Look at what is about to go up in smoke that is on the brink of default and how it will impact the gold and silver markets.

On The Brink Of Default

September 5 (King World News) – James Turk: The good times are over, Eric. We’ve had the boom, and the bust is rolling in.

The evidence that we face tough times ahead continues to mount. It is a global phenomenon, which is not surprising given the sole reliance on fiat currencies everywhere and the ongoing central bank manipulation of interest rates.

Look at China as an example because the fault lines there are numerous and readily apparent, particularly in key sectors of its primary economy. Bloomberg reported that 34 of the top 50 real estate developers are in default, and that doesn’t include the huge, and what is currently the most troublesome company – Country Garden Holdings – which is on the brink of default…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

Bankruptcies Sure To Follow

Bankruptcies are sure to follow, and that’s when the bust really becomes problematic. These heavily indebted companies and countless others in China and every other country that borrowed untold billions during the good times are discovering that they can’t meet their debt obligations. And pressure on them is increasing as unpaid interest expense continues to accrue at rates they never foresaw during the good times.

Demand for their product has fallen off a cliff. So they are stuck with unsold – and in some cases, unsaleable – inventory, which is the scary part as is made clear from basic bank accounting. Bad assets create unpayable liabilities, which is the money people have deposited in banks. So bad assets mean bad banks that put your money at risk.

This unsaleable real estate supposedly gives value to the loans that banks extended during the good time to these companies now in default. But illiquid property means the banks are holding bad assets. These are loans that are not likely to be repaid in full if repaid at all, and here’s the rub; bad assets mean that banks can’t meet their liabilities.

I’ve Seen Many Bank Failures In My 55 Year Career

When bank depositors eventually figure out that their money is at risk, they withdraw their money and put it into something they think safe. That’s exactly what happened to Silicon Vally Bank just a few months ago. I’ve seen many banks fail over my 55-year business career, but the problems of bank fragility today are worse than anything I’ve ever seen.

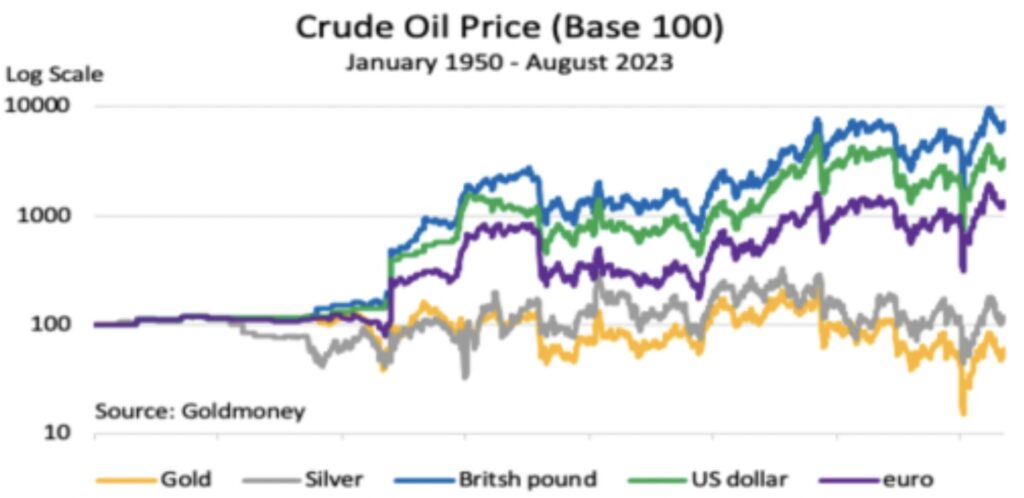

So where do we put our money? Or more accurately, how do we preserve the purchasing power we have accumulated? One answer is gold and silver. KWN readers know their usefulness, and their value is clear from the following base-100 chart prepared on a log scale.

Only gold and silver preserved purchasing power since President Nixon “temporarily” suspended the dollar’s link to gold, with other countries following his bad and unconstitutional decision shortly thereafter. It now takes 32 more dollars today to purchase the same amount of crude oil it did in 1950, when you could fill up the family car with $2 of silver coin. As the chart shows, you can still fill up the family car with the same weight of silver, which answers the question I raised about preserving purchasing power.

When banking problems mount to put banks on the brink, history has proven the usefulness of physical gold and physical silver. Their usefulness is not about to change – they are natural money that have proven they withstand the test of time.

ALSO JUST RELEASED: Gold & Silver Markets Near Historic Upside Explosion CLICK HERE.

ALSO JUST RELEASED: Financial Assets Are Now Set To Seriously Deflate CLICK HERE.

Alasdair Macleod discusses why gold, silver, and mining share investors should ignore the US dollar and all other fiat currencies as well as what other surprises took place this week in the metals markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged