The gold, silver, and mining share markets experienced a turnaround Tuesday as the end of QE is finally upon us.

Turnaround Tuesday

October 14 (King World News) – Peter Schiff: Gold and silver stocks gapped lower along with silver and stocks in general. But buyers showed up immediately, trying to buy the dip, in sharp contrast to how investors used to sell into weakness. Miners are now barely down and turning positive. Classic Turnaround Tuesday action.

The end of QT is upon us, said Jay Powell

Peter Boockvar: The most noteworthy commentary from Jay Powell’s speech in front of the NABE was on the Fed balance sheet where its Treasury holdings have been shrinking by just $5b per month while its holdings of MBS have been reduced by $35b (at least that is the plan though each month varies).

He said it’s about time to stop reducing its size which stands now at about $6.6 Trillion which is 58% bigger than where it stood at the beginning of 2020. For perspective, nominal GDP has risen by 39%. If the Fed’s balance sheet grew in line with the economy, it would need to shrink by about another $800b. But that is apparently not going to be the case. He also defended the use of QE but it’s clear they went too hog wild with it, especially with MBS purchases that gave us a 50% rise in home prices over 5 years.

He said specifically, “Our long-stated plan is to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions. We may approach that point in coming months, and we are closely monitoring a wide range of indicators to inform this decision.”

When asked about when the Fed would stop reducing the size of its balance sheet and where the right level of bank reserves should be, he always said in the past, “We’ll know it when we see it,” I paraphrase. Well, they are now seeing it as “Some signs have begun to emerge that liquidity conditions are gradually tightening, including a general firming of repo rates along with more noticeable but temporary pressures on selected dates.”

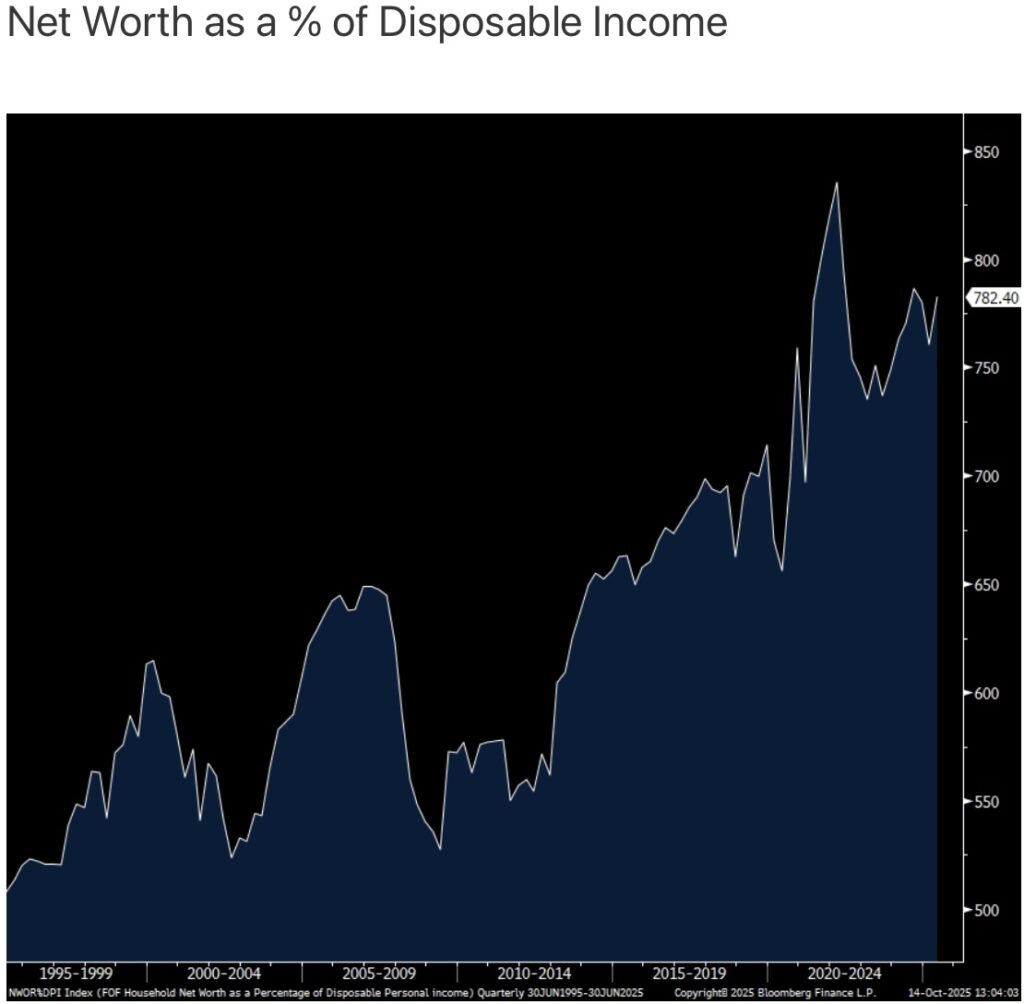

Bottom line, QT is about to end, and has essentially already ended for Treasuries and why there was no response today in the market to what he said. We’ll see if spreads between Treasuries and MBS tighten from here. I think QE (and saying nothing new from me), outside of the 2008-2009 experience with its use, has been a very dangerous use of monetary policy that has resulted in the unaffordability of housing for many (which followed the experiment of a 1% fed funds rate in the early to mid 2000’s that resulted in the obvious) and bubbles in various asset prices that has brought the net worth as a percent of disposable income to 782% as of Q2 2025. That compares with 614% in Q1 2000 and 649% in Q1 2007. Steve Eisman years ago poetically referred to QE as ‘monetary policy for rich people.’ What an incredible ride for asset and home owners but what a tough road it’s been for everyone else.

Prins Correctly Predicted Silver Would Be In The $50s This Week

To listen to Nomi Prins discuss why short sellers in the silver market are going to get destroyed, where gold is headed, what to expect from mining stocks, uranium and much more CLICK HERE OR ON THE IMAGE BELOW.

Just Released!

To listen to Alasdair Macleod discuss the squeeze in the gold and silver markets and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.