What a week for the gold, silver and mining share markets, but take a look at this…

Billionaire Pierre Lassonde’s audio interview has now been released! But first…

Will Silver Be Next?

May 17 (King World News) – Alasdair Macleod: There has been an enormous squeeze on the Comex copper contract, driving it to unheard of premiums against London and Shanghai. Similar conditions could be ahead for silver.

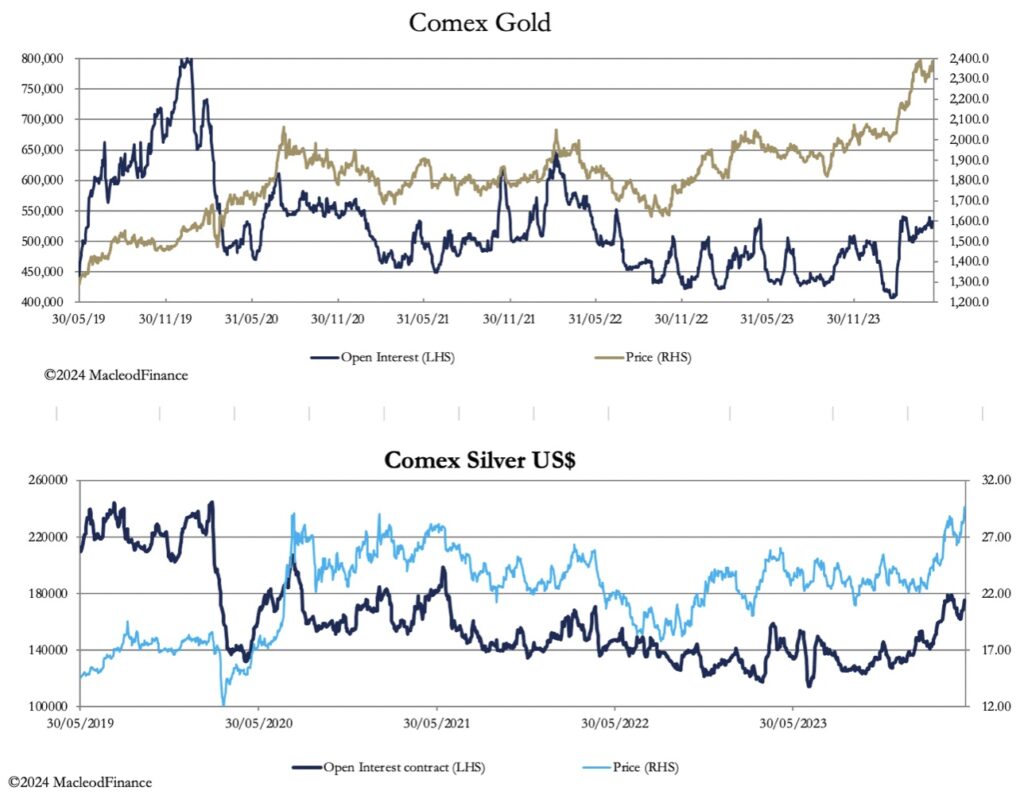

Gold and silver continued to rally this week, challenging the highs established in mid-April. In European trading this morning, gold was $2385, up $16 from last Friday’s close. Silver was $29.68, up $1.54 on the same timescale [futures now $31.77]. Comex turnover in both contracts was not excessive, though Open Interest is creeping up, as shown below.

Higher Open Interest is consistent with bull markets, but as a measure of how overbought a contract has become it does need watching. Both charts suggest there is further room on the upside before a material correction/consolidation is likely.

On its own, technical analysis suggests that both gold and silver might have to do more work before successfully challenging the April highs, and that they would be better based for doing so. But this is without reckoning on other factors, such as geopolitics, and importantly the trend for future Comex futures expiries to end in demands for delivery.

Standing for delivery has been an increasing feature on Comex. Perhaps this matters less with gold, being a large, physical market. But like copper, silver is in increasing demand as an industrial metal, central to the global move away from fossil fuels.

China Stockpiling Silver

Recently, I have written about how China appeared to be stockpiling silver and controlling the price to facilitate it. And that now India is ramping up production of photovoltaics, that control has slipped away from China. Reliance Industries, the large Indian conglomerate is ramping up production having opened the first 5-gigawatt production facility of a total 20-GW planned, and it is not the only Indian corporation expanding into this market with state encouragement.

So far this year, on Comex 15,538 silver contracts of 5,000 ounces each have been stood for delivery, representing 77,690,000 ounces, which is 23% of world mine production over the same period. The raiding of Comex vaults has not been confined to this year either. And at 65 million ounces currently registered for delivery, that’s only 13,000 futures contracts.

The Silver Institute estimates that there has been a supply deficiency of 431 million ounces over the last three years. Industrial demand for photovoltaics and other ESG-compliant applications accelerating further in 2024 is drawing down previously accumulated stocks at a furious rate. And now we must consider additional investment demand.

With a gold-silver ratio of about 80 times, there is very little in the way of monetary factors priced into silver, but it is strongly influenced by gold rising approximately twice as fast. Economic and geopolitical factors are currently boosting gold valued in fiat currencies. And with massive quantities of bullion migrating from western capital markets into China and other Asian nations, bullion shortages have only been offset by ETF liquidation.

ETF liquidation was also evident in silver in 2022 to the tune of 125 million ounces, slowing to an estimated 30 million ounces in 2023 according to the Silver Institute. But with gold prices now firmly established in a bull market, almost certainly both industrial and investor demand will combine in a dramatic price squeeze.

Like the LME over nickel, will Comex, be forced at some point to declare force majeure? I wouldn’t rule it out! To continue listening to Alasdair Macleod discuss this week’s explosive upside action in gold, silver and mining shares and what to expect next CLICK HERE OR ON THE IMAGE BELOW.

Billionaire Pierre Lassonde’s audio interview has now been released!

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.