is that stands-for-delivery are draining the Comex establishment of bullion. In the fifteen sessions since Thanksgiving, over 75 tonnes of gold and 1,393 tonnes of silver have leeched out of its possession, not to mention the drain from Exchanges-for-Physical, whereby futures are swapped for forward positions in London. This may be arbitrage, but it almost certainly includes forward purchases for delivery and is a hidden demand factor.

In short, gold’s move down this week has the characteristics of a sell-off and a prelude to a bear squeeze in an increasingly tight market for next year. Central banks, wealth funds, and predominantly Asian sources trying to lighten up on western currencies continue to take all the bullion on offer. At the moment these forces are marginal ,driven by the largest buyers taking a view on credit which is yet to be adopted by a wider public, particularly in the western hemisphere.

Following Powell’s statement, the shift to higher dollar bond yields is having a profound effect on other currencies and bond markets. With its socialist government, Britain’s sterling and gilt market is particularly vulnerable. The next chart is of sterling, which is clearly bearish with a death cross forming and the value collapsing beneath:

Next is the ultra-long 2071 gilt, which echoes sterling’s bearishness pointing to significantly higher yields:

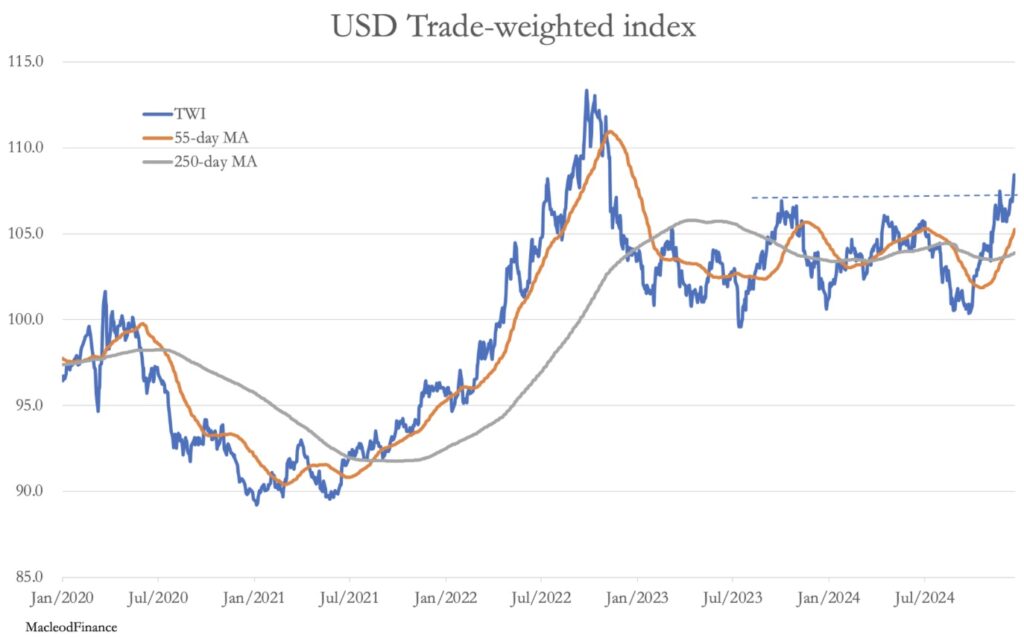

Similar cases can be made for Japan and the Eurozone. While the outlook for these currencies and their bonds is dire, the dollar has built on its post-election rally with the trade-weighted index looking bullish having broken out above resistance.

That the dollar’s TWI has further to go and with global markets unprepared for rising bond yields threaten multiple debt and credit crises elsewhere. When markets understand the implications for the entire fiat currency system, the move to get out of them into gold will gain momentum. In short, this is the ideal setup for a collapse of the currency/credit bubble and a substantial boost for gold. To listen to Alasdair Macleod discuss the wild trading in gold and silver this week, the Fed’s move to lower interest rates, have we hit bottom yet as we get ready to head into 2025 and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.