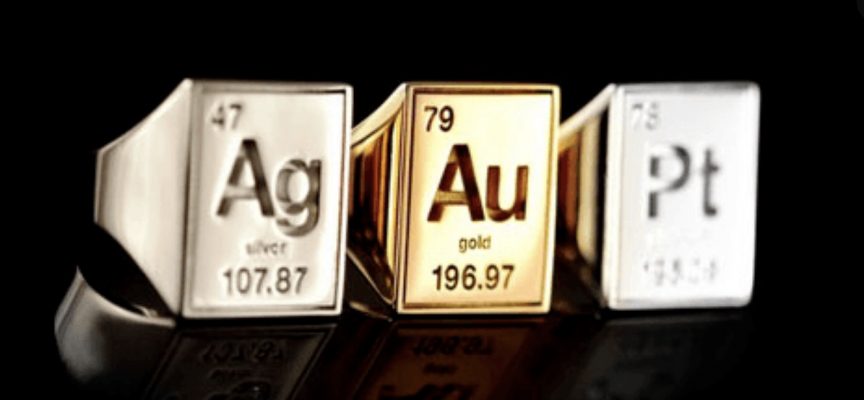

On the heels of the Dow plunging more than 700, the war in the gold, silver and platinum markets continues to rage.

War In The Gold, Silver And Platinum Markets Continues To Rage

June 24 (King World News) – Ole Hansen, Head of Commodity Strategy at Saxo Bank: Gold’s break to a fresh 8 year high has been missing one key ingredient for it to proper challenge the next key resistance at $1800/oz. Silver’s inability to break above $18/oz despite the tailwind from gold has triggered some weakness across these two metals from sellers of recently establish longs, especially in silver.

Weakness In Silver Spurs Selling In Gold

Another Record

The gold-silver ratio has spiked back above 101 while platinum, another metal that often enjoys gold’s tailwind, has seen its discount to gold temporarily reach (a new record) $970/oz.

Platinum’s Discount To Gold Is Now $970

Gold’s Quandary

The underlying fundamentals have not changed and we still see gold trade higher to challenge $1800/oz and beyond. But in order for the rally to have legs we need to see demand for the minor metals pick up as well. That has clearly not happened yet according the latest move.

Gold Pulls Back In Sympathy With Silver

Not This Again…

Disappointed silver longs now bailing out thereby pulling gold back to unchanged while XAUXAG spikes to 101.

Gold/Silver Ratio Spikes Above 100…Again

Summary:

Gold’s break to a fresh 8 year high has been scuppered by silver’s inability to join the rally…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

As a result we have seen profit taking from recently established longs. Overall we maintain a bullish outlook for both metals.

Gold Hits 8 Year High But Here Is The Big Surprise

***Also Released: Gold Hits 8 Year High Closes In On $1,800, But Here Is The Big Surprise CLICK HERE.

***To listen to James Turk discuss the failure of London Gold Pool II and the price of gold hitting new all-time highs along with silver click here or on the image below.

© 2020 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.