With the price of gold futures rebounding back to the $2,500 level, we are repeating the hairy 1970s with radical proposals being discussed to control inflation. Plus a look at what is happening with gold and silver.

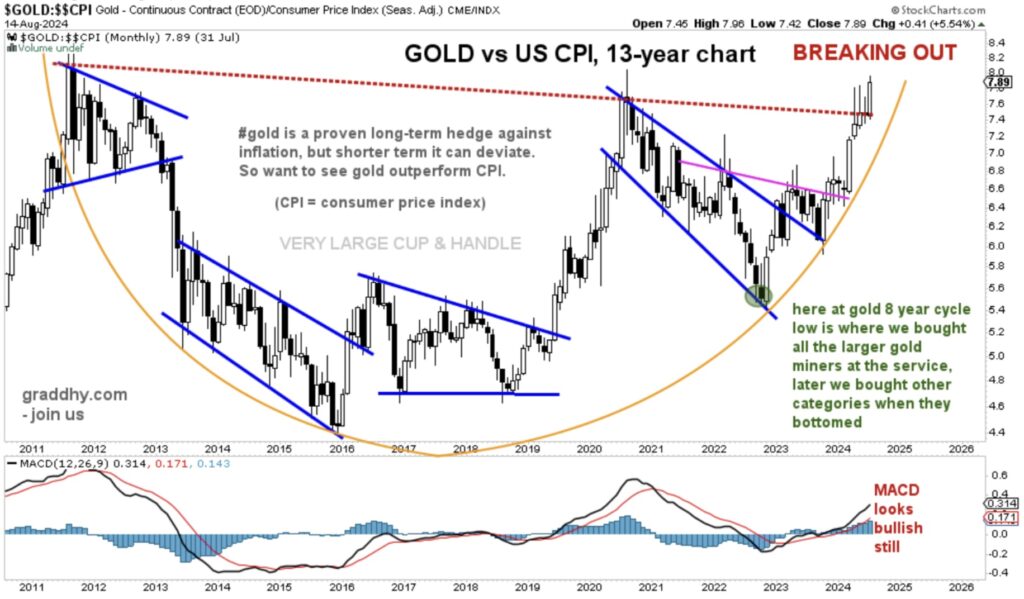

August 15 (King World News) – Graddhy out of Sweden: This chart is a very bullish chart for precious metals. It is climbing the right side of the orange arc, and now it is going for the big break out above red line!

Here Is Another Look At Gold’s Parabolic Move!

Gold is gearing up.

Silver vs S&P 500

Graddhy out of Sweden: This very big picture ratio chart is now clear: Silver has broken out and is backtesting versus US stock market. This means a historical, global asset class rotation is in the making.

Silver Set To Skyrocket vs S&P 500, Dow & NASDAQ

This will be the last precious metals bull. So vital to make the most of it.

Hairy 1970s: Nixon’s Failed Wage & Price Controls

Peter Boockvar: I’ll hit this quickly but when I hear a presidential candidate call for a federal ban on the price gouging of food and groceries, I remember my history lesson on the Nixon wage and price controls put in place in 1971 to combat that flair up in inflation. That set the table for the next leg higher in inflation. I also heard yesterday on tv the terms ‘mission accomplished’ with inflation and the ‘inflation battle is done.’ I believe that was also echoed a few times in the 1970’s. I hope of course hope they are right this time and we will continue to see a slowdown in overall inflation but I’ll say again, a sustainable low rate of inflation is when victory can be declared, not just seeing the downside of the inflation spike.

July import prices rose a touch more than expected. Ex food and energy prices were flat m/o/m and up just .8% y/o/y.

I do want to point out that import air freight costs jumped 12% m/o/m in July and something I’ve been highlighting as a consequence of the spike in container prices. It was mostly from the Asian region where air cargo prices were up by 14.8% m/o/m.

The Treasury market response was pretty swift to the lower than expected claims figure and slightly better retail sales report as the 2 yr yield is jumping by 13 bps to back above 4% at 4.09%. The 10 yr yield is up 9 bps to 3.93%.

As for the Fed, based on the inflation stats this week and today’s data, they will only be cutting by 25 bps in September. The only thing that possibly changes that is another jump higher in the unemployment rate for August seen in a few weeks. Rate cut odds of 50 bps in September are now down to 26%. It was above 50% earlier in the week.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.